As an eager investor, I recall my initial foray into bull options trading, driven by the promise of lucrative returns. However, the intricacies of this specialized market initially proved daunting. After extensive research and guidance from seasoned traders, I unraveled the secrets to successful bull options trading. In this comprehensive guide, I embark on a journey to empower you with the knowledge and strategies to navigate this exhilarating investment landscape.

Image: www.cmgwealth.com

Understanding Bull Options: Riding the Upswing

Bull options are financial contracts that convey the right, not the obligation, to purchase an underlying asset at a predefined price (strike price) on or before a specific date (expiration date). These instruments thrive in bullish market conditions, where investors anticipate an upward trajectory in the underlying asset’s value. Bull options offer the potential for outsized gains with limited risk, making them a popular choice among traders seeking market upside exposure.

Types of Bull Options: Navigating the Options Market

- Call Option: Grants the buyer the right to purchase the underlying asset at the strike price on or before the expiration date.

- Bull Call Spread: Involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price with the same expiration date. This strategy limits risk while still capturing potential upside.

- Bull Put Spread: Tailored for moderately bullish markets, this strategy involves selling a put option at a lower strike price and buying a put option at a higher strike price with the same expiration date. It provides a limited profit potential with a higher probability of success.

Leveraging Bull Options: Maximizing Upside Potential

The key to successful bull options trading lies in mastering the art of selecting the right options, managing risk effectively, and capitalizing on market opportunities. Here are some essential strategies to consider:

Image: www.anleger.blog

Option Selection: Choosing the Right Candidates

- Strike Price: Choose a strike price that is slightly above the current market price for call options and slightly below the current market price for put options.

- Expiration Date: Select an expiration date that provides sufficient time for the underlying asset’s price to move in the anticipated direction.

- Volatility: Consider the implied volatility of the underlying asset. Higher volatility favors option premiums, but it also increases the potential for losses.

Risk Management: Mitigating Losses

While bull options offer the potential for significant gains, it’s crucial to manage risk prudently. Employing strategies such as:

- Stop-Loss Orders: Determine a specific price level at which the position will be automatically closed to minimize losses.

- Position Sizing: Allocate a portion of your trading capital to each trade, ensuring that a single loss won’t jeopardize your overall portfolio.

- Hedging: Use offsetting positions to reduce overall risk. For example, buying a call option and simultaneously selling a put option.

- What are the primary risks associated with bull options trading?

- The main risks include the potential for the underlying asset’s price to move against the anticipated direction, resulting in losses on the option premium paid.

- How can I determine the profitability of a bull options trade?

- Compare the option premium at the time of purchase to the difference between the underlying asset’s price and strike price at the expiration date.

- Is it possible to make consistent profits in bull options trading?

- While bull options trading can be lucrative, it requires a blend of market knowledge, risk management skills, and continuous learning. Consistent profits are not guaranteed, but the potential for substantial gains is substantial.

Expert Advice: Riding Bullish Trends

Drawing upon insights from industry veterans, here are invaluable tips to enhance your bull options trading strategies:

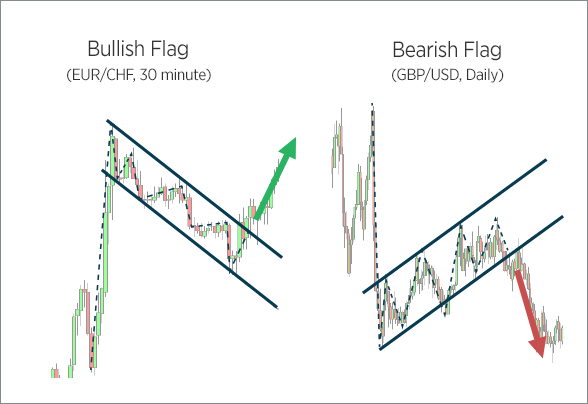

Embrace Technical Analysis: Deciphering Market Movements

Technical analysis examines price charts to identify historical patterns and trends. By leveraging indicators such as moving averages and support and resistance levels, you can gain valuable insights into the underlying asset’s price behavior.

Follow Market News and Events: Uncovering Market Catalysts

Stay informed about macroeconomic events, corporate earnings reports, and industry updates that can significantly impact the underlying asset’s price. Timely knowledge empowers you to make informed decisions and adjust your trading strategy accordingly.

FAQ: Empowering Your Bull Options Journey

Bull Options Trading

Image: dnasoa.com

Conclusion: Seizing Market Opportunities

Bull options trading presents a compelling opportunity for investors seeking to harness the potential of rising markets. By understanding the intricacies of this specialized market, selecting options strategically, managing risk prudently, and embracing the latest trends, you can position yourself to capture market upside while mitigating potential losses.

Are you ready to embark on the exciting world of bull options trading? With the knowledge and strategies outlined in this guide, you now possess the tools to navigate this dynamic market and potentially reap its rewards. Seize the opportunities, trade wisely, and may your bull options journeys culminate in resounding success!