In the realm of investing, options trading offers a multitude of opportunities for risk management and profit generation. Among the various options strategies, TD Options Trading (also known as TD Ameritrade Options Trading) stands out as a popular choice for both novice and experienced traders alike. To navigate this market effectively, understanding the concept of contract size is crucial.

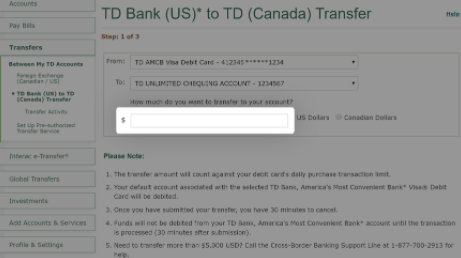

Image: www.remitbee.com

In this comprehensive guide, we will delve into the intricacies of TD options trading contract size, empowering you with the knowledge necessary to trade confidently. We will cover the definition, history, and significance of contract size, as well as the latest trends and expert advice. By the end of this article, you will possess a solid foundation in this fundamental aspect of options trading.

Understanding TD Options Trading Contract Size

In TD options trading, each contract represents 100 shares of the underlying security. This means that when you purchase an options contract, you are essentially agreeing to buy or sell 100 shares of the underlying stock at the strike price on the expiration date. The strike price is the predetermined price at which the underlying security can be bought or sold.

The contract size of 100 shares is not unique to TD Options Trading. It is a standard convention across the options trading industry, ensuring uniformity and liquidity in the market. This standardized contract size facilitates the efficient trading of options contracts, as it allows for easy comparison and execution of orders.

Significance of Contract Size

The contract size plays a pivotal role in determining the potential profit or loss in options trading. A larger contract size implies a higher potential return, as each contract represents a larger number of underlying shares. Conversely, a smaller contract size involves a lower potential return, but it also reduces the risk exposure.

For instance, let’s assume that the underlying stock is trading at $50 per share and you purchase a call option with a strike price of $52 and a contract size of 100 shares. If the stock price rises to $55 at the expiration date, you will have the option to exercise the call and purchase 100 shares at the strike price of $52. This would result in a profit of $3 per share, totaling $300 (100 shares x $3 per share).

Latest Trends and Developments

The options trading landscape is constantly evolving, and TD Ameritrade regularly introduces updates and enhancements to its trading platform. One notable trend is the increasing popularity of micro options contracts. Micro options have a contract size of 10 shares, making them more accessible to retail investors with smaller account balances.

Another emerging trend is the use of artificial intelligence (AI) in options trading. AI-powered tools can analyze market data and provide actionable insights, helping traders to make informed decisions. As technology continues to advance, we can expect further innovations in the options trading space.

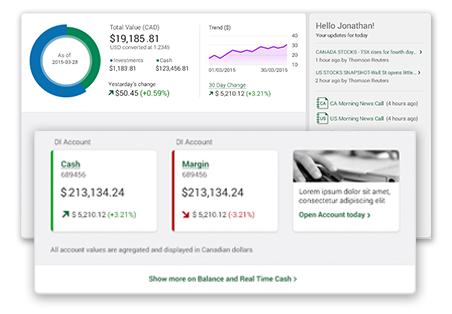

Image: www.tradingview.com

Tips and Expert Advice

To succeed in TD options trading, it is essential to follow sound strategies and seek guidance from experienced traders. Here are some tips and expert advice:

- Start with a small position size. As a beginner, it is advisable to start with a small number of contracts to limit your risk exposure.

- Choose liquid options. Liquidity refers to the ease with which an option contract can be bought or sold. Opt for options with high trading volume to ensure that you can execute your trades efficiently.

- Manage your risk. Develop a comprehensive risk management plan that includes stop-loss orders and position sizing strategies.

- Seek education. The learning process in options trading is ongoing. Attend webinars, read books, and connect with experienced traders to enhance your knowledge and skills.

By adhering to these tips, you can increase your chances of success in TD options trading. Remember, consistency, patience, and a disciplined approach are key to long-term profitability.

Frequently Asked Questions (FAQs)

Q: What is the maximum contract size for TD options trading?

A: The maximum contract size is typically 100 shares for most underlying securities.

Q: Can I trade options with a contract size less than 100 shares?

A: Yes, you can trade micro options with a contract size of 10 shares.

Q: How does contract size affect my profit potential?

A: A larger contract size implies a higher potential return, while a smaller contract size involves a lower potential return but also reduces the risk exposure.

Q: How do I determine the contract size of an option?

A: The contract size is usually specified in the options chain or contract details provided by your broker.

Q: What is the importance of contract size in options trading?

A: Contract size is crucial for determining the potential profit or loss, managing risk exposure, and understanding the underlying value of the options contract.

Td Options Trading Contract Size

Image: niyudideh.web.fc2.com

Conclusion

Understanding the intricacies of TD options trading contract size is essential for success in this dynamic market. By grasping the concepts outlined in this comprehensive guide, you are now equipped with the knowledge to navigate the options trading landscape with confidence.

Whether you are a seasoned trader or just starting out, remember that the path to profitability lies in ongoing learning, sound strategies, and responsible risk management. Embrace the challenges and opportunities of TD options trading, and explore the potential for growth and financial freedom.

Are you interested in learning more about TD options trading contract size?