In the labyrinthine world of financial markets, where uncertainty reigns supreme, options emerge as a beacon of hope for discerning traders. Among these strategies, one stands tall for its ability to harness market volatility to generate consistent profits: mean reversion. Join us on an intricate journey into the realm of options trading mean reversion strategy, a technique that empowers you to conquer market fluctuations and come out on top.

Image: www.pinterest.com

Demystifying Mean Reversion: A Path to Understanding

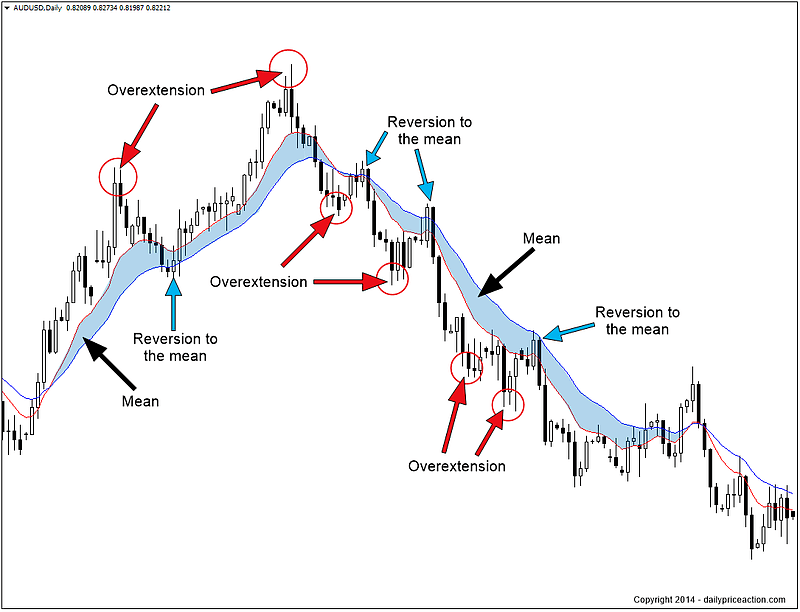

Mean reversion, a fundamental concept in trading and investing, postulates that asset prices tend to oscillate around a long-term average. This predictable movement is often attributed to psychological forces that drive markets to overreact to news and events, creating temporary imbalances. As a result, savvy traders like yourself can capitalize on these deviations, knowing that the market will eventually correct itself.

In the realm of options trading, mean reversion takes on immense significance. Options, financial instruments that grant the right but not the obligation to buy or sell an underlying asset at a set price, offer traders the flexibility to bet on both the direction and magnitude of future market movements. By understanding mean reversion patterns, you can make informed decisions about when to enter and exit option positions, enhancing your odds of success.

Unveiling the Secrets: A Comprehensive Guide to Mean Reversion Strategies

-

Identify Mean-Reverting Assets: The first step in any mean reversion strategy lies in identifying assets that exhibit strong mean-reverting tendencies. Historically, commodities, currencies, and volatility indices have been prime candidates for such strategies. Conduct thorough research to determine the assets that best align with your trading style and risk tolerance.

-

Understand Market Dynamics: Equip yourself with an in-depth understanding of market dynamics, including the underlying economic factors, news events, and technical indicators that influence asset prices. This knowledge will help you discern genuine mean-reversion opportunities from false signals, boosting your profitability.

-

Select Appropriate Options: Choose options with expiration dates that allow sufficient time for the market to revert to its mean. Consider the strike price and premium carefully, balancing risk and reward to maximize your profit potential.

-

Monitor the Market Vigilantly: Regular market monitoring is crucial to the success of your mean reversion strategy. Track the underlying asset’s progress against its historical mean, keeping an eye on any significant deviations. Adjust your positions accordingly to adapt to changing market conditions.

-

Manage Risk Effectively: As with any trading strategy, risk management is paramount. Limit your exposure by setting predefined stop-loss levels, which will automatically terminate your position if market movements exceed predetermined thresholds.

-

Learn from Experience: The path to trading mastery is paved with both successes and setbacks. Each trade, profitable or not, carries lessons that can refine your strategy. Keep a detailed trading journal, meticulously recording your decisions and their outcomes. Analyze your trades to identify patterns and areas for improvement, constantly enhancing your knowledge and skills.

Insights from the Experts: Navigating Mean Reversion with Confidence

“Mean reversion is not about predicting the exact direction of the market but rather capitalizing on its tendency to self-correct,” emphasizes Dr. Mark Fisher, a renowned finance professor at the University of California, Berkeley. “By understanding the underlying forces that drive mean reversion, traders can position themselves to profit from both upside and downside market movements.”

“Successful mean reversion trading requires patience and discipline,” advises Emily Jones, a seasoned options trader with over two decades of experience. “Avoid chasing quick profits and instead focus on identifying high-probability setups. By adhering to a robust trading plan, you can weather market storms and achieve consistent returns.”

Image: tradingextremes.com

Options Trading Mean Reversion Strategy

Image: dailypriceaction.com

Conclusion: Embracing the Power of Mean Reversion

Options trading mean reversion strategy is a powerful tool in the arsenal of savvy traders, enabling them to profit from market volatility and mitigate risks. By adhering to the principles outlined in this comprehensive guide and seeking continuous improvement through education and practice, you can enhance your trading prowess and emerge as a confident navigator in the ever-evolving financial landscape. Remember, the pursuit of trading success is not a sprint but a marathon – persevere with unwavering determination, and the rewards will follow.