In the ever-evolving world of financial markets, option trading stands out as a sophisticated strategy that empowers investors to hedge risks and amplify potential returns. At the heart of this complex discipline lies the concept of standard deviation, a statistical measure that plays a pivotal role in understanding option pricing and volatility.

Image: www.aximdaily.com

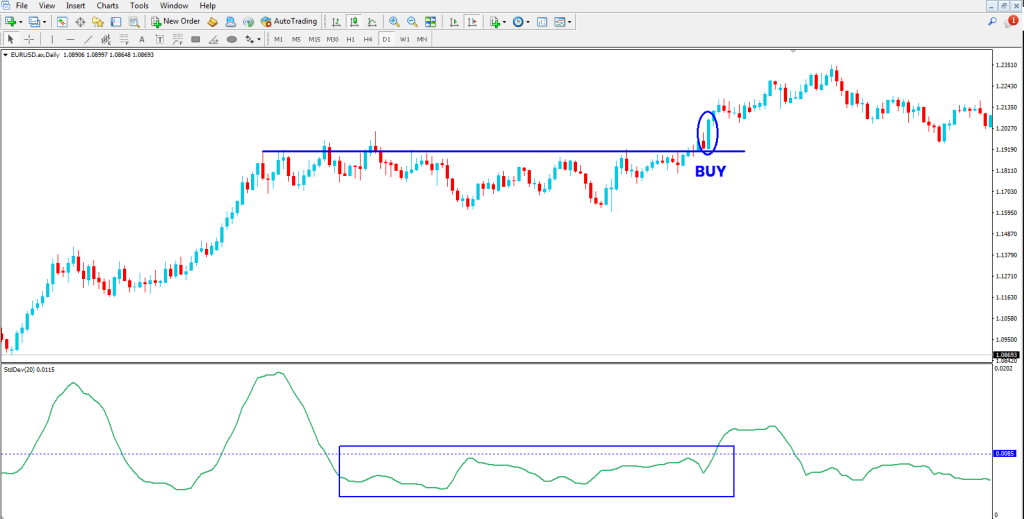

Standard deviation, expressed as σ (sigma), quantifies the dispersion of data points relative to their mean. It serves as a measure of how widely the values are spread out. In the context of option trading, standard deviation gauges the volatility of the underlying asset, providing insights into the potential range of future price movements.

Understanding Volatility and Standard Deviation in Option Pricing

Volatility, the key determinant of option premiums, refers to the degree of price fluctuations experienced by an underlying asset. Higher volatility implies greater price swings, translating into higher option premiums. Standard deviation, by measuring volatility, allows options traders to assess the likelihood and magnitude of future price movements.

The Black-Scholes model, a cornerstone of options pricing theory, incorporates standard deviation as a critical input. The model calculates option premiums based on the underlying asset’s price, strike price, time to expiration, and volatility (represented by standard deviation).

1 Standard Deviation: A Measure of Expected Price Fluctuations

One standard deviation, often denoted as 1σ, represents an interval approximately 68% likely to contain the future price of the underlying asset. In other words, there is a 68% probability that the price will remain within one standard deviation above or below the current price. This concept is particularly valuable when evaluating options with short expiration periods, where price fluctuations are typically less pronounced.

Leveraging Standard Deviation for Risk Management

Skilled option traders employ standard deviation as a risk management tool. By understanding the potential price movements implied by the standard deviation, traders can make informed decisions about the appropriate strike prices and expiration dates for their options strategies. This analytical approach helps traders strike a balance between potential rewards and downside risks.

Image: traderyam.blogspot.com

1 Standard Deviation Means In Option Trading

Conclusion

Standard deviation, a measure of volatility represented by σ, holds significant implications in option trading. As a key input in the Black-Scholes pricing model, standard deviation enables traders to assess the expected range of price fluctuations and make strategic decisions based on this invaluable information. By leveraging standard deviation, options traders gain a deeper understanding of market dynamics, manage risk effectively, and enhance their overall trading strategies.