With the vast array of trading strategies available in today’s financial markets, options trading stands out as a powerful tool for astute investors. However, mastering the art of options trading requires a deep understanding of market dynamics, and price action analysis emerges as a crucial element in this endeavor. In this in-depth guide, we will delve into the intricacies of price action and explore how it can empower options traders to make informed decisions and maximize their profit potential.

Image: priceaction.com

Understanding Price Action: A Foundation for Options Trading

Price action, simply put, is the study of price fluctuations in a financial instrument over time. By scrutinizing these movements, traders aim to identify trends, patterns, and anomalies that can provide valuable insights into the direction of future price movements. Price action analysis is based on the premise that price action embodies all the relevant information about a market, effectively encapsulating the collective sentiment, expectations, and actions of participants.

For options traders, price action analysis becomes particularly important, as it allows them to gauge the market’s sentiment and anticipate potential reversals or breakouts. By studying price patterns and identifying areas of support and resistance, traders can increase their chances of making profitable trades and reduce the risks inherent in options trading.

Leveraging Price Action for Options Strategies

The versatility of price action analysis makes it applicable to a wide range of options trading strategies. Here are some common techniques employed by options traders:

-

Trend Trading:

Price action analysis helps identify prevailing market trends and anticipate their continuation. Options traders can capitalize on these trends by purchasing call options (betting on rising prices) in an uptrend or put options (betting on falling prices) in a downtrend.

-

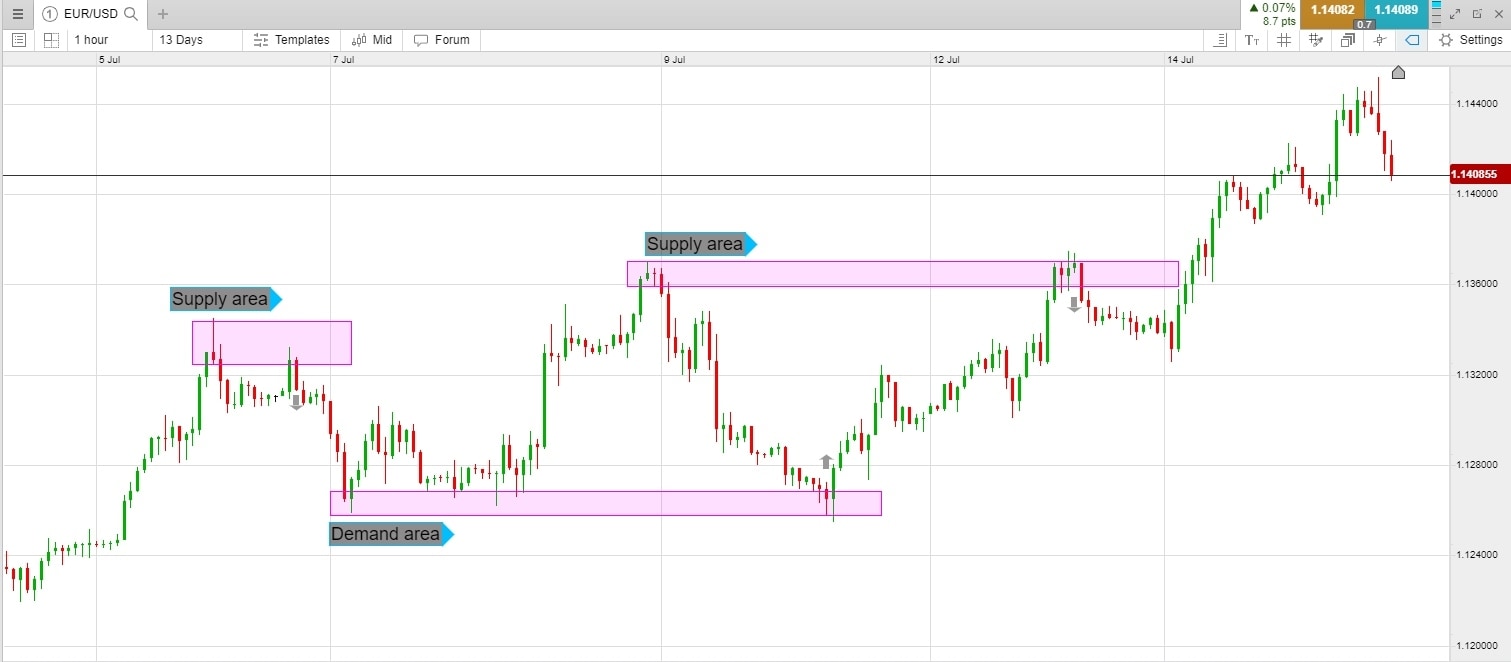

Image: hiainsuranceservices.blogspot.comRange Trading:

Range trading involves identifying price ranges within which an asset fluctuates. Options traders can use price action analysis to determine these ranges and then sell options at the upper end of the range (bearish strategies) or buy options at the lower end (bullish strategies) to profit from price movements within the range.

-

Volatility Trading:

Volatility measures the intensity of price fluctuations, and price action analysis can reveal periods of increased or decreased volatility. Options traders can use this information to adjust their trading strategies accordingly, for example, buying options during periods of high volatility or selling options during periods of low volatility.

Essential Price Action Techniques for Options Traders

Numerous price action techniques are available to options traders, each with its unique strengths and applications. Here are some commonly used techniques:

-

Candlestick Patterns:

Candlesticks are graphical representations of price movements over a specific period. They provide visual cues about market behavior and can reveal significant patterns, such as bullish or bearish engulfing patterns, inside bars, or doji candlesticks.

-

Support and Resistance Levels:

Support levels represent price points at which the market consistently finds buyers, while resistance levels indicate price points at which the market encounters sellers. Identifying these levels through price action analysis can help options traders anticipate potential reversals or breakouts.

-

Trendlines and Chart Patterns:

Trendlines connect a series of swing high or swing low points, indicating the overall market trend. Chart patterns, such as triangles, wedges, or head and shoulders patterns, can provide indications of potential trend changes or reversals.

Beyond Price Action: Combining Strategies for Enhanced Results

While price action analysis is a powerful tool, it is essential to note that it should not be used in isolation. By combining price action analysis with other trading techniques, such as technical analysis, fundamental analysis, or sentiment analysis, options traders can further enhance their trading decisions.

Technical analysis involves the study of historical price data to identify patterns and trends, while fundamental analysis focuses on evaluating a company’s financial health and external factors that may impact its stock price. Sentiment analysis, on the other hand, gauges the collective emotions and expectations of market participants, which can influence price movements.

By triangulating insights from multiple sources, options traders can increase the accuracy of their predictions and minimize the risks associated with a single trading strategy.

Can I Use Price Action For Options Trading

Image: www.cmcmarkets.com

Conclusion: Unveiling the Power of Price Action for Options Trading

Price action analysis is an indispensable tool for options traders, providing valuable insights into market movements and enabling them to make informed trading decisions. By mastering price action techniques and combining them with other trading strategies, options traders can navigate the complexities of the market, harness price fluctuations, and maximize their profit potential.

Remember, successful options trading requires a well-rounded understanding of financial markets, continuous learning, and constant adaptation to evolving conditions. Embrace the power of price action analysis as a cornerstone of your options trading strategy, and unlock the doors to enhanced profitability and trading success.