In the realm of financial markets, where uncertainty and volatility reign supreme, traders seek strategies that can mitigate risk while maximizing potential returns. Among these strategies, the straddle options trading strategy emerges as a popular choice for navigating high-volatility environments. This article will delve into the intricacies of the straddle options trading strategy, providing a comprehensive guide to its mechanics, applications, and potential profitability.

Image: www.profiletraders.in

Unveiling the Straddle Options Trading Strategy

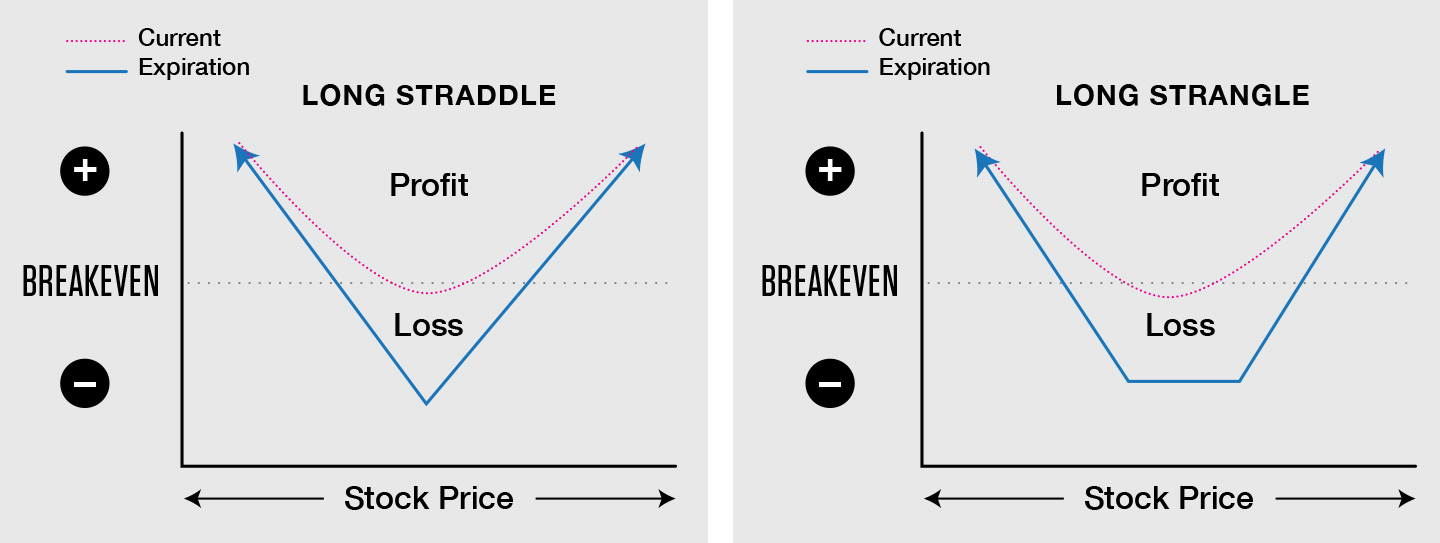

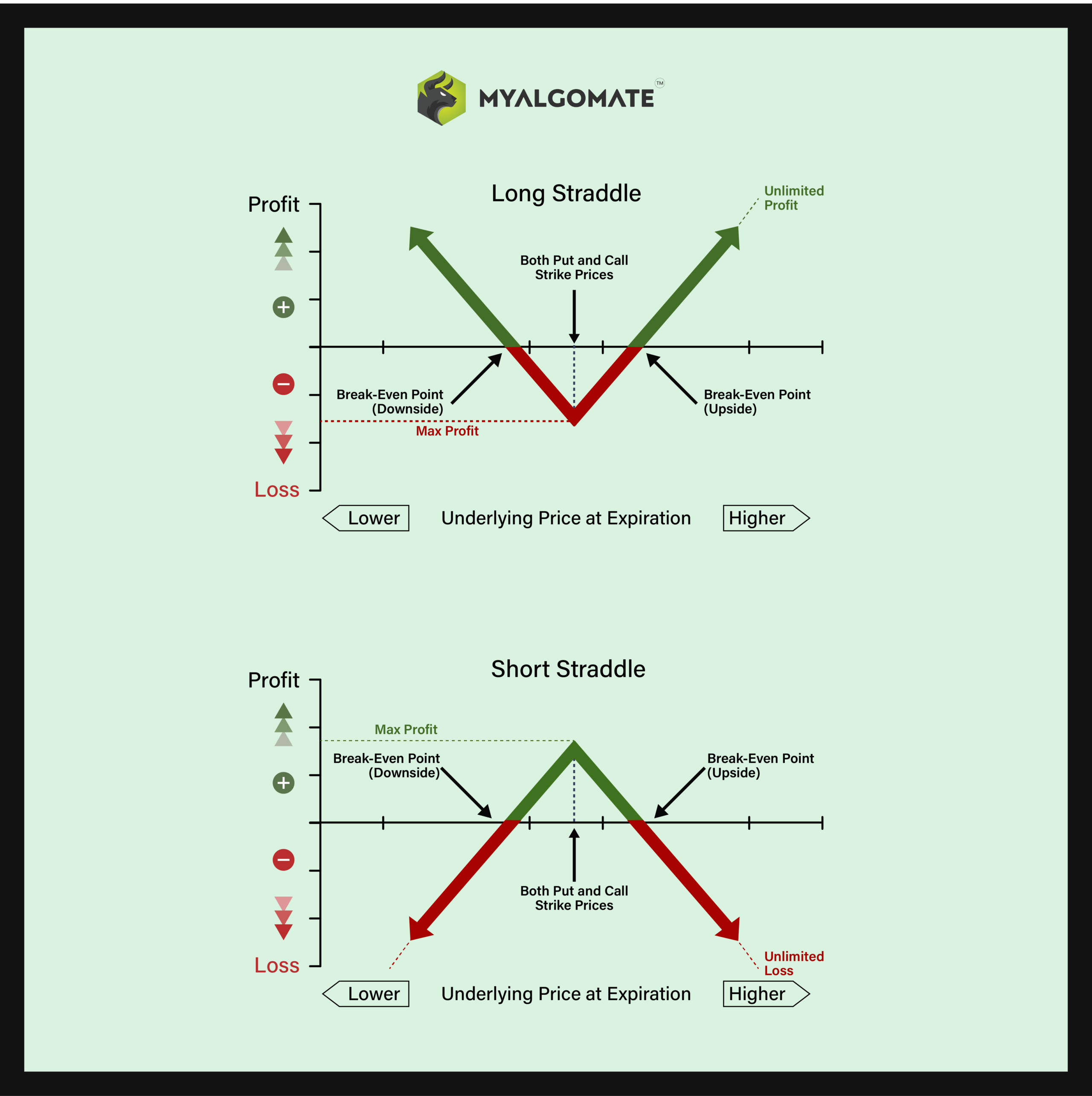

A straddle options trading strategy involves simultaneously buying both a call option and a put option with the same strike price and expiration date on the same underlying asset. The call option grants the holder the right, but not the obligation, to buy the asset at the strike price, while the put option provides the right to sell the asset at the strike price. This strategy is commonly employed when the trader anticipates significant price fluctuations in either direction but is uncertain about the exact direction of the movement.

Mechanics of the Straddle Options Trading Strategy

The construction of a straddle options trading strategy requires the purchase of both a call and a put option with identical strike prices. The total cost of the strategy is the sum of the premiums paid for both options, which represents the maximum possible loss. The potential profit from a straddle options trading strategy is derived from the difference between the market price of the underlying asset and the strike price, adjusted for the premiums paid.

Applications of the Straddle Options Trading Strategy

The straddle options trading strategy is particularly well-suited for markets characterized by high levels of volatility. This is because the strategy profits from large price fluctuations in either direction, regardless of the specific direction. Some common scenarios where the straddle options trading strategy may be employed include:

-

Anticipating Earnings Announcements: When a company is scheduled to release its earnings report, there is typically a heightened level of volatility as investors speculate on the potential impact of the results on the underlying stock price.

-

Major Economic Events: The release of major economic data, such as GDP or unemployment figures, can also trigger market volatility. Straddle options trading strategies can be used to capitalize on the potential price fluctuations associated with these events.

-

Political Events: Political events, such as elections or major policy announcements, can also introduce uncertainty into markets, creating opportunities for straddle options trading strategies.

Image: tickertape.tdameritrade.com

Potential Profitability of Straddle Options Trading Strategies

The potential profitability of straddle options trading strategies is dependent on several factors, including the volatility of the underlying asset, the time to expiration, and the premiums paid for the options. Generally, strategies constructed on highly volatile assets with short expiration times have higher potential returns but also higher risks. It is crucial for traders to carefully assess these factors and manage their risk exposure accordingly.

Straddle Options Trading Strategy

Image: www.myalgomate.com

Conclusion

The straddle options trading strategy is a powerful tool that can be used to navigate high-volatility markets and generate potential profits. However, it is important for traders to fully understand the mechanics, applications, and risks associated with this strategy before implementing it. By carefully considering market conditions and managing their risk exposure, traders can leverage the straddle options trading strategy to capitalize on price fluctuations and achieve their financial goals.