Introduction

In the ever-evolving realm of finance, options trading stands out as a sophisticated instrument with the potential to unlock substantial returns. However, navigating the intricate world of options requires a deep understanding of strategies that can help you harness market forces and mitigate risks. In this comprehensive guide, we will delve into seven key options trading strategies, empowering you with the knowledge and tools you need to succeed in this dynamic market. Additionally, at the end of this article, you’ll find a link to download a complimentary PDF version of this guide for your future reference.

Image: www.slideserve.com

Unveiling Options Trading Strategies

1. Covered Call Strategy: A Conservative Approach

The covered call strategy is an income-generating strategy designed for conservative traders. It involves selling (writing) a call option while simultaneously owning the underlying asset (stock). This strategy generates income from the premium received for selling the call option and benefits from the potential appreciation of the underlying asset.

2. Cash-Secured Put Strategy: Protection with Income

Similar to the covered call, the cash-secured put strategy involves selling (writing) a put option while possessing sufficient cash reserves to purchase the underlying asset at the strike price. This strategy generates income from the premium received for selling the put option and provides protection against potential declines in the underlying asset’s price.

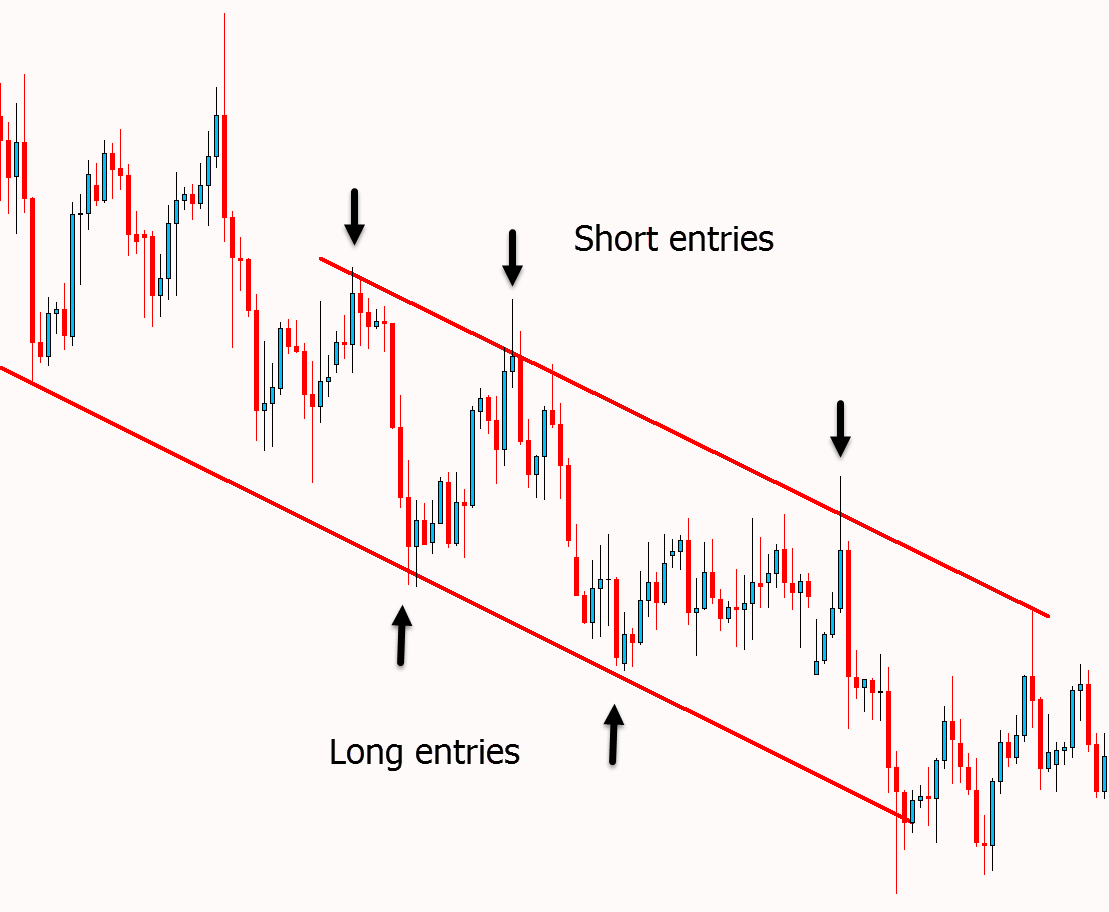

Image: learnpriceaction.com

3. Naked Call Strategy: High Risk, High Reward

The naked call strategy, unlike the previous two, involves selling (writing) a call option without owning the underlying asset. This is a high-risk, high-reward strategy that can lead to unlimited losses if the underlying asset’s price rises significantly. However, it also has the potential to generate substantial profits.

4. Naked Put Strategy: Potential for High Returns

Like the naked call strategy, the naked put strategy involves selling (writing) a put option without owning the underlying asset. It also carries unlimited risk but offers the potential for high returns. However, it is more suitable for advanced traders with a high tolerance for risk.

5. Bull Call Spread Strategy: Limited Risk, Defined Reward

The bull call spread strategy involves simultaneously buying a call option at a lower strike price and selling (writing) a call option at a higher strike price. This creates a defined risk and reward scenario, as the maximum loss is limited to the net premium paid and the maximum profit is capped at the difference between the strike prices.

6. Bear Put Spread Strategy: Protection from Downside

The bear put spread strategy is the inverse of the bull call spread. It involves buying a put option at a higher strike price and selling (writing) a put option at a lower strike price. This strategy is designed to profit from a decline in the underlying asset’s price while limiting the maximum loss to the net premium paid.

7. Straddle Strategy: Betting on Volatility

The straddle strategy involves simultaneously buying both a call and a put option with the same strike price and expiration date. This strategy benefits from increased volatility in the underlying asset’s price, as it profits from both upward and downward movements. However, it does not provide a defined risk or reward scenario.

FREE PDF Download: Options Trading Strategies

To enhance your learning experience and provide a convenient reference for future use, we are offering a complimentary PDF version of this guide. This PDF includes all the strategies discussed in this article, along with additional insights and practical examples. To download your copy, [Insert PDF Download Link Here].

Trading Strategies Involving Options Pdf

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

Image: www.investopedia.com

Conclusion

Options trading can be a powerful tool for investors seeking income, protection, or capital appreciation. By understanding the various strategies available, you can tailor your approach to your individual risk tolerance and financial objectives. Remember, trading options involves inherent risks, and it is crucial to conduct thorough research and due diligence before executing any trades. With knowledge, discipline, and a commitment to continuous learning, you can increase your chances of success in the dynamic world of options trading.