In the labyrinthine world of financial markets, options trading stands as a powerful tool for investors seeking leverage and risk management. One key aspect of this domain involves the concept of spreads, where a trader simultaneously buys and sells options with different strike prices and expiration dates to create a customized position. Delving into the intricacies of spreads unravels a tapestry of opportunities and complexities, empowering traders to navigate market fluctuations with precision and finesse.

Image: tradeoptionswithme.com

Understanding the Essence of Spreads

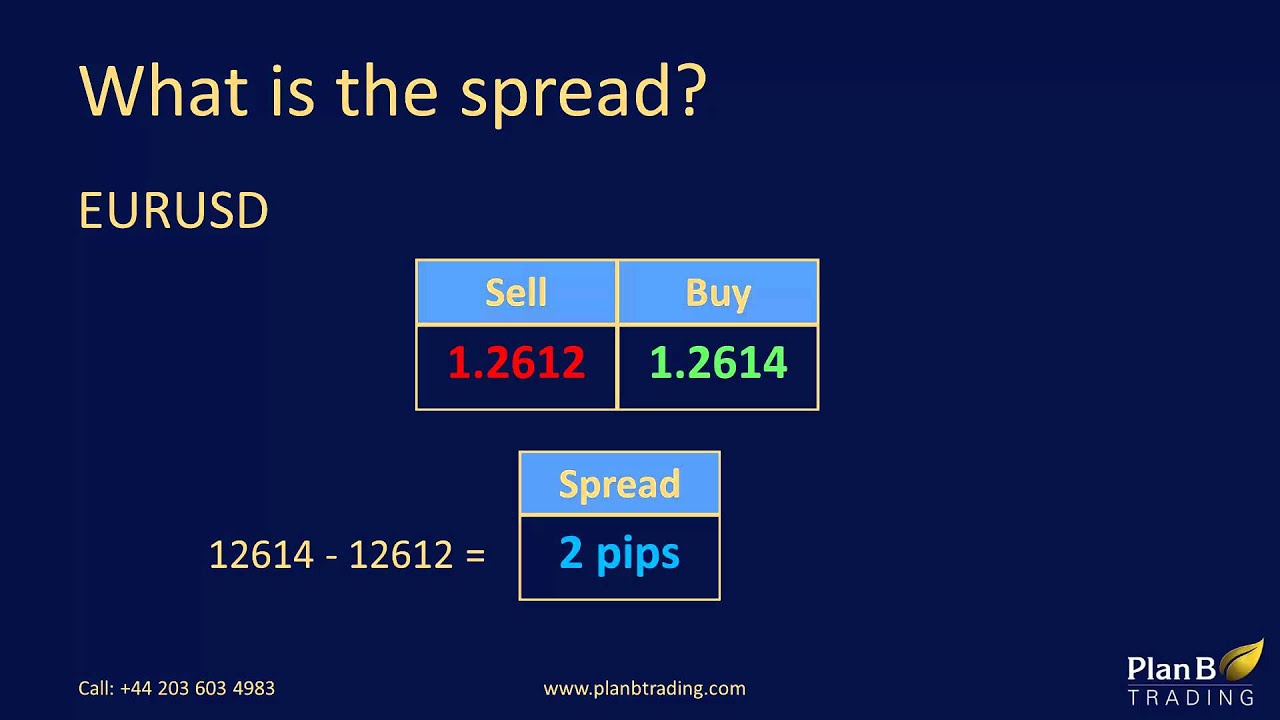

At its core, a spread involves pairing two or more options contracts in varying combinations to create a unique position that aligns with the trader’s outlook and risk tolerance. This strategic approach grants traders the ability to define their exposure, limit potential losses, and enhance their returns within the dynamic market landscape.

Bullish spreads, for instance, are designed to benefit from a rising underlying asset, while bearish spreads anticipate a decline. Neutral spreads, in contrast, remain agnostic to market direction, primarily focusing on volatility or time decay as catalysts for profit.

Exploring the Multifaceted Realm of Spreads

The diverse landscape of spreads encompasses a myriad of strategies, each tailored to specific market conditions and trader objectives. Among the most prevalent variations, vertical spreads reign supreme, characterized by options with the same expiration date but differing strike prices.

Call spreads, for instance, involve purchasing a lower strike call option while simultaneously selling a higher strike call option. This bullish posture seeks to profit from the underlying asset’s anticipated appreciation within a defined range. Conversely, put spreads mirror this strategy, albeit with a bearish bias.

Horizontal spreads, on the other hand, delve into the realm of time decay, where options with the same strike price but varying expiration dates take center stage. Calendar spreads exemplify this approach, entailing the purchase of a near-term option while selling a further-out option, capitalizing on the time value erosion of the former as the outcome.

Unveiling the Mastermind’s Toolkit

Diving deeper into the depths of spread trading unveils a treasure trove of expert insights that illuminate the path to successful execution. Renowned strategists emphasize the significance of:

-

Defining Risk: Precisely delineating potential losses is paramount, ensuring informed decision-making and preventing catastrophic outcomes.

-

Harnessing Volatility: Understanding the impact of volatility on option pricing empowers traders to optimize returns by exploiting market fluctuations strategically.

-

Time Sensitivity: Time decay, an inherent characteristic of options, must be carefully considered, as it exerts a relentless erosion on their value.

Image: www.pinterest.com

Options Trading Different Kinds Of Spreads

Image: imagens1280.blogspot.com

Conclusion: Embracing the Power of Options Trading

Mastering the art of options trading, with its myriad spread strategies, unlocks a gateway to enhanced investment opportunities and precise risk management. By carefully considering market conditions, selecting appropriate strategies, and leveraging expert guidance, traders can harness the full potential of this dynamic arena. Embarking on this journey empowers investors to navigate financial markets with confidence and finesse, reaping the rewards of strategic decision-making amidst the ever-evolving market landscape.