Introduction

In the realm of financial markets, options trading offers a powerful tool for investors to navigate risk and seek potential rewards. Understanding the intricacies of options trading is crucial, and one of its key pillars is comprehending the concept of the strike price. In this comprehensive guide, we will delve into the world of options and provide a thorough understanding of what the strike price is, its significance, and how it influences options trading strategies.

Image: twitter.com

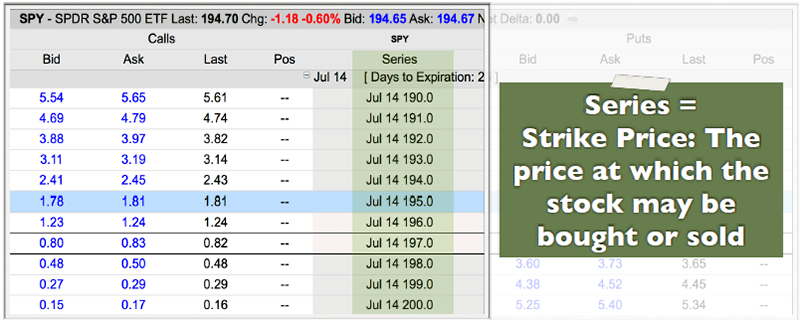

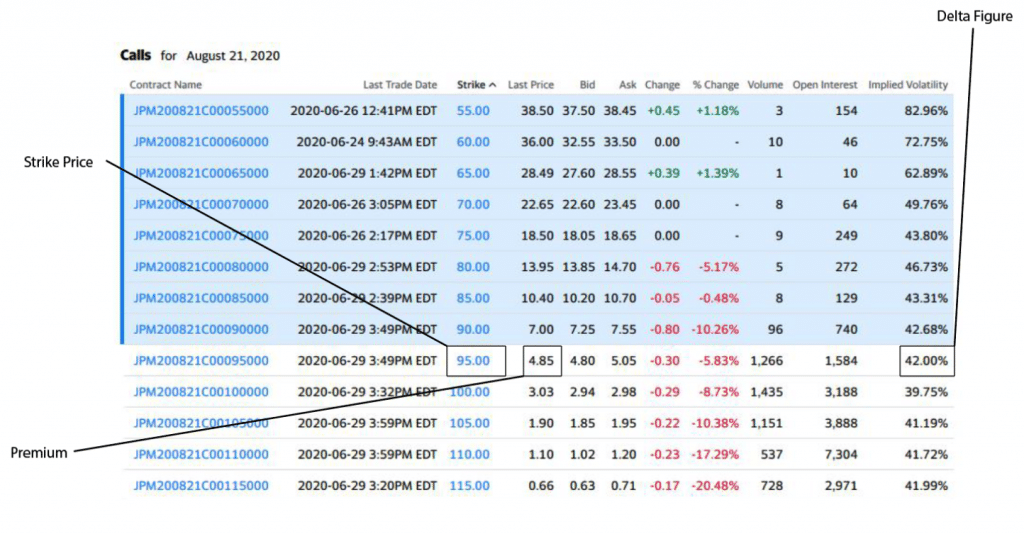

What is a Strike Price?

In options trading, a strike price refers to the predetermined price at which the underlying asset can be bought (in the case of call options) or sold (in the case of put options) on or before the expiration date of the contract. It serves as a benchmark against which the performance of the underlying asset is measured.

Call Option Strike Price

A call option grants the buyer the right (not an obligation) to purchase the underlying asset at the strike price on or before the expiration date. When the market price of the asset exceeds the strike price, the call option becomes profitable as the buyer can exercise their right to buy the asset at a lower price than the market value.

Put Option Strike Price

Conversely, a put option gives the buyer the right (not an obligation) to sell the underlying asset at the strike price on or before the expiration date. If the market price of the asset falls below the strike price, the put option becomes profitable as the buyer can exercise their right to sell the asset at a higher price than the market value.

Image: tradesmartu.com

Significance of Strike Price

The strike price plays a pivotal role in options trading strategies. It determines the potential profit or loss, as well as the risk-reward profile of the trade. By selecting an appropriate strike price, traders can tailor their strategies to align with their investment objectives and risk tolerance.

Factors Influencing Strike Price Selection

Several factors influence the selection of an optimal strike price. These include:

-

Market Trend: The expected direction of the asset’s price movement.

-

Volatility: The anticipated price fluctuations of the asset.

-

Time to Expiration: The length of time remaining until the option expires.

-

Risk Tolerance: The amount of risk the trader is willing to assume.

What Is The Strike Point In Options Trading

Image: club.ino.com

Conclusion

Understanding the strike price is fundamental to successful options trading. By grasping its significance and employing it strategically, traders can unlock the power of this innovative financial tool. Whether you’re a seasoned investor or just starting your journey in options, a clear understanding of the strike price will empower you to make informed decisions and potentially enhance your trading outcomes. Remember, knowledge is the key to unlocking opportunities in the dynamic world of financial markets.