Option trading, a sophisticated financial strategy that involves predicting and profiting from price movements, demands a keen understanding of price action. Price action refers to the constant ebb and flow of market fluctuations – a language that offers valuable insights into the market’s sentiment and potential future behavior. By deciphering this language, option traders can significantly improve their chances of success.

Image: cwsasoccer.org

Harnessing Price Action for Effective Decision-Making

Price action analysis is an invaluable tool for option traders, providing a graphical representation of price movements over time. It enables traders to identify key patterns, such as trend reversals or breakouts, which can signal potential trading opportunities.

By studying price charts, traders can gain a deeper understanding of support and resistance levels, areas where prices tend to bounce or reverse direction. These levels serve as critical junctures at which traders can identify potential entry and exit points, maximizing profit potential while minimizing risk.

The Power of Candlesticks: Illuminating Price Action Nuances

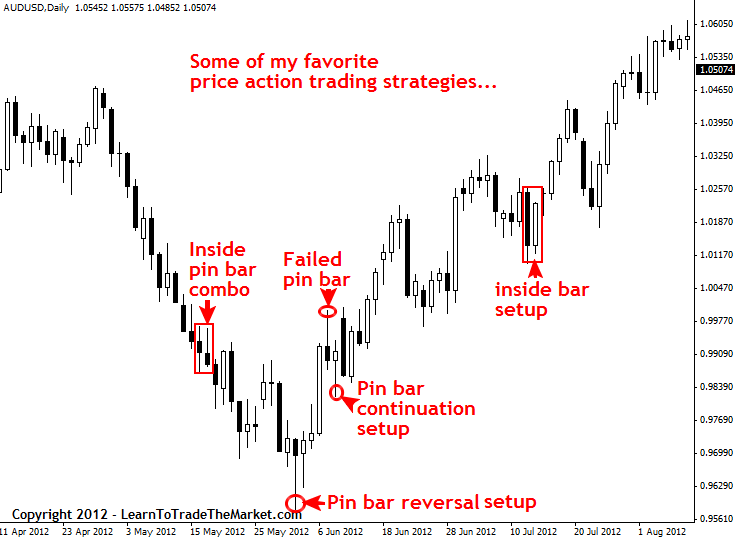

Candlesticks, the preferred chart type for price action analysis, offer a wealth of information in their graphical representation. The body of the candle, indicating the difference between the open and close prices, reveals market sentiment during the specific period. The tail wicks extending above and below the body project the high and low prices reached during the interval.

By combining multiple candlesticks, traders can discern various patterns, including engulfing patterns, inside bars, and hammer candles. These patterns provide insights into market momentum, reversals, and price consolidation, allowing traders to time their option trades strategically.

Unveiling Support and Resistance: Cornerstones of Price Action

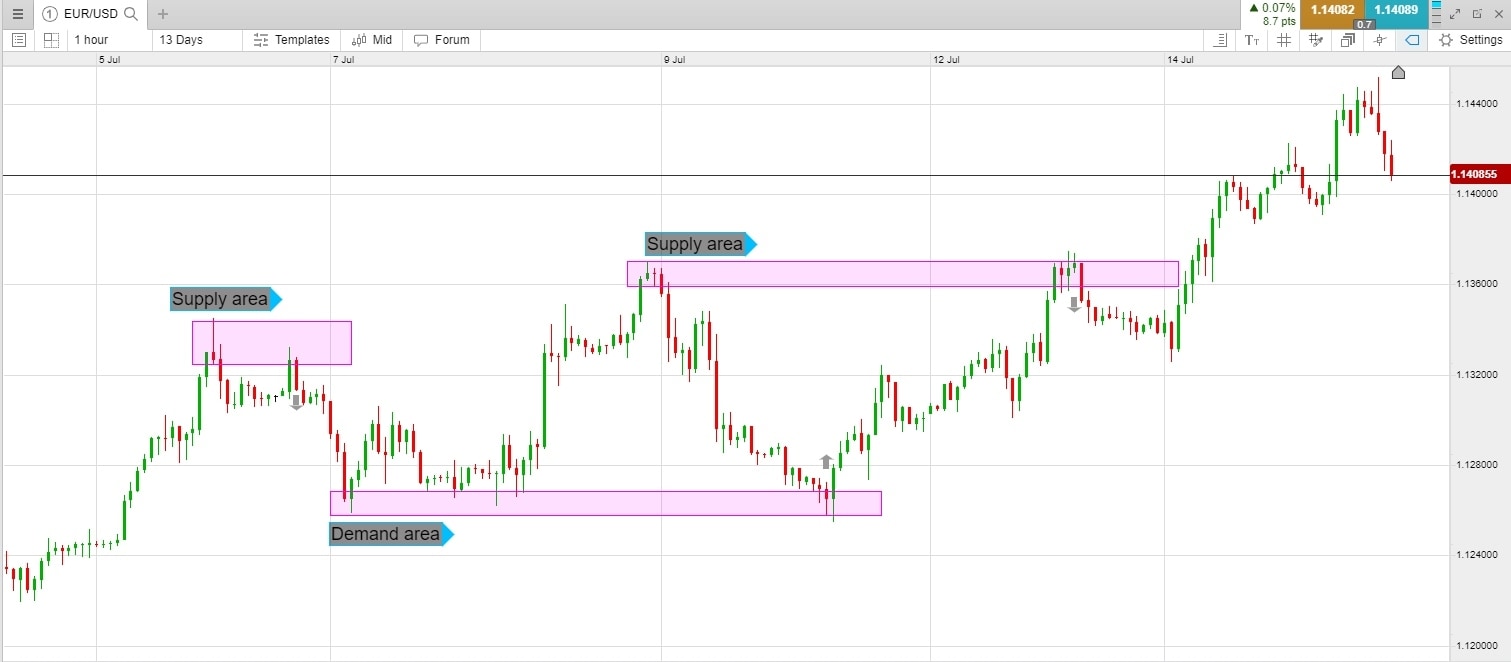

Support and resistance levels, pivotal concepts in price action analysis, depict areas where prices have consistently found resistance or support, causing reversals or pauses in the trend. These levels are often visualized as horizontal lines on price charts and are identified by connecting significant price lows and highs.

Support and resistance act as critical trading benchmarks, signaling potential entry and exit points. When prices approach support, traders may anticipate a bounce, creating an opportunity to buy options with bullish sentiment. Conversely, when prices near resistance, selling options with bearish expectations may offer profit potential.

Image: www.cmcmarkets.com

Chart Patterns: Navigating the Market’s Landscape

Price action patterns, frequently occurring formations on price charts, serve as valuable indicators of market sentiment and potential price movements. Head-and-shoulders patterns, flags and pennants, and double tops and bottoms are a few examples of common chart patterns that traders study to gauge market direction and identify potential trading opportunities.

By recognizing these patterns and understanding their implications, traders can anticipate trend changes and position their option trades accordingly, enhancing their chance of profitability.

Trading against the Trend: Timing Market Reversals

While trading with the trend is generally a prudent approach, identifying and capitalizing on trend reversals can also yield remarkable profits. Price action analysis offers clues to potential reversals through formations like double tops or bottoms, trendline breaks, and divergences between price and momentum indicators

Understanding these signals and placing well-timed option trades can enable traders to profit from the market’s ebb and flow, capturing both uptrends and downtrends.

Trading Tools and Techniques: Enhancing Price Action Analysis

Traders can augment their price action analysis by employing various technical indicators and trading tools. Moving averages, Bollinger Bands, and relative strength index (RSI) are just a few examples of indicators that can provide additional insights into price trends and overbought or oversold conditions.

These tools, when combined with price action analysis, help traders make more informed decisions, refine their strategies, and optimize their risk management.

Option Trading Price Action

Conclusion

Price action, the heartbeat of the financial markets, empowers option traders with a formidable tool for discerning the market’s inner workings and capitalizing on its fluctuations. By mastering the language of price action, traders gain a significant edge, equipping themselves with the knowledge to predict price movements, identify trading opportunities, and maximize their profitability. In the dynamic world of option trading, understanding price action is not just an advantage; it’s an essential key to success.