Option trading, an integral part of financial markets, offers traders opportunities to manage risk and enhance returns. However, it’s essential to be aware of market closures that can impact trading activities. Hence, understanding option trading holidays in 2024 is crucial for traders to plan their strategies accordingly. This article delves into the importance of option trading holidays, provides a comprehensive list of such holidays in 2024, and explores the implications for traders.

Image: gabriellezdaile.pages.dev

Significance of Option Trading Holidays

Option trading holidays are scheduled days when the major financial exchanges, including the Chicago Board Options Exchange (CBOE) and the American Stock Exchange (AMEX), are closed. During these holidays, trading in options contracts is not möglich, which can significantly impact trading decisions and strategies.

Being aware of option trading holidays allows traders to:

- Avoid Missed Opportunities: Traders can plan their trades in advance to capitalize on potential market movements and avoid missing profitable opportunities due to market closures.

- Manage Risk Effectively: Understanding holiday schedules enables traders to adjust their risk management strategies, such as closing positions before holidays to minimize exposure to overnight price fluctuations.

- Plan Sufficient Liquidity: Option trading holidays can affect liquidity, impacting the ability to execute trades effectively. Traders can plan accordingly to ensure they have sufficient liquidity for their trades before the market closes.

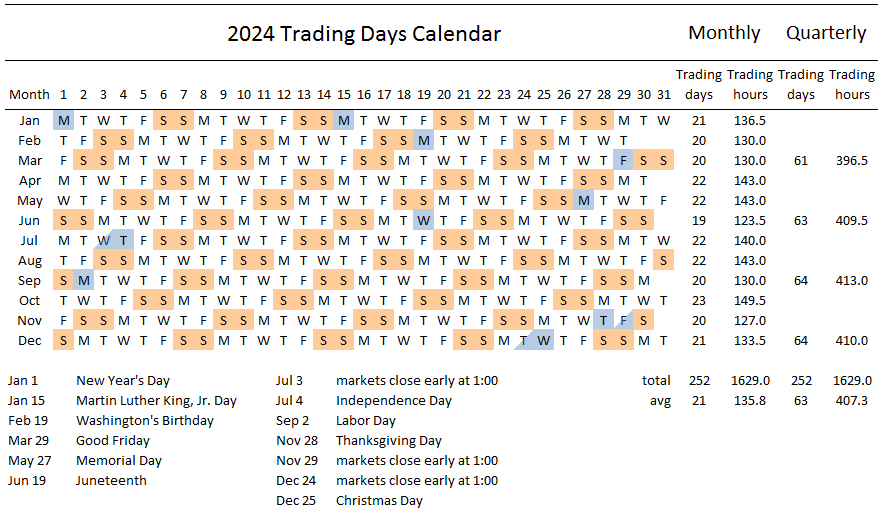

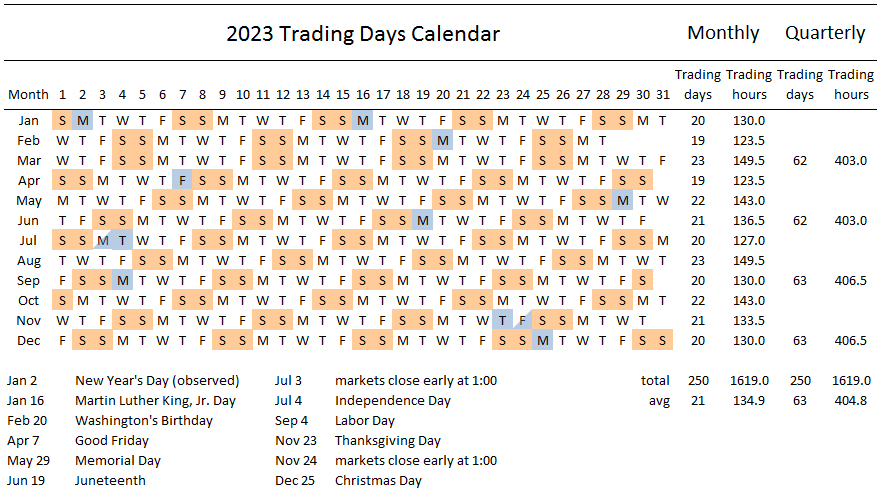

Option Trading Holidays 2024: A Comprehensive Calendar

In 2024, option trading holidays in the United States will fall on the following dates:

- January 1, 2024: New Year’s Day

- January 15, 2024: Martin Luther King Jr. Day

- February 19, 2024: Washington’s Birthday

- May 27, 2024: Memorial Day

- July 4, 2024: Independence Day

- September 2, 2024: Labor Day

- November 11, 2024: Veterans Day

- November 28, 2024: Thanksgiving Day

- December 25, 2024: Christmas Day

Implications for Option Traders

The impact of option trading holidays on traders depends on their trading strategies and risk tolerance. Here are a few considerations:

- Holiday Market Impact: Option prices can be affected by holiday closures, especially if there are significant news events or market volatility leading up to the holiday. Traders should monitor market conditions closely during these times.

- Liquidity Concerns: Trading activity may be reduced on days leading up to and following option trading holidays, which can affect liquidity and impact the ability to execute trades.

- Expiration Dates: Traders should be aware of option expiration dates that fall on or just after trading holidays. Unexpired options may need to be adjusted or closed before the holiday to avoid potential losses.

Image: calendarmay2024holidays.pages.dev

Option Trading Holidays 2024

Image: imagesee.biz

Conclusion: Planning for Success in Option Trading Holidays

Option trading holidays are important events that can impact the operations and strategies of traders. By understanding the significance of these holidays, being aware of the 2024 holiday schedule, and considering the implications for trading, traders can plan their activities effectively and mitigate potential risks. Strategic planning and preparation can help traders navigate option trading holidays and continue to pursue their trading goals efficiently in 2024.