As a seasoned options trader, I’ve witnessed firsthand the significance of understanding market hours. Navigating the dynamic world of options requires precise knowledge of when trading commences and concludes each day. In this comprehensive guide, we’ll delve into the intricate details of E*Trade’s options trading hours, empowering you to seize every opportunity and optimize your trading strategy.

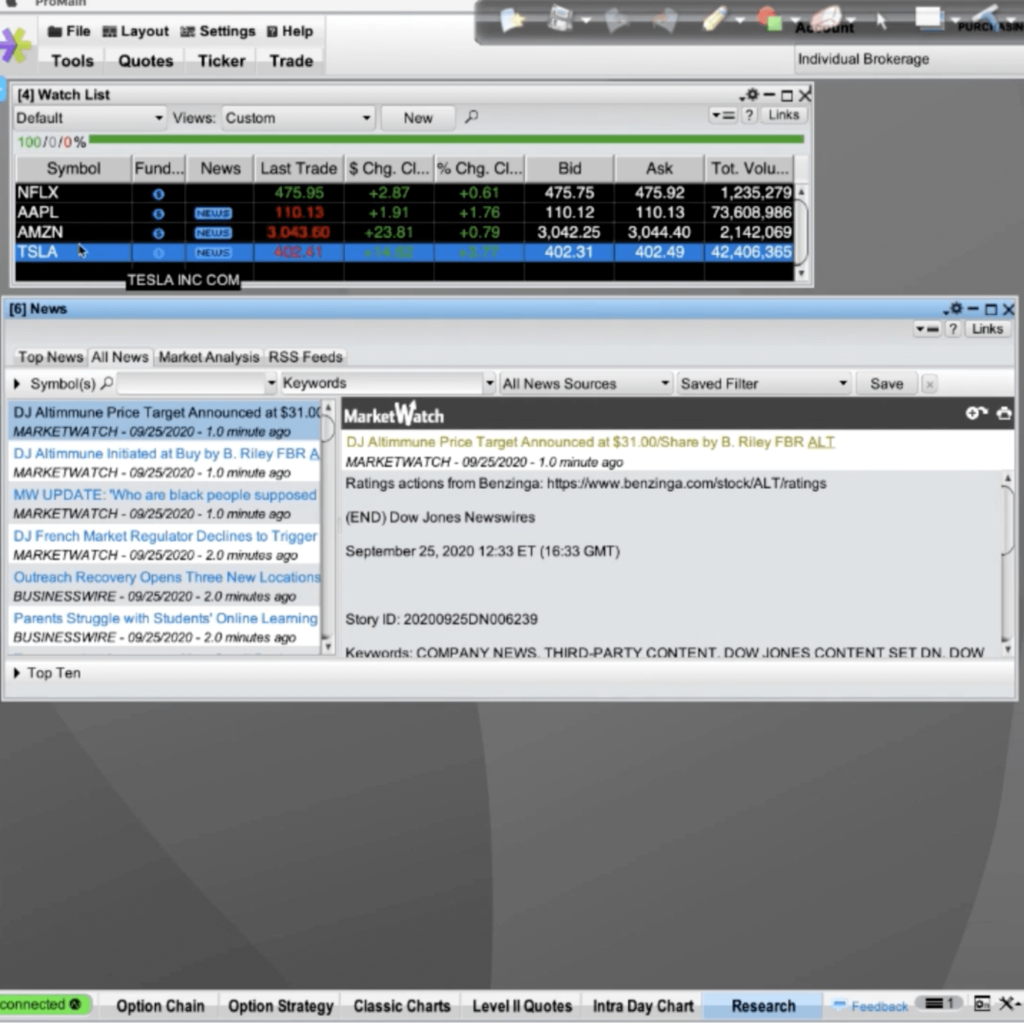

Image: www.stockbrokers.com

Beyond the mere understanding of trading hours, we’ll explore the latest trends and developments shaping the options market, incorporating insights from industry updates, forums, and social media platforms. Stay abreast of emerging practices and stay ahead of the curve with our expert advice and practical tips.

Understanding Options Trading Hours on E*Trade

Options trading on E*Trade generally adheres to the following schedule:

- Pre-market session: 7:00 AM – 9:30 AM ET

- Regular trading hours: 9:30 AM – 4:00 PM ET

- Post-market session: 4:05 PM – 8:00 PM ET

Pre-Market Session

The pre-market session provides an avenue for traders to enter or adjust positions before the market opens. During this time, orders are collected and queued, but no executions occur. Liquidity may be limited, and prices can be volatile.

Regular Trading Hours

The regular trading hours constitute the primary trading period, characterized by high liquidity and greater price stability. The bulk of options trading activity occurs during this window, offering the most favorable conditions for executing trades.

Image: thebrownreport.com

Post-Market Session

The post-market session extends trading beyond regular hours, allowing traders to react to late-breaking news or adjust positions before the next trading day. Liquidity is typically lower compared to regular hours, but it can provide opportunities for extended trading access.

Tips and Expert Advice for Navigating Options Trading Hours

Plan Strategically: Familiarize yourself with E*Trade’s options trading hours and align your trading schedule accordingly. Plan entry and exit points based on market open and close times to optimize opportunities.

Monitor Market News: Stay informed about market events and news that can impact option prices. Utilize E*Trade’s news and research tools to stay up-to-date during pre- and post-market sessions.

Frequently Asked Questions (FAQs)

- Q: What are the benefits of trading options during extended hours?

A: Extended hours trading provides flexibility and can accommodate unpredictable schedules. It allows traders to react to news and adjust positions outside of regular trading hours. - Q: Is liquidity the same during all trading hours?

A: No, liquidity can fluctuate throughout trading hours. Pre- and post-market sessions typically have lower liquidity than regular trading hours. - Q: Can I place orders outside of trading hours?

A: Yes, you can place orders outside of trading hours, but they will be queued and executed at the start of the next trading session.

Options Trading Hours Etrade

Image: thebrownreport.com

Conclusion

Grasping the intricacies of options trading hours on E*Trade empowers you to make informed decisions and seize market opportunities. By adhering to trading hours, monitoring market events, and following expert advice, you can navigate the options market with confidence. Whether you’re a seasoned trader or just starting out, understanding trading hours is a fundamental aspect of successful options trading.

Are you keen to learn more about options trading hours on E*Trade? Explore the platform’s resources, consult with a financial advisor, and join online communities to further your knowledge. By embracing the information and insights shared here, you can elevate your trading strategy and achieve your financial objectives.