When it comes to investing, options trading presents a unique opportunity to leverage market movements for potential returns. Among the leading brokerages offering options trading, TD Ameritrade stands out as a reliable platform catering to both experienced traders and beginners alike. In this extensive guide, we’ll delve into the intricacies of option trading with TD Ameritrade, empowering you with the knowledge and strategies to navigate this complex financial landscape. From understanding the basics to exploring advanced techniques, we’ll cover everything you need to know about options trading with TD Ameritrade.

Image: tickertape.tdameritrade.com

Unveiling Option Trading: A World of Opportunities

At the heart of option trading lies the concept of contracts that grant the holder the right, but not the obligation, to either buy or sell an underlying asset at a predefined price and time. These contracts are known as options, and they come in two primary flavors: calls and puts. Call options convey the right to buy an asset, while put options offer the right to sell. By understanding these fundamental mechanics, you’re taking the first step towards unlocking the potential of options trading.

Exploring the TD Ameritrade Advantage

TD Ameritrade has long been a trusted name in the world of brokerage services, and its comprehensive platform caters to the diverse needs of options traders. From robust trading tools and in-depth educational resources to unparalleled customer support, TD Ameritrade provides a fertile ground for both seasoned veterans and those new to the world of options trading. Dive into the TD Ameritrade experience and discover why it’s the preferred choice for countless traders seeking to navigate the options market with confidence.

Delving into the Mechanics of Option Trading

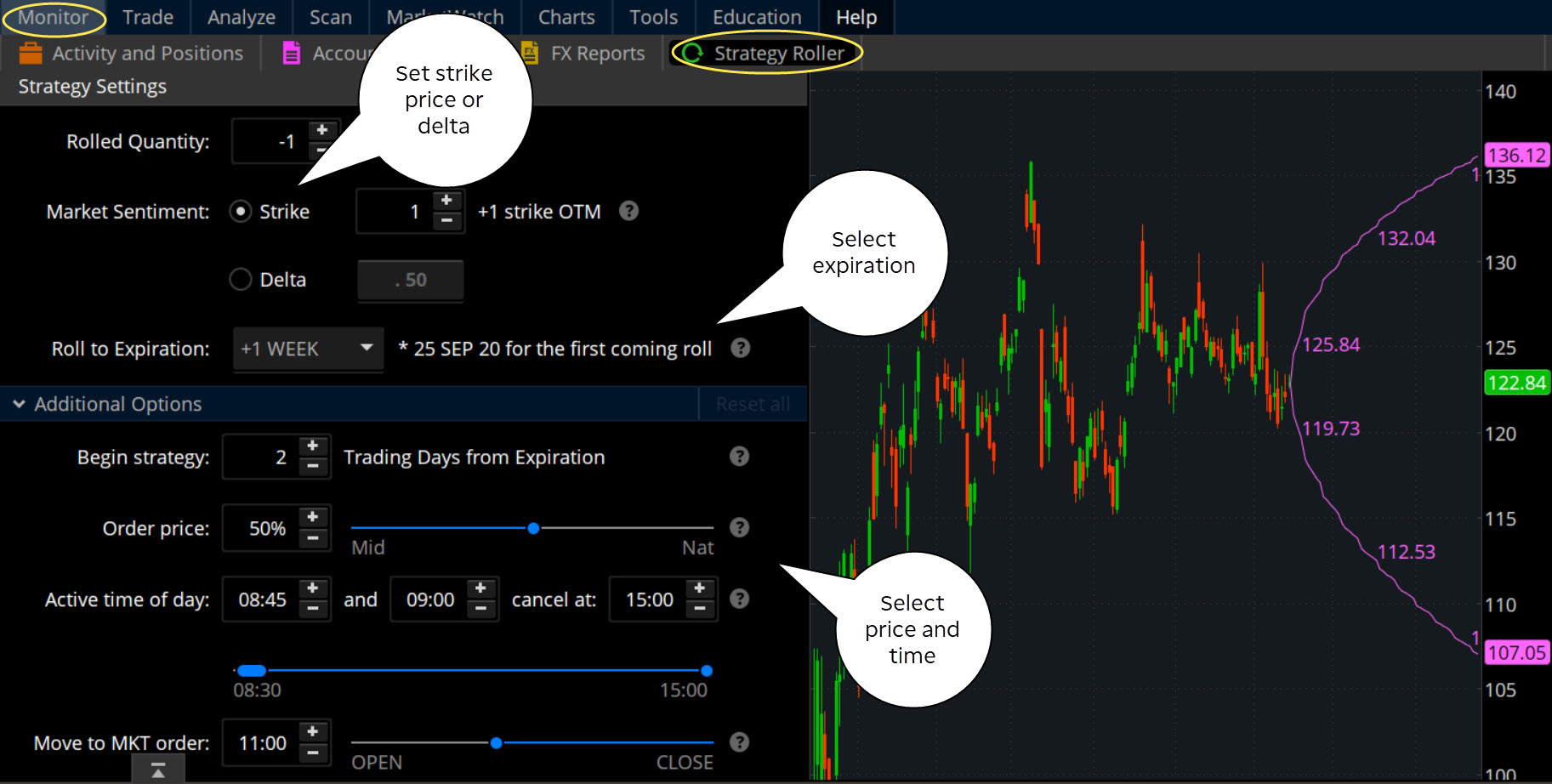

Mastering the art of option trading requires a thorough understanding of its foundational elements. This includes grasping the key concepts of strike price, expiration date, and premium. Strike price represents the price at which the trader can buy or sell the underlying asset, while the expiration date marks the end of the contract’s life. Premium refers to the price you pay to acquire an option contract. Delving into these concepts will equip you with the building blocks necessary for successful options trading.

Image: investingintheweb.com

Strategies for Successful Option Trading

The world of options trading offers a myriad of strategies tailored to different market conditions and risk appetites. From the straightforward approach of buying and selling options to more complex strategies like spreads and combinations, there’s a strategy out there to match every trader’s needs. Explore the diverse range of options trading strategies, each meticulously designed to capitalize on market movements and enhance your trading potential.

Case Studies: Unlocking the Power of Examples

Theoretical knowledge is invaluable, but witnessing the practical application of options trading strategies can be even more illuminating. Discover real-world case studies that showcase how traders have successfully employed various strategies to achieve their investment goals. Learn from their triumphs and pitfalls, gaining invaluable insights that can shape your own options trading journey.

Advanced Techniques for Seasoned Traders

As your options trading expertise grows, delve into the world of advanced techniques that can further enhance your returns. Explore advanced strategies like volatility trading, which involves leveraging the market’s volatility to maximize gains. Learn to decipher complex option pricing models and employ sophisticated trading tools to gain an edge in the dynamic options trading landscape.

Managing Risk in Options Trading

While options trading presents ample opportunities for profit, it’s crucial to recognize and manage the inherent risks involved. Understand the concept of implied volatility and its influence on option pricing. Explore risk management strategies like stop-loss orders and hedging techniques. By adopting a prudent approach to risk management, you mitigate potential losses and protect your hard-earned capital.

Option Trading Covered Td Ameritrade

Conclusion

Navigating the world of option trading covered by TD Ameritrade requires a harmonious blend of knowledge, strategy, and risk management. Throughout this comprehensive guide, we’ve endeavored to equip you with the essential tools to embark on this exciting journey. Remember, options trading presents both opportunities and challenges, and it’s imperative to approach it with a well-informed and measured approach. Whether you’re a seasoned veteran or just starting to explore the realm of options trading, TD Ameritrade offers a fertile ground to hone your skills and pursue your investment aspirations with confidence.