In options trading, standard deviation is a statistical measure that gauges the volatility or price fluctuation of a particular option over time. It also provides an insight into the option’s risk and potential return. I remember when I first started trading options, I was overwhelmed by the sheer amount of information and terminology. But gradually understanding concepts like standard deviation helped me make more informed trading decisions.

Image: www.babypips.com

The higher the standard deviation, the more significant the option’s price swings. This knowledge enables traders to comprehend the risks associated with the option and assess their tolerance for volatility. Let’s deep dive into the world of standard deviation in options trading!

Standard Deviation in the Options Market

In the options market, the standard deviation of an option reflects its historical price volatility relative to the underlying asset. It is expressed as a percentage and calculated using historical data. Volatility is a key factor in determining an option’s premium, as it directly affects the option’s price range. A higher standard deviation indicates a wider range of potential price movements, leading to a higher option premium.

Interpreting Standard Deviation

Standard deviation is a double-edged sword. On one hand, it indicates the potential for substantial gains if the option’s price moves in the predicted direction. Yet, on the other hand, it also showcases the risk of significant losses due to unfavorable price movements. Understanding the standard deviation empowers traders to make informed choices about their risk appetite and align their trading strategies accordingly.

Calculating Standard Deviation

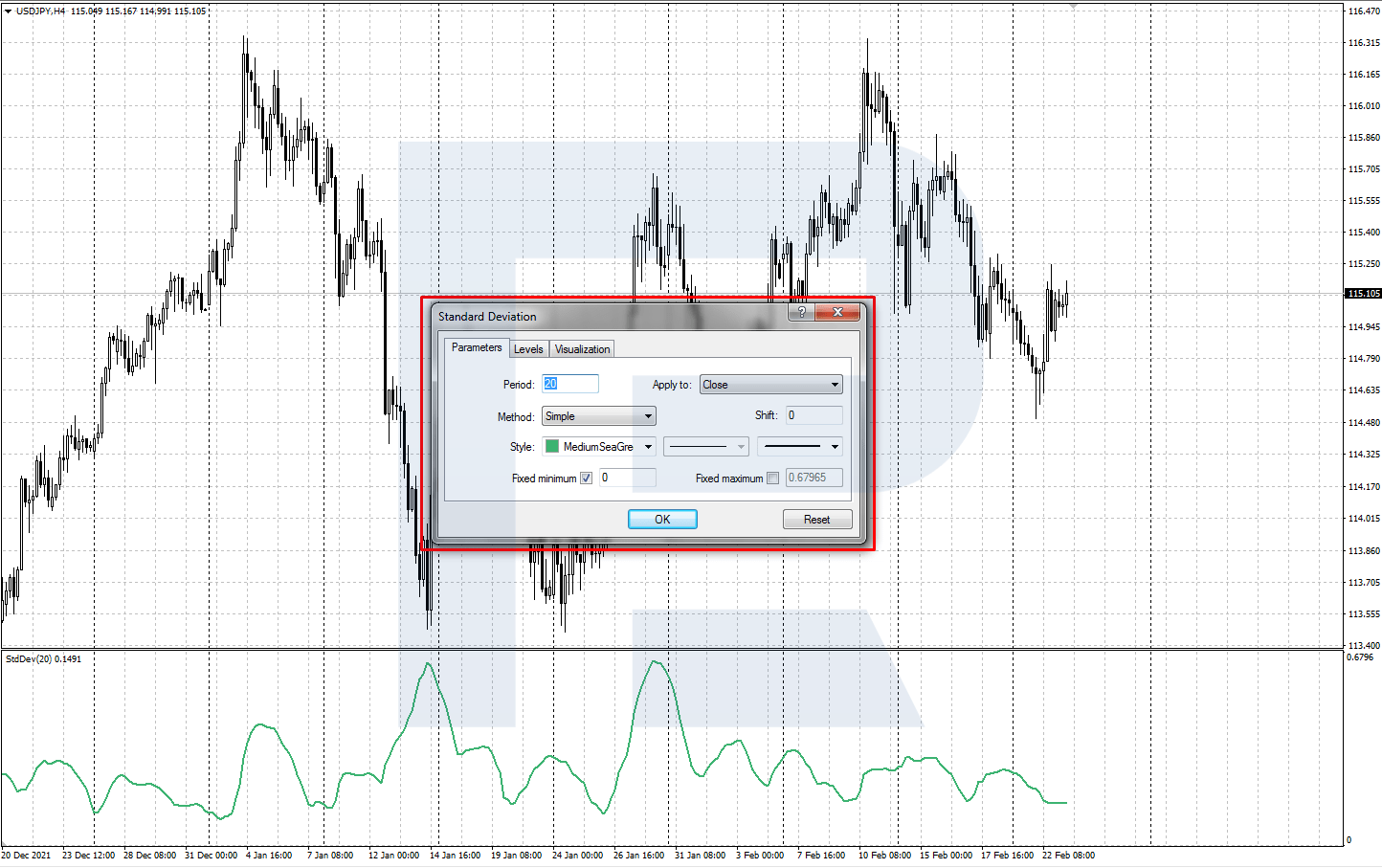

Traditionally, calculating standard deviation required complex statistical computations. However, with advancements in technology, many online platforms and trading software provide in-built features that calculate standard deviation automatically. Traders can input historical price data into these tools to obtain real-time standard deviation values.

Historical volatility, a crucial component in the calculation, measures the price fluctuations of the underlying asset over a specific period, typically the last 20 or 30 trading days. Higher historical volatility results in a higher standard deviation, indicating greater price variability.

Image: 11waystomakemoney.com

Tips for Using Standard Deviation

Incorporating standard deviation into your trading strategy can enhance decision-making and improve your chances of success:

- Assess Risk Tolerance: Evaluate your risk tolerance and align it with the standard deviation of the options you’re considering.

- Estimate Option Premium: Use standard deviation to estimate the potential price range and future premiums of options.

Frequently Asked Questions (FAQs)

Q: Is a higher standard deviation always better?

A: Not necessarily. A higher standard deviation can indicate greater volatility and potential rewards, but it also amplifies potential losses.

Q: How do I use the standard deviation in my trading strategy?

A: Standard deviation can help you determine the potential range of price fluctuations and assess the risk-reward ratio for different options.

In Options Trading What Is A Standard Deviation

Image: www.youtube.com

Conclusion

Options trading involves understanding various factors that influence an option’s price. Among these, standard deviation is a crucial indicator of volatility. Incorporating it into your trading strategy can refine your decision-making and enhance your risk management techniques. Understanding the concepts discussed in this article should assist you in gaining a better grasp of standard deviation and its effects on options trading.

Whether you’re a seasoned trader or just starting in the options market, I encourage you to explore this topic further and grasp the significance of standard deviation. If you have any specific queries or are looking for an even deeper dive into this captivating subject, feel free to reach out. Let’s continue this conversation and delve deeper into the fascinating world of options trading! I’d love to hear about your experiences and insights with standard deviation.