Introduction

Venturing into the realm of options trading can be an exhilarating yet daunting experience. Understanding the intricacies of options trading level TDA is paramount for optimizing your trading strategy and minimizing risk. This comprehensive guide delves into the fundamental concepts, latest advancements, and effective approaches within the TDA platform, empowering you to navigate the complexities of options trading with confidence.

Image: www.brokerage-review.com

Embarking on Options Trading

Options trading involves the buying and selling of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a stipulated timeframe. Options contracts come in two primary flavors: call options grant the holder the right to buy the underlying asset, while put options entitle the holder to sell.

Navigating Options Trading Level TDA

The TDA platform provides a suite of robust tools and resources to enhance your options trading experience. Upon accessing your TDA account, you will encounter various levels designed to cater to traders of varying skill levels. Options Trading Level TDA stands out as a sophisticated platform tailor-made for advanced traders seeking nuanced functionality.

Level Up with Tiered Features

Options Trading Level TDA grants you access to an array of exclusive features designed to elevate your trading prowess. These include advanced order types such as conditional orders, trailing stop-loss orders, and one-cancels-the-other (OCO) orders. Additionally, real-time market data and Level II quotes empower you with comprehensive market insights.

Image: www.brighthub.com

Unlock Analytical Prowess

Delve deeper into market analysis with Options Trading Level TDA’s advanced charting capabilities and technical indicators. Utilize these tools to identify trading opportunities, assess market trends, and make informed decisions.

Customized Options Chains

Personalize your trading interface with customizable options chains that display vital metrics, including option prices, implied volatility, and the Greeks. This level of customization enables you to tailor your trading environment to suit your unique preferences and strategies.

Comprehensive Market Overview

Gain a comprehensive market overview with Options Trading Level TDA’s integrated watchlists and market scanners. Monitor multiple underlying assets, track option prices, and receive real-time alerts to stay ahead of the market curve.

Maximizing Your Trading Potential

To maximize your trading potential, consider the following strategies:

Understanding the Greeks

Mastering the nuances of the Greeks is essential for options trading success. These metrics, including Delta, Gamma, Theta, Vega, and Rho, provide insights into an option’s sensitivity to various market factors, enabling you to refine your trading decisions.

Risk Management

Managing risk is paramount in options trading. Implement strategies such as diversification, position sizing, and hedging to mitigate potential losses and enhance your overall trading performance.

Patience and Discipline

Options trading requires patience and discipline. Avoid impulsive trades and stick to a well-defined trading plan. Remember that long-term success in options trading stems from consistency and adherence to sound principles.

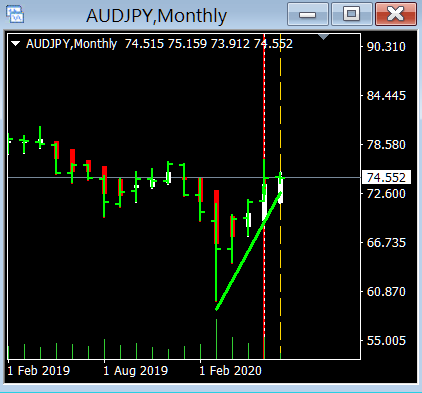

Options Trading Level Tda

Image: www.forexfactory.com

Conclusion

Options Trading Level TDA offers a powerful platform that empowers experienced traders to navigate the complexities of options trading with precision and efficiency. By embracing the platform’s advanced features, mastering the Greeks, implementing effective risk management strategies, and maintaining patience and discipline, you can exploit the opportunities presented by options trading while mitigating associated risks. Remember that continuous learning and market observation are key to sustained success in this dynamic and ever-evolving financial landscape.