In the arena of options trading, it has always been imperative to grasp the fundamental concepts of risk management and calculated decision-making. Understanding standard deviation is a crucial component of this landscape, enabling traders to quantify volatility and make prudent choices based on the inherent level of risk associated with various options strategies.

Image: theforexgeek.com

Standard Deviation in Options Trading: Definition

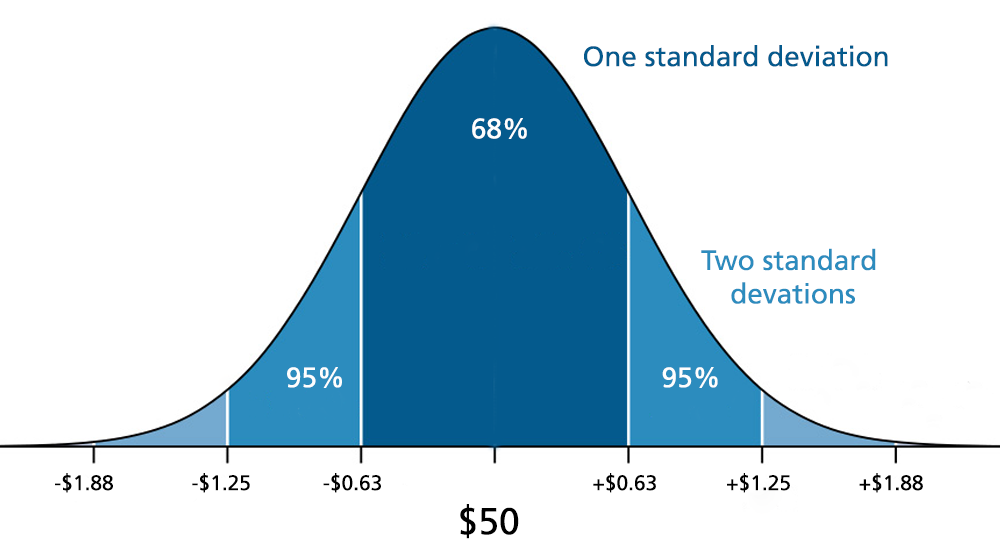

Standard deviation is a statistical measure that quantifies how much the values in a data set deviate from the mean or average. In options trading, it measures how much the underlying asset’s daily returns deviate from its historical average.

A higher standard deviation indicates greater volatility, while a lower standard deviation signifies lower volatility. Volatility is a critical consideration in options trading as it influences the potential gains and losses associated with different strategies.

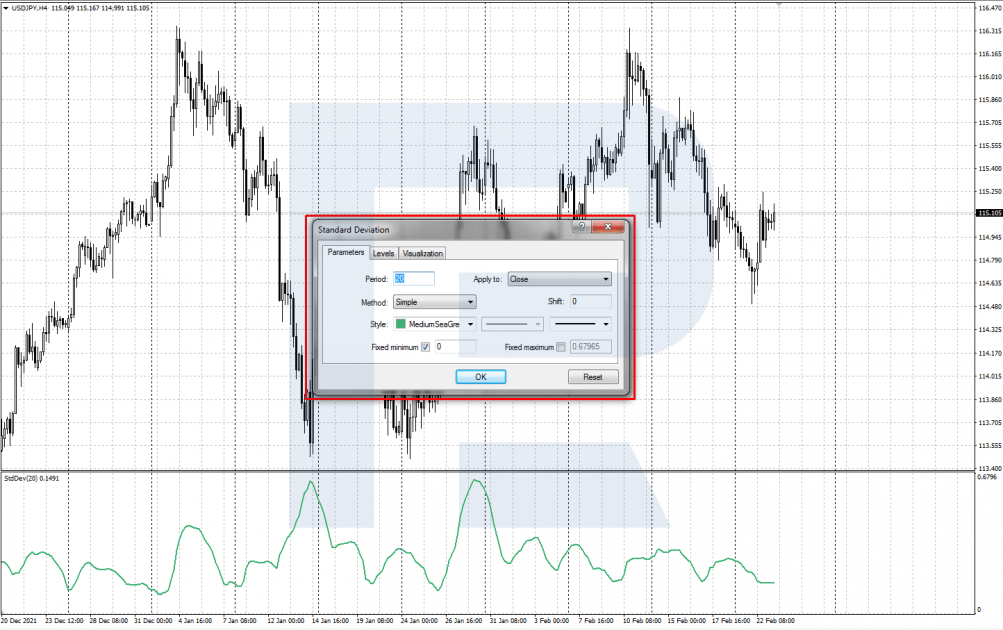

Historical Standard Deviation

The historical standard deviation is calculated using past data on the underlying asset’s returns. It gives us a sense of the average amount of volatility that a particular asset has experienced over a given time frame (for example, one year).

Implied Standard Deviation

The implied standard deviation, on the other hand, is a forward-looking measure that reflects market expectations of the future volatility of the underlying asset. It is derived from the prices of options contracts. The implied volatility may differ from the historical volatility, especially when the market anticipates significant events or changes in the asset’s behavior.

Image: thetradingrobot.com

Significance of Standard Deviation for Options Traders

Standard deviation plays a vital role in options pricing. The higher the standard deviation, the more expensive the options will be. That’s because investors require a higher premium for assuming the increased risk associated with higher volatility

Managing risk is a critical aspect of options trading. A trader’s risk tolerance and the desired level of risk associated with different strategies can be assessed using standard deviation.

Tips for Using Standard Deviation in Options Trading

Before trading options, thoroughly understanding the market conditions and your risk tolerance is critical. Employ standard deviation as a fundamental tool to guide your decisions.

Incorporate standard deviation into your trading plan and use it to select options strategies that align with your risk profile and investment goals. Monitor the realized volatility of your portfolio and adjust your positions as needed to manage risk.

Frequently Asked Questions on Standard Deviation in Options Trading:

Q: How can standard deviation be used to measure risk in options trading?

A: The higher the standard deviation, the greater the potential for daily variations in return and the associated risk of the options strategy.

Q: What factors can cause the implied volatility to deviate from historical volatility?

A: Market conditions, anticipated events, and changes in investors’ risk appetites.

Q: How does implied volatility affect options pricing?

A: Higher implied volatility results in more expensive options premiums due to the perceived increased risk associated with the underlying asset’s price movements.

What Is Standard Deviation In Options Trading

Image: tickertape.tdameritrade.com

Conclusion

Mastering standard deviation in options trading requires a comprehensive understanding of risk management and informed decision-making. Traders can make better-informed choices, evaluate risks, and improve their overall trading strategies by incorporating this critical measure into their analysis.

Are you eager to enhance your options trading knowledge further? Would you like to gain additional insights and learn more about advanced risk management techniques? Dive into our extensive library of resources, subscribe to our newsletter, and stay connected for the latest updates. Your journey toward becoming a successful options trader starts here!