Introduction

In the realm of options trading, the strike price stands as a critical decision that can make or break a trader’s strategy. Imagine a seasoned trader named Sarah, who decided to embark on an options trading journey. At first, bewildered by the intricacies of strike price selection, she resolved to delve into the depths of this financial enigma. Little did she know that this decision would pave the way for countless profitable trades. Eager to share her newfound knowledge, Sarah eagerly awaits to guide you through the labyrinth of strike price selection.

Image: www.rockwelltrading.com

Understanding Strike Price: The Gateway to Option Trading

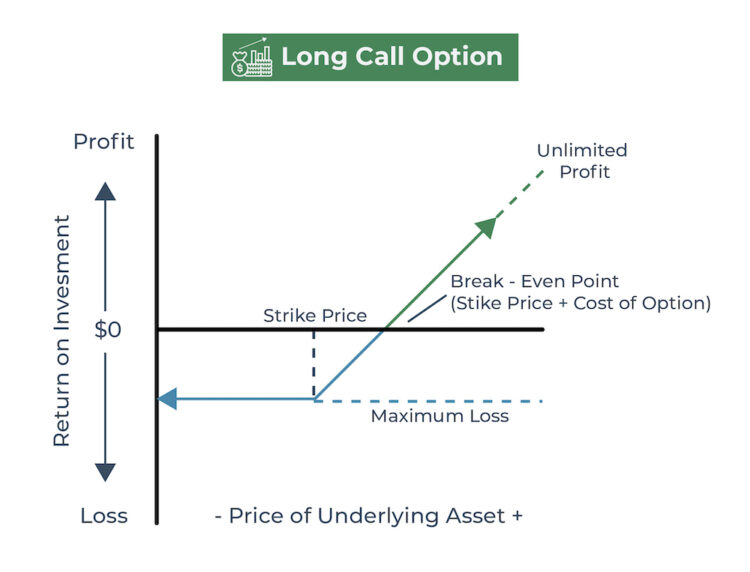

An option contract, unlike its stock counterpart, bestows upon its holder the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the “strike price,” on or before a specified date. Therefore, the strike price serves as the focal point of an options contract and dictates whether the option is “in-the-money” (ITM), “at-the-money” (ATM), or “out-of-the-money” (OTM). An ITM option means that the option holder can currently exercise the option and make a profit, while an OTM option suggests that exercising the option would result in a loss.

Choosing the Perfect Strike Price: A Balancing Act

Selecting the appropriate strike price is an art form that requires traders to navigate the delicate interplay between profitability, risk tolerance, and the underlying asset’s price movement. Traders must consider a multitude of factors, including the underlying asset’s volatility, the time remaining until expiration, and their own trading objectives.

One popular approach is to select a strike price that is ATM or slightly ITM, intending to exploit the underlying asset’s potential price appreciation. However, this approach carries a higher risk as the option premium (the price paid for the option) is typically higher for ITM options. Conversely, selecting an OTM strike price reduces the risk but also decreases the potential profit as the underlying asset’s price must rise significantly for the option to become profitable.

Hedging Strategies: Using Options to Mitigate Risk

Options trading is not merely about making a quick buck but also about managing risk. Seasoned traders often employ hedging strategies to safeguard their portfolios from potential losses. One common hedging strategy involves buying a put option with a strike price below the current stock price. This way, the trader limits potential losses if the stock price plummets, effectively creating a safety net. Another hedging strategy entails selling a covered call option, allowing the trader to generate income and mitigate downside risk.

Image: investinganswers.com

Real-World Example: Sarah’s Strike Price Triumph

Let’s revisit our intrepid trader, Sarah. Armed with her newfound knowledge, she decided to purchase call options on Apple stock (AAPL), anticipating a surge in its price. After careful consideration, she opted for a strike price of $150, slightly ITM, as she believed AAPL’s price would continue to climb. Her calculated risk paid off handsomely as AAPL’s stock price soared, and Sarah’s call options skyrocketed in value.

Key Takeaways for Option Trading Success

-

Understand the concept of strike price and its role in options contracts.

-

Choose a strike price that aligns with your trading strategy and risk tolerance.

-

Consider the underlying asset’s volatility and time to expiration when selecting a strike price.

-

Explore hedging strategies to mitigate risk and enhance your portfolio’s resilience.

Option Trading Strike Price Selection

Conclusion

Selecting the right strike price in options trading is a crucial skill that separates successful traders from the rest. By understanding the fundamentals of strike price selection, evaluating the underlying asset’s dynamics, and implementing risk-management strategies, traders can increase their chances of profiting from this versatile financial instrument. Just like Sarah, who transformed from a perplexed novice to a confident trader, you too can master the art of strike price selection and unlock the potential of options trading.