Introduction:

Image: www.marketoracle.co.uk

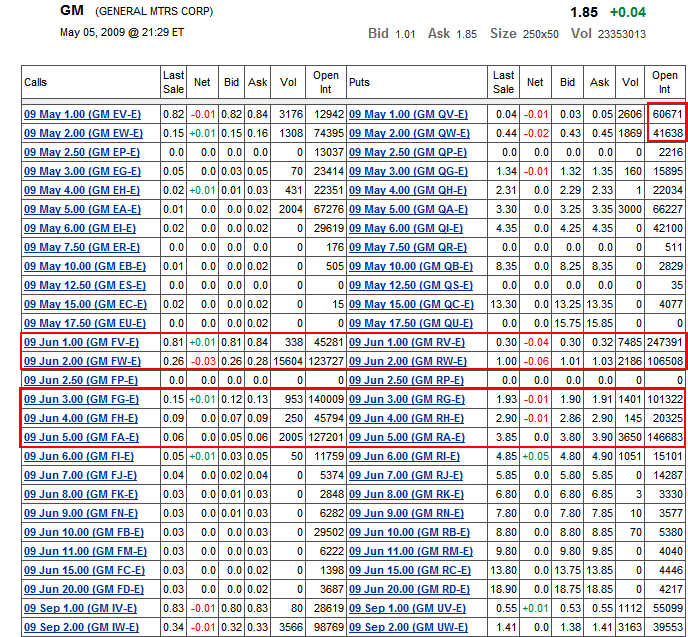

In the realm of financial markets, options trading has emerged as a powerful tool for investors seeking to enhance their portfolio returns or hedge against market volatility. General Motors (GM), a renowned automotive giant, offers a wide range of option trading opportunities that can cater to both novice and experienced traders. Whether you’re a seasoned veteran or a budding enthusiast, understanding the intricacies of GM option trading can unlock a world of possibilities.

Options trading involves the buying or selling of contracts that grant the holder the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price on or before a specific date. By utilizing GM options, traders can strategically position themselves to benefit from price fluctuations in the company’s stock while managing their risk exposure.

Delving into the GM Option Trading Universe

Option Basics:

Options contracts are composed of three critical elements: the underlying asset (in this case, GM stock), the strike price (the designated price at which the option can be exercised), and the expiration date (the last day on which the option can be executed). Buyers of options pay a premium to acquire the contract, while writers receive this premium in exchange for assuming the obligation to fulfill the contract.

Call Options:

Call options provide buyers with the right to purchase the underlying asset at the strike price before the expiration date. When the stock price rises above the strike price, call options gain value, enabling the holder to potentially profit by exercising the option or selling it in the market.

Put Options:

Put options confer upon buyers the right to sell the underlying asset at the strike price before the expiration date. In a scenario where the stock price falls below the strike price, put options become more valuable, giving the holder the option to sell the stock at the higher strike price or profit by selling the option itself.

Navigating GM Option Trading

Market Factors:

The value of GM options is heavily influenced by various market factors, including the stock’s price, implied volatility, time to the expiration date, and interest rates. Understanding the dynamics of these factors is crucial for making informed trading decisions.

Option Premiums:

The cost of an option contract is known as its premium. Premiums are determined by the market’s assessment of the probability of the option being exercised profitably. Factors such as volatility, strike price, and time to expiration all impact the premium.

Option Greeks:

Option Greeks, such as Delta, Gamma, Theta, Vega, and Rho, are mathematical measures that quantify the sensitivity of option prices to changes in underlying factors. These Greeks provide traders with insights into the risks and potential rewards associated with various options strategies.

Unleashing the Power of GM Options

Income Generation:

Selling covered calls or put options can generate additional income for traders who own GM stock. By collecting premiums from option buyers, traders can supplement their returns while also managing their risk exposure.

Risk Management:

Buying put options can serve as a hedge against the potential decline in GM stock prices. By purchasing a put option, traders can limit their losses if the stock price falls below the strike price.

Speculation:

Options trading offers ample opportunities for traders to speculate on the future direction of GM stock. Utilizing strategies such as buying or selling naked options can amplify potential profits but also entail greater risk.

Image: warriortradingnews.com

Charting Success in GM Option Trading

Technical Analysis:

Technical analysis plays a pivotal role in GM option trading. By studying historical stock price movements, traders can identify patterns and trends that may provide insights into future price movements.

Fundamental Analysis:

Fundamental analysis involves assessing the financial health, industry dynamics, and competitive landscape of General Motors. By understanding the company’s strengths, weaknesses, and future prospects, traders can make more informed trading decisions.

Risk Management Strategies:

Effective risk management is paramount in GM option trading. Implementing strategies such as stop-loss orders, position sizing, and risk-reward ratio analysis can help traders mitigate losses and protect their capital.

Embracing the Future of GM Option Trading

As technology continues to reshape the financial landscape, GM option trading has witnessed the emergence of innovative platforms and tools. Electronic trading platforms provide traders with real-time market data, advanced charting capabilities, and automated execution engines.

Option Analytics:

Online option analytics tools enable traders to analyze complex option strategies, evaluate risk-reward profiles, and optimize their trading decisions.

Artificial Intelligence:

Artificial intelligence (AI) is transforming GM option trading through automated trade execution, sentiment analysis, and predictive modeling. AI algorithms can help traders identify trading opportunities, reduce execution time, and enhance decision-making processes.

Gm Option Trading

https://youtube.com/watch?v=Gm6g2fvLrKU

Conclusion

GM option trading presents a wealth of possibilities for investors seeking to enhance their portfolio returns, hedge against risk, or speculate on market fluctuations. By understanding the core concepts of options trading and utilizing the strategies outlined in this article, traders can navigate the GM option trading landscape with confidence. Remember to embrace the power of research, risk management, and continuous learning to achieve success in this dynamic arena.