Embark on the Path to Trading Success

In the dynamic world of options trading, where volatility reigns supreme, discovering strategies that maximize returns while managing risk is paramount. Among these strategies, the Long Straddle Option Trading Strategy stands tall, offering the potential for substantial gains in volatile markets. This comprehensive guide delves into the intricacies of this strategy, empowering you with the knowledge and confidence to navigate the complex world of options trading.

Image: boomingbulls.com

Deciphering the Long Straddle Strategy

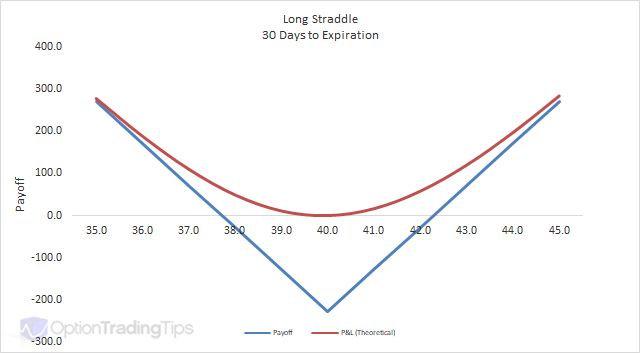

A long straddle involves simultaneously purchasing both a call and a put option with the same strike price and expiration date. This strategy essentially bets on increased volatility in either direction, as it profits from significant price swings in the underlying asset. The call option grants the buyer the right to buy the asset at a predetermined price, while the put option provides the right to sell.

By constructing a long straddle, the trader anticipates large stock price movements. If the underlying asset’s price deviates significantly from the strike price in either direction, the trader stands to profit. However, if the price remains relatively stable or moves within a small range, the strategy can result in losses due to time decay and option premiums.

Navigating the Long Straddle Strategy

-

Define the Strike Price: The strike price is the target price at which the trader can buy or sell the underlying asset. It should be set at a level where the trader anticipates significant price movement.

-

Determine the Expiration Date: The expiration date marks the end of the trading period for the options. Long straddles typically employ short-term expirations to capture quick price fluctuations.

-

Set the Premium: The option premium is the cost of purchasing the options. It represents the trader’s investment and determines the potential profit or loss.

-

Manage Risk: As with any trading strategy, careful risk management is crucial. Traders should consider stop-loss orders to limit losses and set profit targets to secure gains.

-

Monitor the Market: The success of a long straddle strategy relies heavily on market conditions. Traders must diligently monitor news events, earnings reports, and economic data that could impact the underlying asset’s price.

Tips and Expert Advice

-

Maximize Market Volatility: Long straddles thrive in volatile markets. Traders should seek out stocks with high betas or those reacting to upcoming catalysts that could induce price swings.

-

Timing is Key: Choosing the right entry and exit points is essential for success. Traders should consider entering the trade before a significant event or when market conditions suggest potential volatility.

-

Control Risk: Leverage and option premiums can magnify both profits and losses. Traders should trade with capital that they can afford to lose and use prudent risk management techniques.

Image: www.researchgate.net

FAQ on Long Straddle Trading

- What is the goal of a long straddle strategy?

- To capitalize on significant price movements in the underlying asset’s price, either upward or downward.

- What are the advantages of this strategy?

- Potential for substantial gains in volatile markets.

- Provides protection against directional uncertainty.

- What are the risks associated with a long straddle strategy?

- Losses due to time decay or small price fluctuations.

- Limited profit potential if the market remains stable.

Long Straddle Option Trading Strategy

Image: www.optiontradingtips.com

Conclusion

The Long Straddle Option Trading Strategy is a versatile tool that offers the potential for significant returns in volatile market conditions. By comprehending the concepts outlined above and adhering to the tips provided by experts, traders can effectively implement this strategy and increase their trading prowess.

We invite you to explore the captivating world of options trading further. Whether you’re a seasoned veteran or a novice eager to embark on this journey, we encourage you to delve into the wealth of resources available online and to seek professional guidance when necessary. By doing so, you empower yourself to make informed decisions and pursue investment opportunities with confidence.