Are you a seasoned options trader or just starting out? Either way, you’ve probably heard the term “theta decay,” the gradual erosion of an option’s value as time passes. But what happens to theta decay on non-trading days, when the options market is closed? Do options continue to lose value, even when there’s no trading activity? In this comprehensive guide, we’ll delve into the intricacies of theta decay and explore how it operates on non-trading days.

Image: www.youtube.com

Understanding Theta Decay: The Silent Value Eroder

Theta decay is an intrinsic characteristic of all options contracts, a relentless force that diminishes their value with each passing day. The value of an option contract is primarily determined by two factors: its intrinsic value and its time value. Intrinsic value is the difference between the underlying asset’s price and the option’s strike price, while time value represents the potential for the underlying asset to move in the option holder’s favor. Theta decay is the gradual erosion of this time value, which occurs as the option approaches its expiration date.

Theta Decay and the Non-Trading Day Enigma

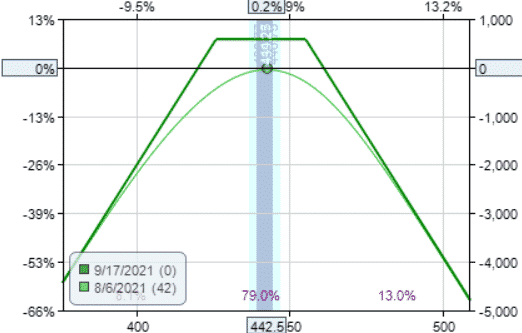

So, do options continue to lose value on non-trading days? The answer is a resounding yes. Although the options market may be closed, theta decay does not take a break. The time value of an option continues to dwindle on non-trading days, just as it does on trading days. In fact, because there is no trading activity, the theta decay effect is amplified, as there is no opportunity for the option’s price to fluctuate due to market forces.

Visualizing Theta Decay on a Non-Trading Day

Imagine an option contract with a time value of $0.50 at the close of a trading day. When the market reopens the next trading day, all other factors being equal, the time value of the option will have decayed to $0.49. However, if the market is closed for a non-trading day, the time value will have decayed to $0.48, a more significant loss than if the market had been open. This is because theta decay works continuously, regardless of market activity.

Image: luckboxmagazine.com

Implications for Options Trading on Non-Trading Days

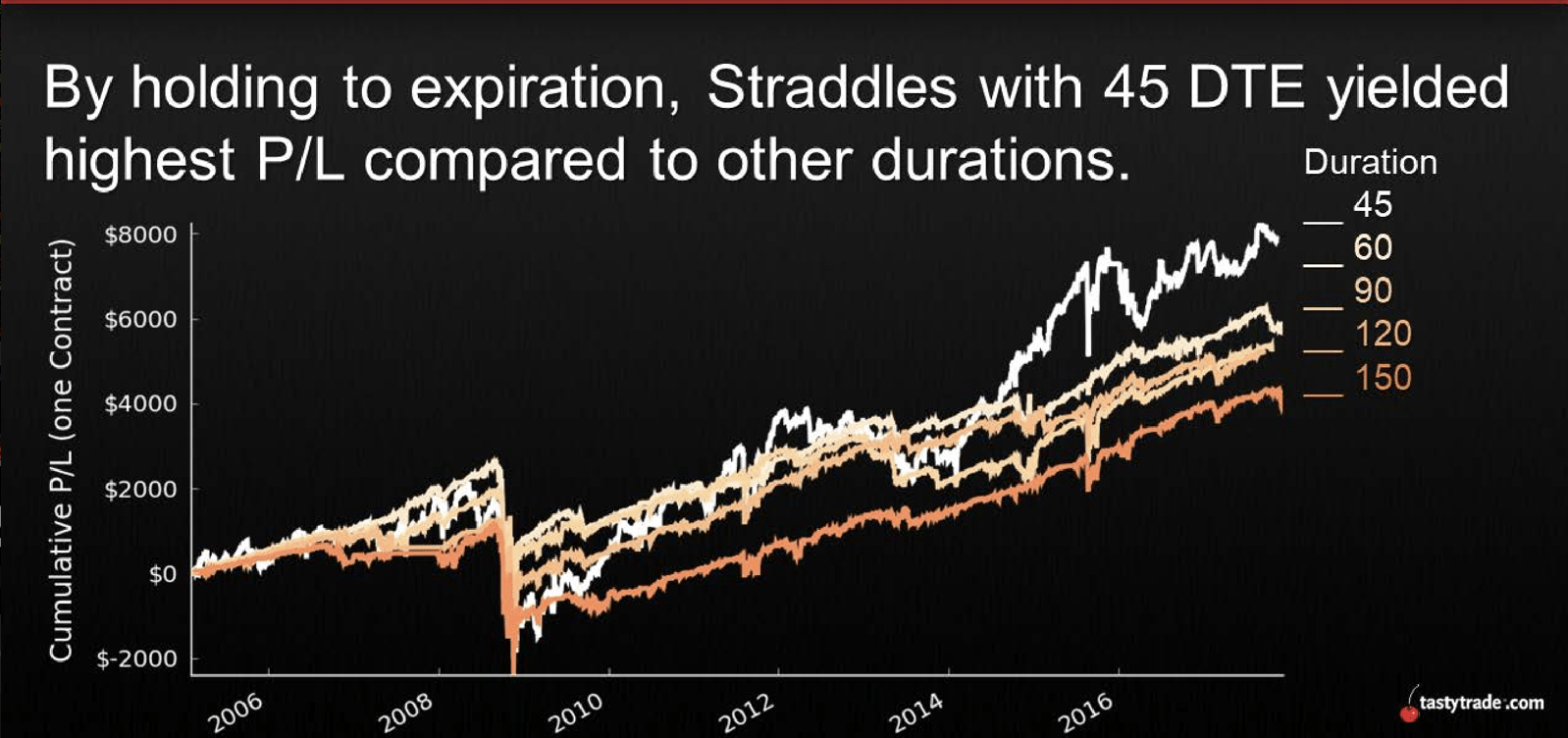

Understanding how theta decay operates on non-trading days is crucial for options traders, especially those holding short-term options. Short-term options, such as weekly options, have a higher rate of time decay compared to longer-term options. Therefore, traders holding short-term options need to be mindful of the accelerated theta decay on non-trading days and adjust their trading strategies accordingly.

Mitigating the Impact of Theta Decay on Non-Trading Days

While theta decay is an unavoidable aspect of options trading, there are strategies traders can employ to mitigate its impact on non-trading days:

-

Trade longer-term options: Long-term options have a slower rate of time decay compared to short-term options, making them less susceptible to value erosion on non-trading days.

-

Consider options with higher implied volatility: Implied volatility is a measure of the market’s expectation of future price volatility in the underlying asset. Options with higher implied volatility have a higher rate of time decay, but they also have greater potential for gains if the underlying asset’s price moves significantly.

-

Monitor the time to expiration: The closer an option is to its expiration date, the faster its time value decays. Traders should be aware of the number of days until expiration and adjust their strategies accordingly.

Do Option Theta Decay On Non-Trading Days

Image: optionstradingiq.com

Conclusion

Theta decay is an omnipresent force in options trading, relentlessly eroding the value of options as time passes. While the options market may be closed on non-trading days, theta decay does not pause, resulting in a more pronounced loss of time value. Understanding how theta decay operates on non-trading days is essential for options traders, particularly those holding short-term options. By employing appropriate strategies and managing risk effectively, traders can navigate the challenges posed by theta decay on non-trading days and maximize their chances of success in options trading.