Delve into the Lucrative World of Bullish Options

Welcome to the exhilarating realm of trading bull call options. As an avid options trader, I’ve witnessed firsthand the potential for lucrative returns. In this comprehensive guide, we’ll delve into the intricacies of trading bull call options, empowering you with the knowledge and strategies to navigate this dynamic market effectively.

Image: letraderdudimanche.com

Bull call options grant the holder the right, but not the obligation, to purchase an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These options are typically employed when the trader anticipates an upward price movement in the underlying asset.

The allure of bull call options lies in their ability to amplify potential gains while limiting risk compared to outright stock purchases. By purchasing a call option, investors can leverage their capital, potentially maximizing their returns with a relatively small initial investment.

Understanding the Basics: Strategy and Execution

Trading bull call options involves identifying assets with strong bullish potential and carefully selecting strike prices and expiration dates aligned with your investment horizon and risk tolerance. It’s crucial to conduct thorough research, monitoring market trends and analyzing company performance before making any trades.

Once you’ve identified a suitable opportunity, you’ll need to purchase the call option at a premium-the price paid to acquire the option contract. The premium is determined by various factors, including the strike price, time to expiration, and implied volatility. Understanding the factors influencing the premium is vital for informed decision-making.

Maximizing Returns: Tips and Expert Advice

Harnessing the potential of bull call options requires a combination of strategy, risk management, and execution tactics. Here are some valuable tips to enhance your trading:

- Select In-the-Money Options: Consider purchasing options with strike prices below the current underlying asset price for increased probability of profitability.

- Determine Optimal Expiration Dates: Choose expiration dates that align with your expected time frame for the underlying asset to appreciate in value.

- Manage Risk with Covered Calls: Sell call options against stocks you own to generate premium income while limiting potential losses.

Incorporating these strategies can significantly enhance your chances of success in the bull call options market.

Common Questions Unraveled

To further clarify the concepts discussed, let’s address some frequently asked questions:

- Q: What are the potential risks associated with trading bull call options?

A: As with any investment, there are risks involved. Options trading carries the potential for significant losses, especially if not managed appropriately. - Q: When is it the best time to trade bull call options?

A: Bull call options are ideally traded in bullish market conditions when the underlying asset is expected to increase in value. - Q: What is the difference between buying and selling bull call options?

A: Buying a bull call option conveys the right to purchase the underlying asset, while selling a bull call option obligates the seller to deliver the asset if the option is exercised.

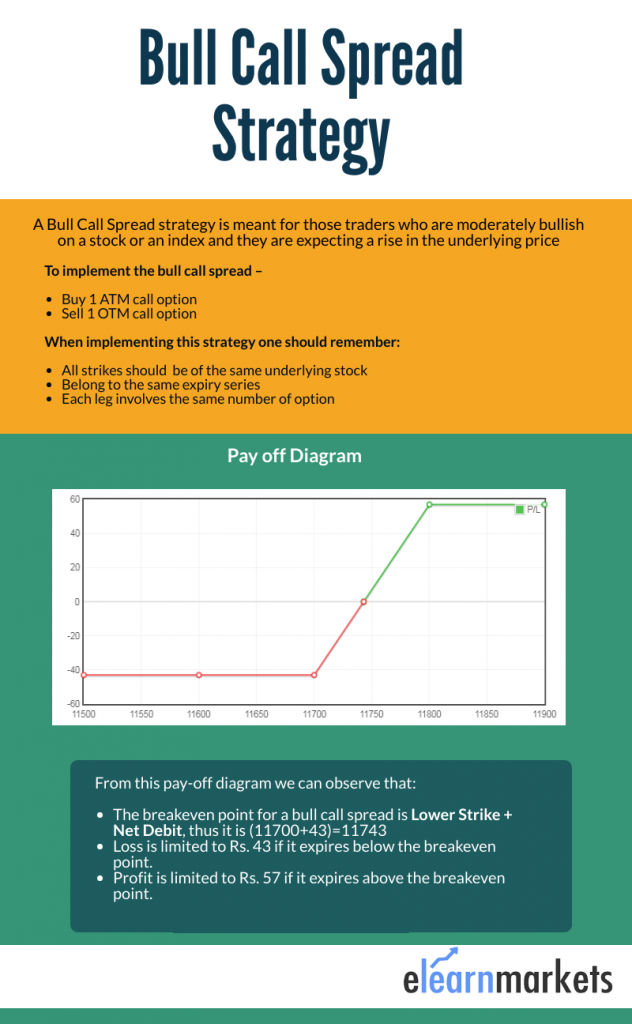

Image: blog.elearnmarkets.com

Trading Bull Call Options

Image: www.asiaforexmentor.com

Conclusion: Embark on Your Bullish Trading Journey

Navigating the ever-changing landscape of bull call options trading requires knowledge, strategy, and a keen understanding of the market. By embracing the insights provided in this guide and relentlessly pursuing knowledge, you can harness the potential of this dynamic investment vehicle.

Are you ready to venture into the exciting world of bull call options trading? Commence your journey today, delve into the depths of this strategy, and witness the potential for lucrative returns it holds.