Introduction

In the realm of options trading, strikes play a pivotal role in shaping your investment strategies and determining your potential returns and risks. Understanding the concept of strikes is essential for navigating this dynamic financial landscape. This comprehensive guide will delve into the intricacies of strikes, empowering you to harness their power and achieve optimal trading outcomes.

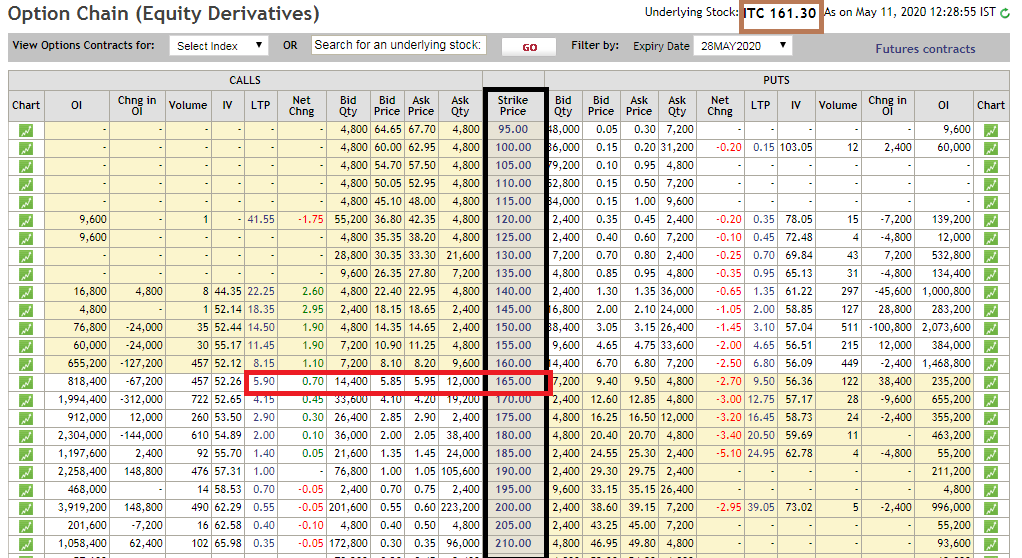

Image: www.elearnmarkets.com

What is a Strike Price?

A strike price is a predetermined price point at which an option contract can be exercised, giving the holder the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at that specific price. When you purchase an options contract, you are essentially betting that the underlying asset’s price will move in your favor by the expiration date.

Types of Strikes

There are two main types of strikes:

- At-the-Money (ATM) Strike: This is a strike price that is equal to the underlying asset’s current market price.

- Out-of-the-Money (OTM) Strike: This is a strike price that is either above the current market price (for call options) or below the current market price (for put options).

The Impact of Strikes on Option Premiums

The strike price significantly influences the premium, or price, of an option contract. ATM strikes command higher premiums compared to OTM strikes because they offer a higher probability of being exercised. As the strike price moves further OTM, the premium decreases due to the lower likelihood of the option being profitable.

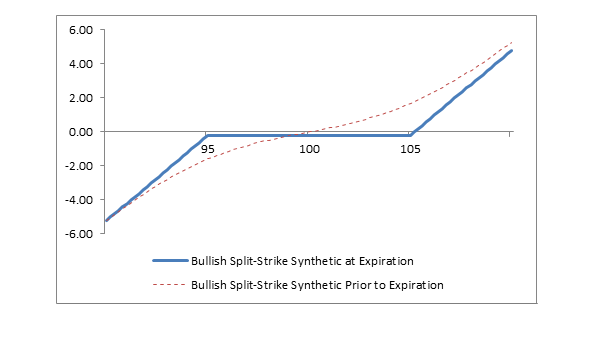

Image: www.makemoney.ng

Choosing the Right Strike Price

Selecting the appropriate strike price is crucial for successful options trading. Consider the following factors when making your choice:

- Market Volatility: High volatility favors OTM strikes with lower premiums due to the increased potential for significant price fluctuations.

- Direction of the Trade: If you anticipate an upward trend, consider ATM or slightly OTM call strikes. For anticipated downtrends, OTM put strikes are more suitable.

- Time to Expiration: Options with longer expiration dates generally allow for a wider range of strike prices.

Strikes in Practice

To illustrate the impact of strikes, let’s consider an example:

Suppose you believe the stock of XYZ Corporation will rise in value. You purchase a call option with an ATM strike of $100. If XYZ’s stock price exceeds $100 at the expiration date, you can exercise your right to buy the stock at the lower price of $100, potentially generating a profit.

Alternatively, if XYZ’s stock price falls below $100, the option will expire worthless, and you will lose your premium.

Expert Insights

“Strikes serve as a vital parameter in options trading, influencing both potential returns and risks,” says Emily Nguyen, a renowned options trading expert. “When choosing a strike, it’s essential to consider the market context, your trading goals, and your risk tolerance.”

“Remember that strikes are not set in stone; adjustments can be made as market conditions evolve,” advises Mark Carter, a veteran options broker. “Monitoring strike prices and making timely adjustments can optimize your trading strategies.”

Actionable Tips

- Use historical premium data and volatility measurements to inform your strike selection.

- Combine different strike prices within a single trade to create custom strategies.

- Consider “rolling” your strikes if market conditions change significantly.

Strikes In Options Trading

Image: www.fidelity.com

Conclusion

Strikes are the cornerstone of options trading, offering the potential for significant profits but also carrying inherent risks. By understanding the intricacies of strikes, you can enhance your trading acumen, make informed decisions, and maximize your chances of success in this dynamic and rewarding financial arena.