Image: www.aximdaily.com

Unveiling the Dance of Risk and Reward in Options Trading

In the captivating realm of options trading, standard deviation emerges as an enigmatic partner, beckoning traders with promises of amplified returns yet cloaked in a veil of risk. Join us as we embark on a comprehensive exploration of this elusive concept, deciphering its secrets and equipping you with the knowledge to navigate this exhilarating yet treacherous dance with precision and confidence.

Peering into the Core of Standard Deviation

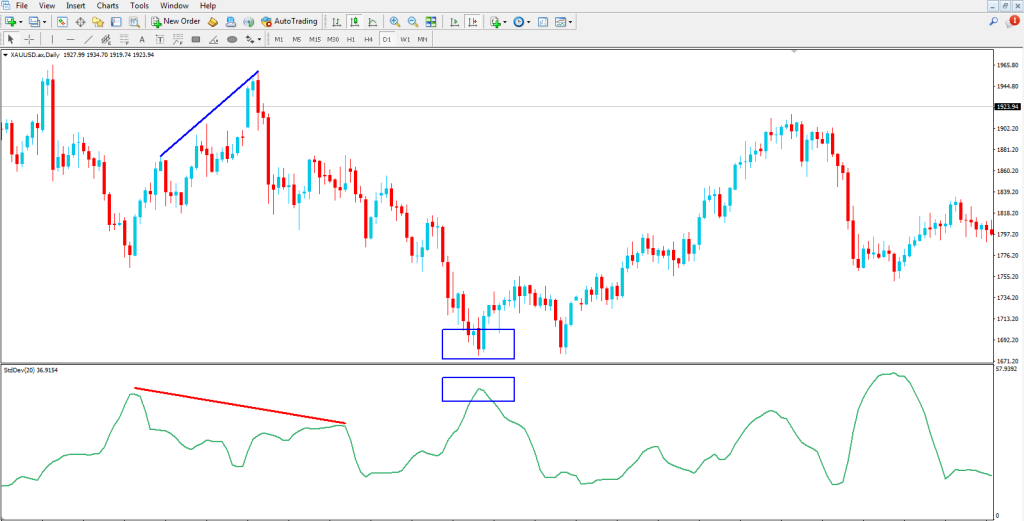

Standard deviation, oft described as the “heartbeat of volatility,” measures the dispersion of data points from the mean. Within the context of options trading, it quantifies the potential fluctuations in an underlying asset’s price over a specific time frame. By comprehending standard deviation, traders gain invaluable insights into the magnitude and frequency of price swings, enabling them to craft informed decisions amidst the ebb and flow of the markets.

Deciphering the Symphony of Standard Deviation

Visualize standard deviation as a bell-shaped curve, with the mean value at its center and the bulk of data points clustering closely around it. As the standard deviation widens, the curve flattens and spreads out, indicating a higher likelihood of extreme price movements. Conversely, a narrow standard deviation signifies a tighter concentration of data points, suggesting a more predictable price trajectory.

Leveraging Standard Deviation for Strategic Insight

For options traders, standard deviation serves as a crucial barometer of risk and reward. A higher standard deviation implies greater price volatility, enhancing the probability of substantial gains but also amplifying the potential for significant losses. On the other hand, a lower standard deviation suggests a more stable price environment, offering tempered returns yet mitigating the risks associated with extreme market fluctuations.

Incorporating Standard Deviation into Your Trading Arsenal

To effectively harness the power of standard deviation, traders must incorporate it into their decision-making process. This multifaceted tool can be utilized in diverse ways:

-

Gauging Risk Tolerance: Standard deviation serves as an indispensable metric for assessing one’s risk appetite. Traders should align their trading strategies with their tolerance for market volatility, ensuring harmony between their financial goals and the inherent uncertainties of options trading.

-

Selecting Strike Prices: Standard deviation plays a critical role in determining appropriate strike prices for options contracts. By considering the standard deviation of the underlying asset, traders can make informed decisions about the range of price movements they anticipate, thereby optimizing their chances of profitable trades.

-

Managing Volatility: Standard deviation empowers traders to manage volatility effectively. In periods of heightened volatility, traders may consider employing strategies that capitalize on price swings, such as selling options or implementing volatility-based trading techniques. During calmer market conditions, more conservative approaches may be prudent.

Navigating the Elusive Dance with Wisdom

Navigating the intricate dance of standard deviation in options trading requires both finesse and forethought. By embracing this enigmatic concept, traders can unlock the potential for enhanced returns while mitigating risks. Remember, standard deviation is not a definitive predictor of market behavior, but rather a valuable tool that, when wielded wisely, can illuminate the path towards informed and potentially rewarding trading decisions.

Image: www.trendingblogers.com

Standard Deviation In Options Trading