Introduction: Understanding Stop-Loss Orders

In the dynamic world of options trading, one of the most critical tools at a trader’s disposal is the stop-loss order. A stop-loss order instructs your broker to automatically sell an option when its price reaches a predetermined level, limiting potential losses and protecting your capital. Setting an effective stop-loss order is a delicate balance between minimizing risk and maximizing profit potential, making it a crucial skill for any options trader.

Image: www.pinterest.com

Understanding Options and Stop-Loss Orders

Options are financial contracts that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (strike price) before a certain date (expiration date). Stop-loss orders are essential in options trading because they help traders manage risk by limiting potential losses on both winning and losing trades.

Step-by-Step Guide to Setting Stop-Loss Orders

-

Identify Your Risk Tolerance: Before setting any stop-loss orders, it’s essential to assess your individual risk tolerance. This will determine how aggressive or conservative your stop-loss levels should be. Higher risk tolerance allows for wider stop-loss levels, while lower risk tolerance requires tighter stops.

-

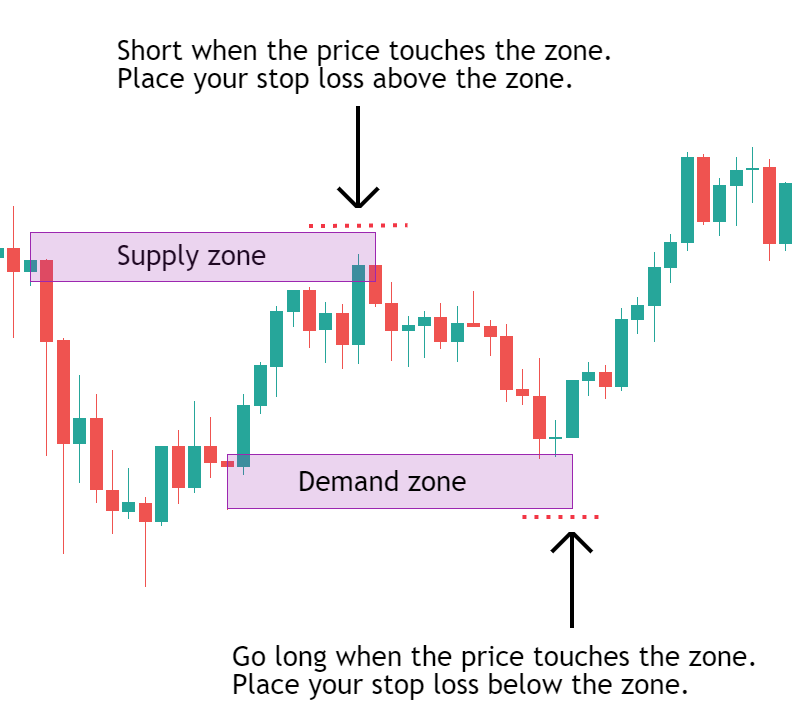

Determine the Support and Resistance Levels: Support and resistance levels are significant areas in technical analysis that can indicate potential turning points in price action. Setting stop-loss orders just below support levels for long positions (or above resistance levels for short positions) provides an additional layer of protection.

-

Calculate Your Maximum Loss: Before putting a stop-loss order, determine the maximum amount of loss you are willing to accept on each trade. This depends on factors such as your account size, position size, and risk tolerance.

-

Estimate the Stop-Loss Trigger Point: Based on the above factors, estimate the price level where you would want to automatically close your position and cut your losses. The trigger point should be placed below the current market price for long positions (or above the current market price for short positions).

-

Set Your Stop Order: Enter the chosen stop-loss price into your trading platform. Ensure that you have selected the correct order type (stop-limit order for greater control over the execution price).

Types of Stop-Loss Orders

-

Standard Stop Order: This is the most basic type of stop-loss order and executes at or below (for sell orders) or at or above (for buy orders) the specified trigger price.

-

Stop-Limit Order: A more sophisticated stop order that executes only when the trigger price and a specified limit price are met. This order type offers greater precision but is less likely to be filled than a standard stop order.

-

Trailing Stop Order: A dynamic stop-loss order that trails the price of the underlying asset as it moves in a favorable direction. This order type locks in profits if the price moves in the trader’s favor while providing continuous protection against losses.

Image: www.the-pool.com

Impact of Slippage and Market Volatility

It’s important to note that executed stop-loss orders may differ from the predetermined trigger price due to market volatility and slippage. Slippage refers to the difference between the trigger price and the actual execution price when a stop-loss order is filled. This can be a significant factor in highly volatile markets.

Human Psychology and Stop-Losses

Understanding the psychological impact of stop-loss orders is crucial for traders. The fear of losing can lead to setting overly tight stop losses, resulting in premature exits and missed profit opportunities. Conversely, being too lenient with stop-losses can expose traders to significant losses. Striking the right balance is essential.

How Do You Set Stop Loss In Options Trading

Image: www.livingfromtrading.com

Conclusion

Setting effective stop-loss orders is a cornerstone of successful options trading. By understanding the concepts and strategies presented in this article, traders can enhance their risk management and improve their overall trading performance. Remember, the key to mastering stop-loss orders lies in adapting them to your individual risk tolerance and trading style. With careful consideration and practice, traders can harness the power of stop-loss orders to protect their capital and unlock the full potential of options trading.