In the dynamic world of financial markets, option trading has emerged as a powerful tool for investors seeking to enhance their returns and manage risk. At the heart of this strategy lies the concept of strike prices, a pivotal parameter that influences the potential rewards and risks involved. Join us on an enlightening journey as we delve into the intricacies of option trading strike prices and provide actionable insights to help you navigate this exciting realm.

Image: www.projectfinance.com

Understanding Strike Prices: A Key to Options Mastery

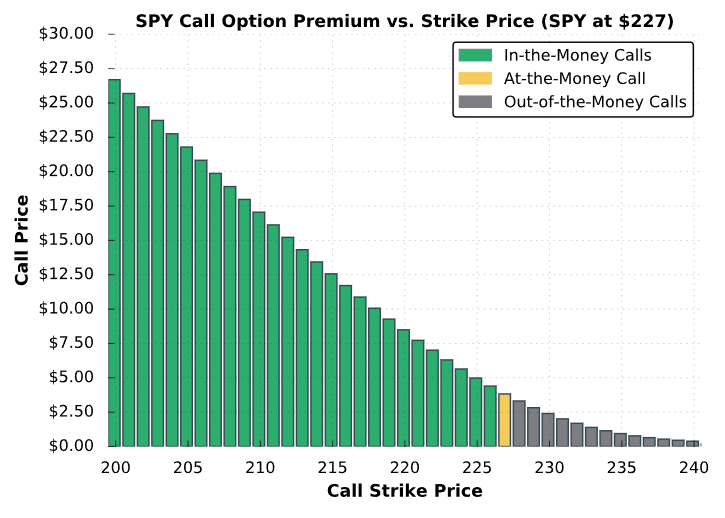

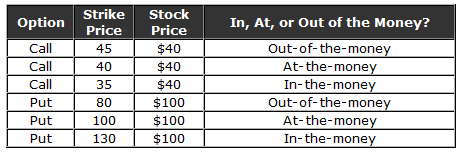

A strike price is a predefined price at which an option can be exercised, allowing the holder to buy or sell an underlying asset. This crucial element determines the break-even point for options traders. When an option’s price aligns with its strike price, it is said to be “at-the-money.” Any movement away from the strike price introduces either “in-the-money” or “out-of-the-money” scenarios.

In-the-money options hold intrinsic value, meaning they can be exercised immediately for a profit if the underlying asset’s price continues its favorable trend. Out-of-the-money options, on the other hand, lack intrinsic value and rely solely on the potential future price movements to become profitable.

Selecting the Optimal Strike Price: A Calculated Decision

Choosing the right strike price is a critical decision that significantly impacts an option’s profitability. Several factors must be meticulously considered during this process, including:

Underlying Asset’s Price and Volatility:

The current price and anticipated volatility of the underlying asset play crucial roles in strike price selection. In-the-money options are more expensive than out-of-the-money options, but they offer a higher probability of profit if the underlying asset’s price continues in the desired direction.

Image: www.learn-stock-options-trading.com

Time to Expiration:

The time remaining until the option’s expiration date also influences the strike price decision. Longer-term options provide more time for the underlying asset’s price to fluctuate, increasing the potential for profit but also the risk of loss.

Trading Strategy:

The specific trading strategy employed further refines the strike price selection process. Conservative investors seeking to mitigate risk may opt for in-the-money options, while more aggressive traders willing to tolerate higher risk can explore out-of-the-money options.

Expert Insights and Actionable Strategies

To illuminate the intricacies of strike prices in option trading, we sought the wisdom of seasoned experts:

“Carefully evaluating the underlying asset’s price, volatility, and time to expiration is paramount when selecting a strike price,” emphasizes Mark Thompson, a renowned options trader and author. “Understanding these factors and aligning them with your trading goals is key to maximizing potential returns.”

Echoing this sentiment, Jane Williams, a respected market analyst, adds, “Dynamic hedging strategies involving multiple strike prices can enhance risk management. By adjusting the strike prices based on market movements, traders can mitigate losses and enhance their overall trading performance.”

Actionable Tips: Empowering Your Options Trading Journey

Empowered with these expert insights, let us delve into practical tips to elevate your options trading:

- Conduct thorough research on the underlying asset’s historical price movements, volatility, and industry trends. This knowledge forms the bedrock for informed strike price selection.

- Experiment with different strike prices using a paper trading account. This risk-free environment allows you to test strategies without incurring real-world losses.

- Consider utilizing options chains to visualize the potential rewards and risks associated with various strike prices. This visual representation simplifies the decision-making process.

Option Trading Strike Prices

Image: www.pinterest.com

Conclusion: Unveiling the Power of Strike Prices

Option trading strike prices, like the brushstrokes of a master artist, empower traders to shape their financial destiny. By comprehending their significance, selecting them strategically, and leveraging expert guidance, you can unlock the full potential of this versatile trading tool. Remember, the journey to options mastery is an ongoing endeavor, marked by continuous learning and a relentless pursuit of knowledge. Embrace this journey with a unwavering spirit, and the rewards of informed option trading shall be your faithful companions.