Introduction

Image: choosegoldira.com

Investing in options is a great way to potentially amplify gains in a Roth IRA. It’s an excellent investment vehicle for growth-oriented investors seeking tax-advantaged returns. Join me as we delve into the world of schwab roth ira options trading.

Options are derivative contracts that give you the right, but not the obligation, to buy or sell an underlying asset (in this case, stocks) at a specific price on or before a certain date. They are valuable tools that can enhance your investment strategy and offer a variety of benefits.

Benefits of Options Trading in a Roth IRA

- Tax Advantages: Withdrawals from a Roth IRA are tax-free, including potential gains from options trading.

- Growth Potential: Options offer leverage, allowing you to potentially grow your investments faster.

- Diversification: Options can provide diversification to your portfolio, as they are not directly tied to market movements.

- Income Generation: Selling options can generate income, which can be used to supplement your retirement savings or offset potential losses.

Understanding Options Basics

To understand schwab roth ira options trading better, let’s start with the basics:

- Calls: Give you the right to buy an asset.

- Puts: Give you the right to sell an asset.

- Strike Price: The price at which you can buy (call) or sell (put) the asset.

- Expiration Date: The date on which the option expires.

- Premium: The price you pay to purchase an option.

Schwab’s Options Trading Platform

Schwab offers a user-friendly options trading platform that provides a wide range of features, including:

- Real-time quotes: Access up-to-date market data for informed decision-making.

- Historical data: Analyze past performance to identify trading opportunities.

- Option chains: Visualize different options contracts to find the best fit for your needs.

- Strategy deployment tools: Create complex option strategies to suit your investment goals.

Tips for Successful Roth IRA Options Trading

Before embarking on schwab roth ira options trading, consider these tips:

- Understand Options Risks: Options trading involves significant risks. Educate yourself thoroughly before investing.

- Choose the Right Broker: Select an experienced broker like Schwab that offers a robust options trading platform and support.

- Start Small: Begin with small trades and gradually increase your involvement as you gain experience.

- Manage Your Risk: Use stop-loss orders or other risk management techniques to limit potential losses.

- Have a Plan: Develop a clear trading plan that outlines your investment goals, risk tolerance, and exit strategies.

FAQs on Roth IRA Options Trading

Q: Is options trading suitable for all investors?

A: Options trading is not suitable for all investors. It is a complex strategy that involves significant risks and should only be pursued by experienced and knowledgeable investors.

Q: Can I open a Roth IRA specifically for options trading?

A: Yes, you can open a Roth IRA with the primary purpose of trading options. However, it is crucial to research and fully understand the risks and potential rewards involved.

Image: www.schwab.com

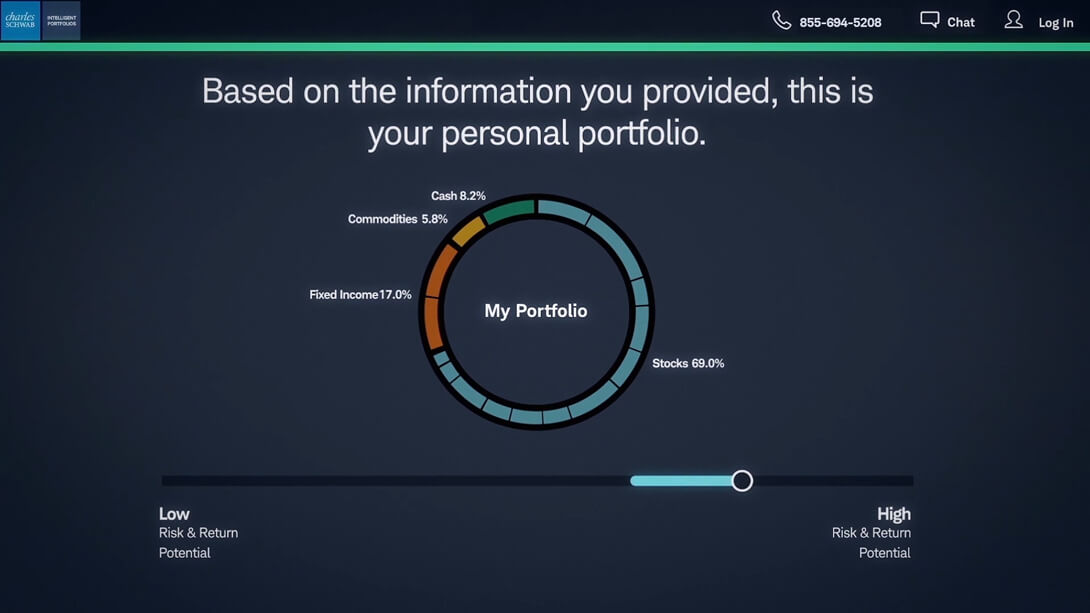

Schwab Roth Ira Options Trading

Image: www.thelifegroup.org

Conclusion

Schwab roth ira options trading can be a powerful tool to enhance your portfolio and build your retirement savings. By following our guide, leveraging Schwab’s platform, and implementing the tips and advice provided, you can navigate the world of options trading with greater confidence.

Are you interested in learning more about schwab roth ira options trading? Contact us for a personalized consultation and discover how we can assist you in achieving your financial goals.