Prepare to embark on a financial odyssey where time becomes a malleable force, and the boundaries between the present and future blur. Welcome to time warp option trading, a realm where traders harness the enigmatic power of options to bend time to their advantage.

Image: www.pinterest.com

In the labyrinthine world of finance, options emerge as versatile tools that empower traders to control, to some extent, the flow and direction of events in the market. Time warp option trading takes this control to a new level, enabling traders to manipulate time itself.

Harnessing the Time Warp Effect

The essence of time warp option trading lies in the strategic manipulation of options’ time decay. Options, by nature, are subject to time decay, meaning their value diminishes as their expiration date approaches. However, by strategically buying and selling options with different expiration dates, traders can create a “time warp” effect that suspends or even reverses time’s relentless march.

Imagine purchasing an option with a short-term expiration and simultaneously selling an identical option with a longer-term expiration. As time elapses, the short-term option loses value rapidly, while the long-term option retains or even gains value. This calculated interplay allows traders to capitalize on the interplay of time decay, virtually reversing the hourglass’s flow.

Understanding Time Warp Option Strategies

- Long Term Warps: Buying long-term options and selling short-term options with the aim of holding the long-term options until their value appreciates.

- Short Term Warps: Selling long-term options and buying short-term options to benefit from short-term volatility while neutralizing the longer-term risk.

- Combination Warps: Combining long and short time warps to create customized strategies that cater to specific market conditions.

Expert Tips and Insights

Navigating the complexities of time warp option trading requires both skill and strategic foresight. Seasoned traders offer the following advice to enhance your endeavors:

- Market Mastery: Understand the intricate workings of the underlying market before venturing into time warp options.

- Volatility Awareness: Monitor volatility levels closely as they significantly impact option pricing and time decay.

- Risk Management: Always prioritize risk management by calculating potential losses and implementing strategies to mitigate them.

- Patience and Discipline: Time warp option trading demands patience and discipline. Do not fall prey to short-term market fluctuations.

Image: audionyq.com

Frequently Asked Questions

Dive into a series of commonly asked questions to enhance your understanding of time warp option trading.

- Q: What is the primary advantage of time warp options?

A: Time warp options empower traders to manipulate time decay, potentially generating profits regardless of market direction.

- Q: Which strategies are most effective for time warp options?

A: The effectiveness of different strategies hinges on market conditions. Explore long term, short term, and combination warps to identify optimal approaches.

- Q: What are potential risks associated with time warp options?

A: Time warp options introduce risks related to volatility, time decay, and improper strategy execution. Implement risk management measures to mitigate these risks.

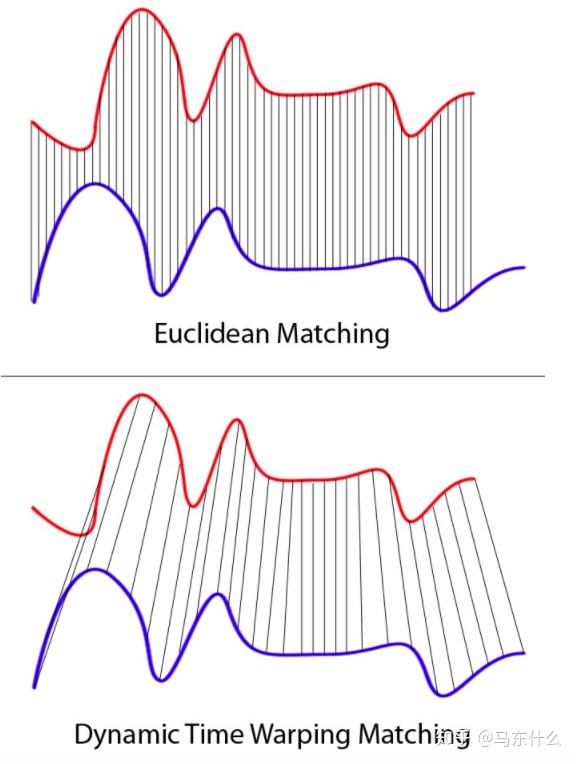

Time Warp Option Trading

Image: zhuanlan.zhihu.com

Conclusion

Time warp option trading stands as a testament to the ingenuity of financial innovation, enabling traders to manipulate time and create market opportunities. By mastering this unorthodox approach, you can unlock the secrets of time’s warp and seize the potential it holds.

Are you ready to transcend the limitations of time and embark on a transformative trading journey? Discover the limitless possibilities that await you in the realm of time warp option trading.