In the realm of options trading, predicting price movements can be a daunting task. However, one technique that has gained traction is standard deviation move option trading. This approach harnesses the power of historical data and statistical analysis to identify opportunities with a high probability of success.

Image: www.warriortrading.com

Envision standing at the edge of a precipice, gazing down upon a treacherous path filled with uncertainties. Standard deviation move option trading serves as a compass, guiding us through the fog of market volatility, allowing us to discern where the greatest opportunities lie.

Defining Standard Deviation

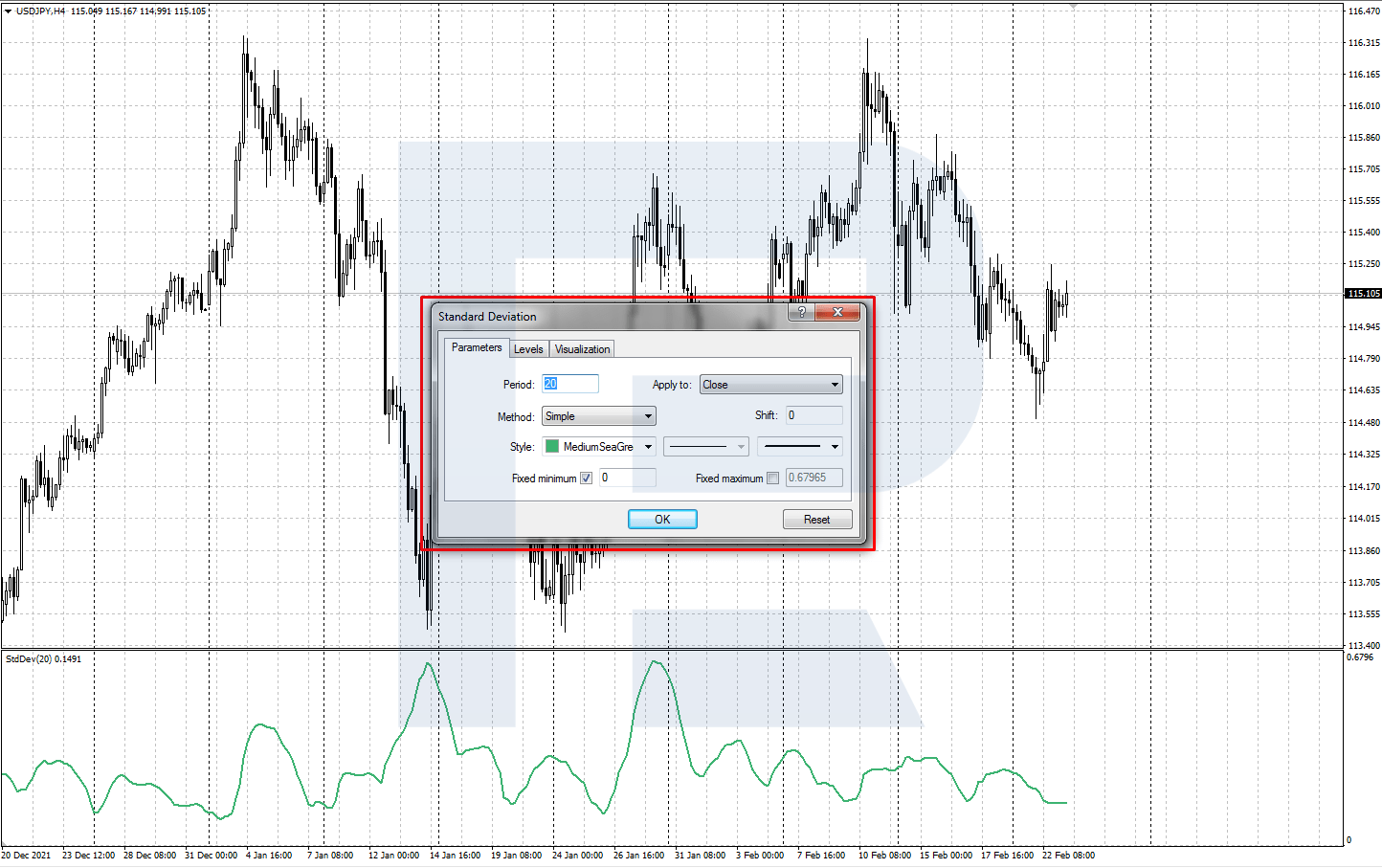

Standard deviation, a statistical measure of dispersion, quantifies the spread of data points from their mean value. Simply put, it represents the average distance between data points and their central tendency. In the context of options trading, standard deviation measures the historical volatility of an underlying asset.

Exploiting Historical Volatility

By analyzing historical standard deviation, traders can gauge the typical price fluctuations of an underlying asset. This information enables them to determine whether the market is relatively calm or experiencing heightened volatility. For instance, a low standard deviation suggests a stable market, while a high standard deviation indicates significant price movements.

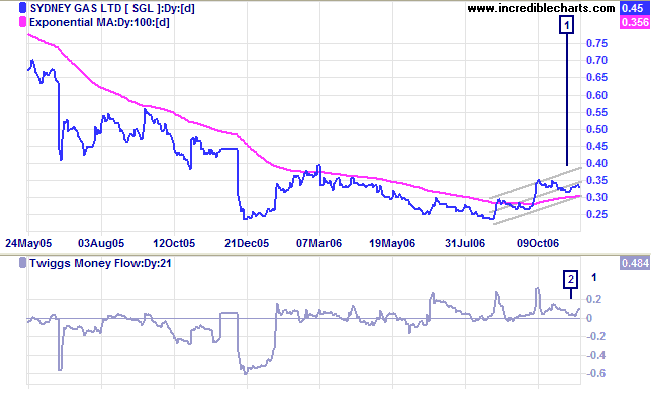

Understanding Standard Deviation Move Options

Standard deviation move options are a specialized type of option contract that pays out if the underlying asset moves beyond a specified number of standard deviations from its current price. These options offer a defined risk and reward profile, allowing traders to trade on volatility without directly speculating on the direction of the asset.

For example, consider an option contract that expires two weeks from today. The underlying asset is trading at $100, and the historical standard deviation over the past 100 days is 1.5%. In this case, a two standard deviation move option contract would expire in the money if the underlying asset rises above $103 or falls below $97.

Image: www.incrediblecharts.com

Tips and Expert Advice for Success

Mastering standard deviation move option trading requires a combination of knowledge, experience, and expert guidance. Here are some valuable tips to help you navigate this complex market:

- Understand the risks: Standard deviation move options can amplify volatility, so it’s crucial to comprehend the potential risks involved.

- Choose the right underlying asset: Select assets with predictable volatility and sufficient trading volume to ensure liquidity.

- Use proper risk management: Employ disciplined stop-loss orders to limit potential losses and protect your capital.

- Seek professional guidance: Consider consulting an experienced options trader or financial advisor for personalized guidance and support.

Frequently Asked Questions (FAQs)

Q: How do I calculate the strike price of a standard deviation move option?

A: Multiply the underlying asset’s current price by the desired number of standard deviations.

Q: What is the difference between a standard deviation move call option and a put option?

A: A call option pays out if the underlying asset rises above the strike price, while a put option pays out if the underlying asset falls below the strike price.

Q: Can I trade standard deviation move options on any stock or index?

A: While most stocks and indices offer standard deviation move options, liquidity and pricing may vary depending on the specific underlying asset.

Standard Deviation Move Option Trading

Image: blog.roboforex.com

Conclusion

Standard deviation move option trading is a powerful tool for navigating the volatile world of options trading. By understanding historical volatility, traders can harness probability to identify opportunities with favorable risk-reward profiles. While this technique requires a disciplined approach and careful risk management, the potential rewards can be substantial.

Are you interested in learning more about standard deviation move option trading? Dive deeper into the specifics by exploring additional resources or connecting with experienced traders. Remember, knowledge and proper execution are the keys to unlocking success in this complex yet rewarding realm.