***

Image: thebrownreport.com

Introduction:

Have you ever wondered what happens to the stock market after the regular trading hours end? Enter the realm of aftermarket options trading, a thrilling world where savvy investors extend their reach beyond the confines of the typical trading day. Join us as we explore the ins and outs of aftermarket options trading with E*Trade, unlocking the potential for extended profit-making opportunities and broadening your trading horizons.

Understanding Aftermarket Options Trading:

Aftermarket options trading takes place after the regular trading session ends, typically from 4:00 PM to 8:00 PM ET. It allows investors to continue trading specific options contracts that track the underlying stocks or assets they represent. Unlike traditional stock trading, aftermarket options trading offers the leverage of options contracts, which gives traders the right to buy or sell an underlying asset at a predetermined price, providing enhanced return potential.

*Why Trade Options After Hours with ETrade?**

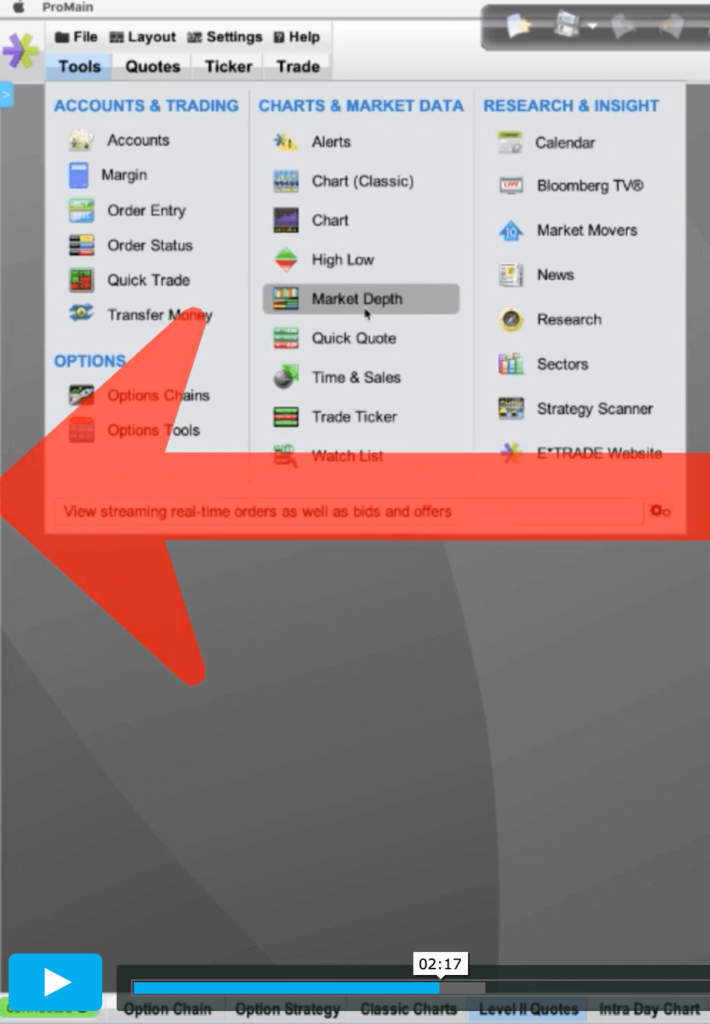

ETrade stands as a leading platform for aftermarket options trading due to its user-friendly interface, extensive research tools, and real-time market data. By choosing ETrade, you gain access to:

- Extended trading hours: Capitalize on price movements that occur after regular market hours, potentially capturing missed opportunities.

- Enhanced liquidity: E*Trade’s large trading network enables better liquidity, reducing trading costs and improving execution speed.

- Sophisticated trading tools: Leverage technical indicators, charts, and news feeds to analyze market trends and make informed decisions.

*Getting Started with Aftermarket Options Trading on ETrade:**

- *Open an ETrade account:* To begin, create a trading account at ETrade. Complete the registration process, verify your identity, and fund your account.

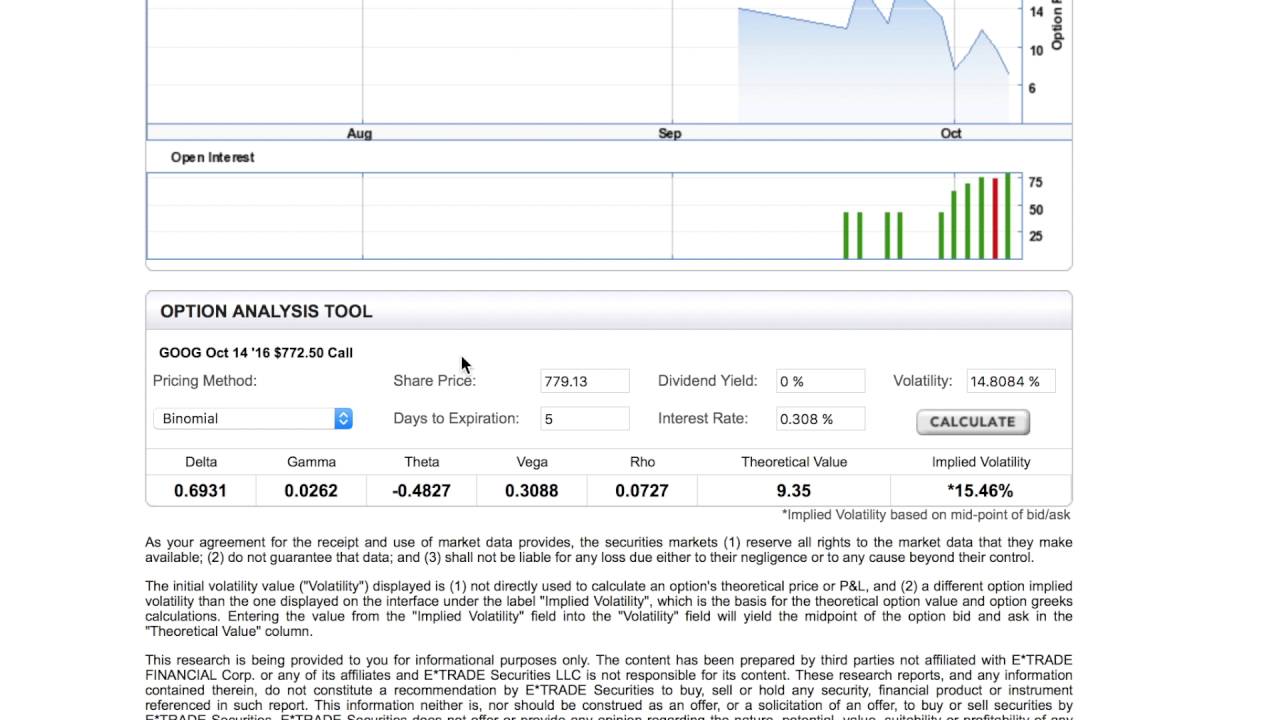

- Choose an options contract: Select an options contract based on the underlying asset you wish to trade. Consider the strike price, expiration date, and option type.

- Place your order: Decide whether to buy or sell the options contract. Enter your order specifying the quantity, price, and order type.

- Monitor your position: Track your options position and adjust your strategy as needed. Stay informed about market news and underlying asset performance.

Expert Insights and Actionable Tips:

“Aftermarket options trading can be a double-edged sword. While it offers extended opportunities, it also carries higher risks. Beginners should proceed with caution,” says renowned financial expert Mark Cuban.

- Manage risk judiciously: Employ stop-loss orders to limit potential losses. Consider spreading your investments across multiple options contracts.

- Do your research: Thoroughly understand the underlying asset and the specific options contract you’re trading. Seek guidance from financial advisors if needed.

- Stay nimble: Market conditions can change rapidly after hours. Be prepared to adjust your strategies or exit positions promptly.

Conclusion:

Aftermarket options trading with ETrade opens up a wealth of opportunities for investors looking to extend their trading horizons and capture potential profits beyond regular market hours. By leveraging ETrade’s platform and insights, you can navigate the complexities of aftermarket options trading with confidence and empower your investment journey. Remember to approach this endeavor with a measured approach, informed decisions, and a willingness to adapt as the market unfolds. Embrace the world of aftermarket options trading and unlock the financial possibilities it holds.

Image: www.youtube.com

Aftermarket Options Trading Etrade