In the ever-evolving world of finance, the ability to identify and capitalize on profitable trading opportunities is crucial. Options trading, particularly in the Nifty index, offers traders a potent avenue to enhance their returns. However, navigating the intricacies of options trading requires a comprehensive understanding of the underlying concepts and a robust analytical framework. Here’s where the AFL for Nifty Option Trading comes into play, empowering traders with the knowledge and tools to make informed decisions.

Image: www.marketcalls.in

AFL: A Powerful Analytical Tool for Option Traders

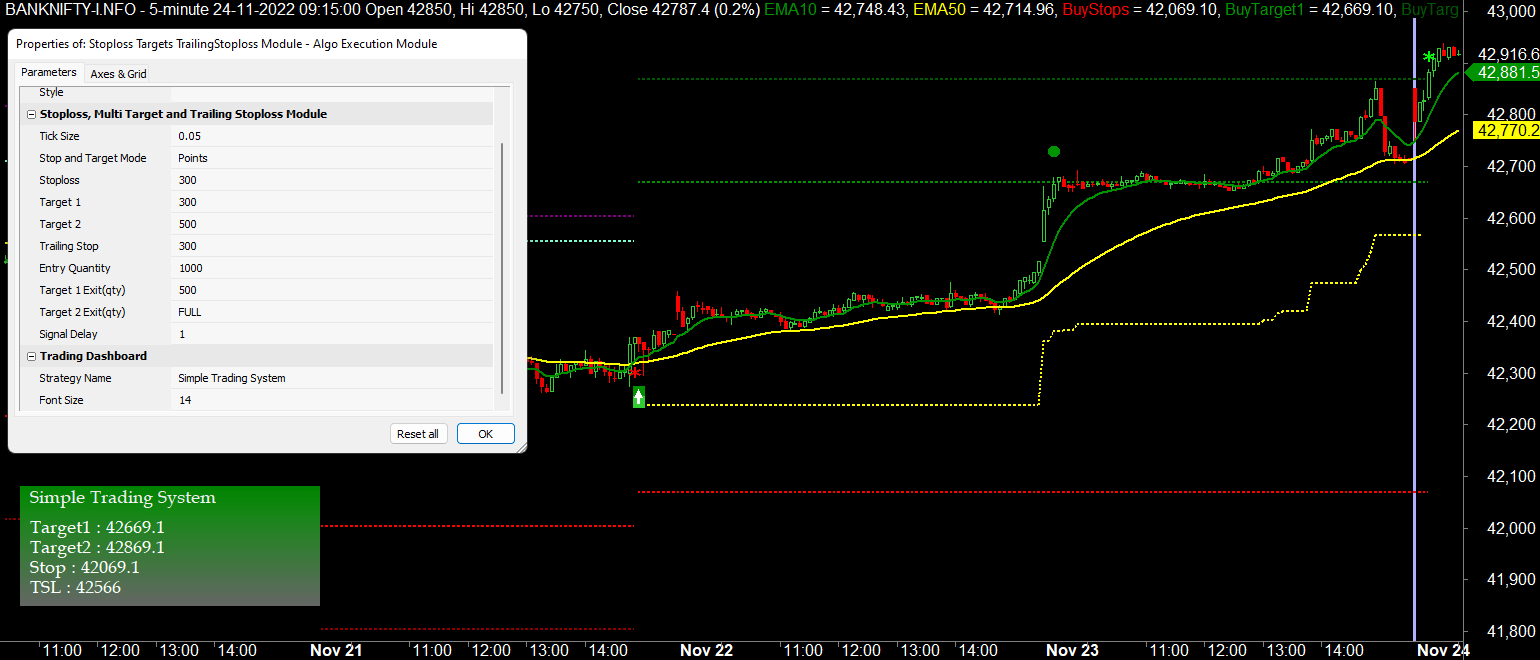

AFL, short for Advanced Financial Language, is a versatile programming language specifically designed for technical analysis and the development of trading strategies. Particularly in the context of Nifty option trading, AFL provides traders with an array of advanced features and functionalities that enhance their trading capabilities.

With AFL scripts, traders can automate complex calculations, create custom indicators, and define trading signals based on their unique requirements. This empowers them to analyze market data efficiently, identify potential trading opportunities, and execute trades with greater precision and confidence.

Unveiling the Secrets of Nifty Option Trading

Nifty options, based on the Nifty 50 index, are derivative contracts that grant traders the right to buy (call options) or sell (put options) the underlying index at a specified price (strike price) on a predetermined date (expiry date). Understanding the dynamics of Nifty option trading is essential for exploiting the profit potential it offers.

Through the AFL scripting language, traders can delve into the intricacies of Nifty option trading and evaluate critical factors such as volatility, historical trends, and market sentiment. This in-depth analysis allows them to make informed decisions about strike prices, expiry dates, and option strategies that align with their risk appetite and trading goals.

AFL Scripts: A Trader’s Arsenal for Precision Trading

To harness the full potential of AFL in Nifty option trading, traders can leverage a vast library of pre-built scripts available online or create their own custom scripts. These scripts automate complex calculations and provide valuable insights into market behavior.

For instance, traders can employ trend-following scripts to identify potential breakouts or reversals in the Nifty index. Volatility scripts can gauge market sentiment and help traders determine optimal strike prices for their option strategies. Moreover, backtesting capabilities within AFL enable traders to evaluate the performance of their trading strategies over historical data, fine-tuning their approach for enhanced profitability.

Image: www.pinterest.com

Empowering Traders with Expert Insights

Beyond the technical aspects, the AFL community fosters a wealth of experience and knowledge sharing among traders. Seasoned experts regularly contribute their insights, strategies, and custom AFL scripts, offering a valuable resource for aspiring and experienced traders alike. By tapping into this collective wisdom, traders can refine their understanding of Nifty option trading and make more informed decisions.

Afl For Nifty Option Trading

Harnessing AFL for Profitable Trading

In conclusion, the AFL for Nifty Option Trading empowers traders with an unparalleled toolkit to navigate the complexities of this dynamic market. Through its analytical capabilities, traders can gain a deeper understanding of market dynamics, identify potential trading opportunities, and develop customized trading strategies. Armed with the right knowledge and tools, traders can unleash the profit-generating potential of Nifty option trading and achieve their financial goals.