Options trading, a complex and often enigmatic financial endeavor, harbors a secretive adversary: max pain. This inconspicuous term, shrouded in mystery, plays a pivotal role in determining the strike price of an option contract that inflicts the greatest financial torment upon traders. Understanding this elusive concept is akin to wielding a secret weapon, empowering you to navigate the tumultuous waters of options trading with newfound confidence.

Image: inbloon.com

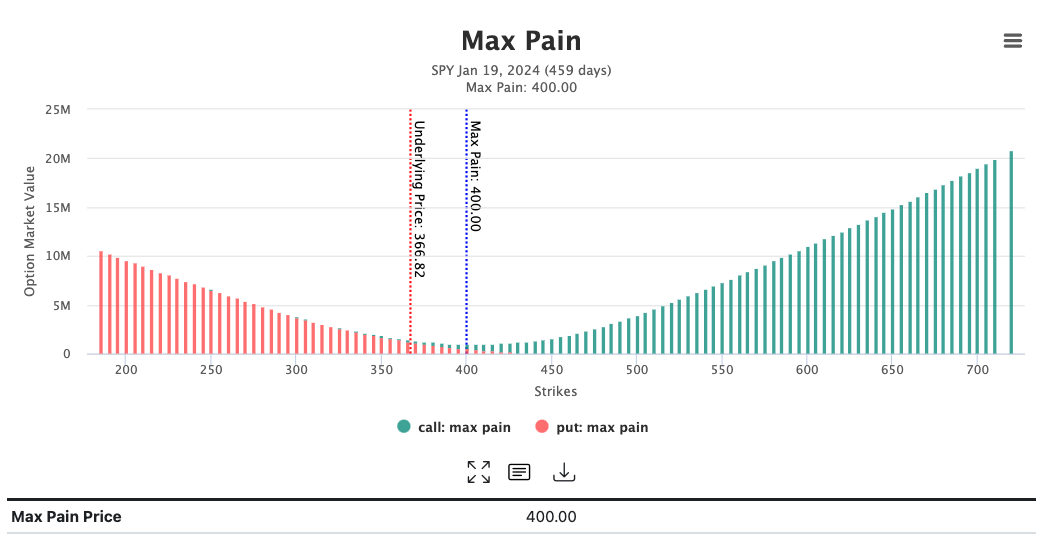

Max pain, in layman’s terms, is the strike price of an option that results in the maximum number of contracts expiring worthless at expiration. It represents a treacherous quicksand for options traders, a point where their hopes and dreams are mercilessly crushed. The culprit behind this financial agony is the premium paid for the option, which vanishes into thin air if the option expires out of the money.

The significance of max pain lies in its ability to influence options pricing and market sentiment. Market makers, astute financial alchemists, diligently monitor max pain levels to craft option premiums that maximize their gains. They strategically position the max pain strike price at a level where the premiums they collect outweigh the potential losses if the options expire worthless.

Traders, armed with the knowledge of max pain, can harness this information to their advantage. By identifying the max pain strike price, they can gauge the market makers’ expectations and make informed decisions about option trading strategies. If the market sentiment aligns with max pain, suggesting that the underlying asset will likely close near the max pain strike price, traders may opt to sell options near that level to capitalize on the high probability of profit. Conversely, if the market sentiment diverges from max pain, indicating a potential for significant asset price movement, traders may consider buying options at or near the max pain strike price in anticipation of a lucrative payday.

Calculating max pain is not a walk in the park, requiring a diligent examination of the open interest and implied volatility of options contracts with different strike prices. However, several resources, both online and through brokers, offer tools and calculators to simplify this daunting task.

Stay tuned for the captivating conclusion, where we unveil the secrets of identifying max pain and demystify the art of profiting from this enigmatic force.

Image: beststocks.com

What Is Max Pain In Options Trading

Image: optioncharts.io