Theta decay, an intrinsic characteristic of options, is the gradual erosion of its time value as its expiration date approaches. This concept plays a vital role in options trading, particularly for short-term strategies. In this comprehensive guide, we delve into the intricacies of theta decay, its implications, and effective strategies for managing time value in options trading.

Image: niftyoptiontrading.blogspot.com

Defining Theta Decay: The Clock Ticking on Options Value

Theta decay is the rate at which an option’s time value decreases as the days until expiration dwindle. This decay is the manifestation of the reduction in the option’s intrinsic value, which is the difference between the strike price and the underlying asset’s current price. As an option approaches its expiration date, its intrinsic value declines, and so does its overall value.

The Importance of Theta Decay in Options Trading

Theta decay has a significant impact on options trading, especially for short-term strategies that rely on capturing time value. Traders need to be aware of theta decay’s effects to make informed decisions about options positions and manage risk effectively. By understanding theta decay, traders can exploit it to their advantage or mitigate its impact.

Slow and Steady: The Gradual Erosion of Time Value

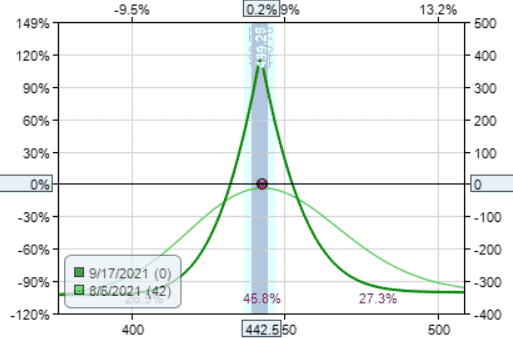

Theta decay is a gradual process that accelerates as an option nears expiration. In the early stages of an option’s life, theta decay may be relatively insignificant. However, as the expiration date draws closer, the rate of time value erosion increases exponentially. This phenomenon emphasizes the importance of managing time value strategically, particularly in short-term options trading.

Image: luckboxmagazine.com

Trading Strategies: Managing Time Value in Options Trading

Theta decay has a profound influence on trading strategies. Options traders employ various strategies to either capitalize on or minimize the effects of theta decay. Some common strategies include:

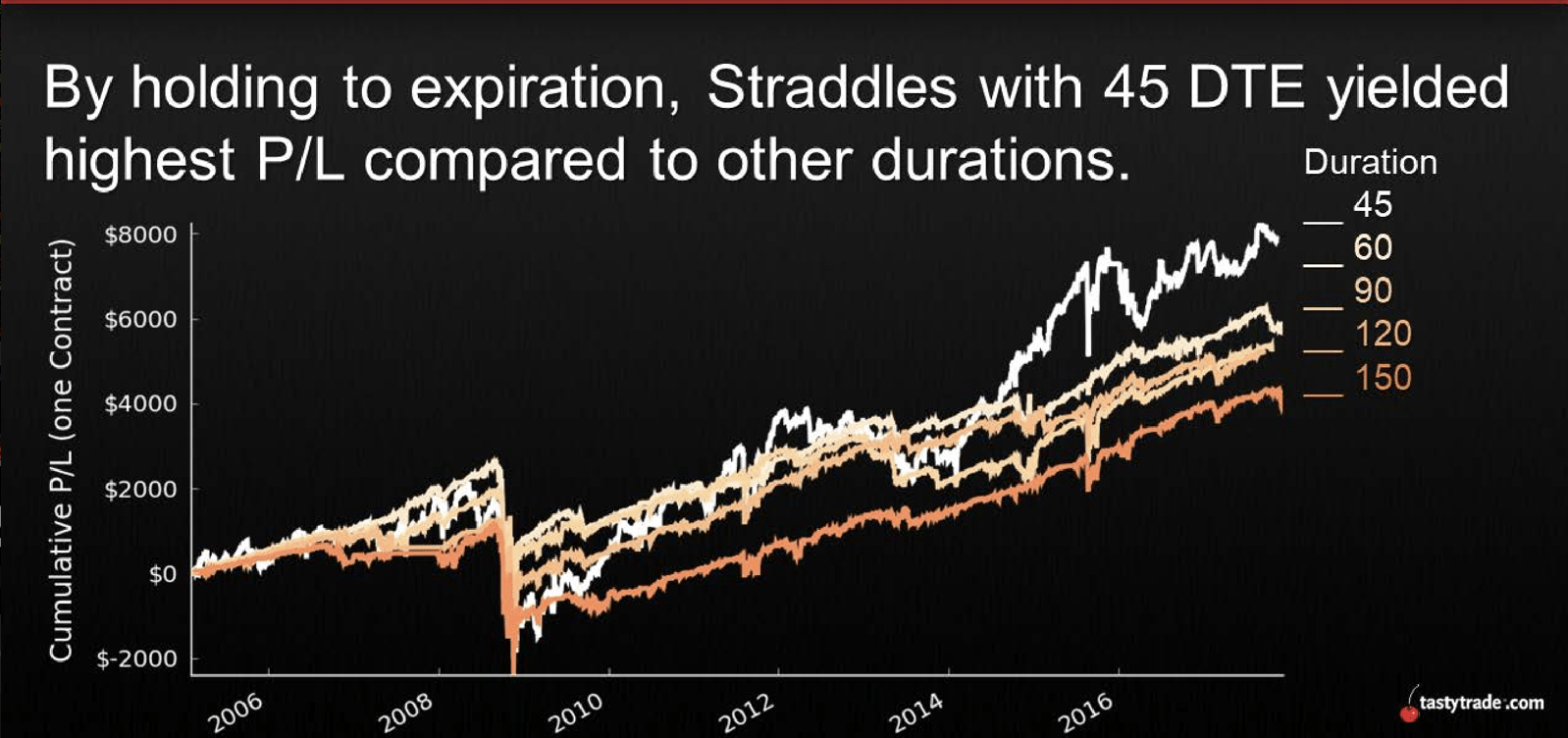

- Selling premium: Selling options, particularly those with short expirations, allows traders to capitalize on theta decay as the time value erodes.

- Buying premium: Purchasing options with sufficient time to expiration provides a buffer against theta decay, increasing the potential for profit from price movements.

- Spreading strategies: Combinations of options, such as bull and bear spreads, can minimize the impact of theta decay by diversifying risk and allowing for profits through price movement rather than solely relying on time decay.

- Rolling options: Extending the expiration date of an option before its current expiration can mitigate the effects of theta decay and provide additional time for the desired price movement to occur.

Market Dynamics: Theta Decay in Different Environments

Theta decay is not impervious to market conditions. Volatility plays a significant role in the rate of theta decay. In high-volatility markets, the implied volatility component of option pricing increases, offsetting the effects of theta decay to some extent. Conversely, in low-volatility markets, theta decay becomes more pronounced, hastening the erosion of time value.

Real-World Applications: Theta Decay Beyond Theoretical Concepts

Theta decay has tangible implications in various real-world options trading scenarios. For instance, traders who sell options near their expiration may find that their profits can be eroded by theta decay if the underlying asset price remains unchanged or moves against their prediction. Conversely, buyers of options must carefully consider the impact of theta decay on their strategies and adjust positions accordingly.

Theta Decay Options Trading

Image: optionstradingiq.com

Conclusion: Harnessing Time Value with Theta Decay Knowledge

Theta decay is an integral aspect of options trading that can significantly influence the success of trading strategies. Understanding the dynamics of theta decay empowers traders to make informed decisions, manage risk effectively, and exploit time value to their advantage. By mastering the intricacies of theta decay, options traders can enhance their trading performance and achieve their financial goals.