1. Introduction

Image: www.webull.com

In the realm of investing, options trading has emerged as a lucrative yet intricate arena. Webull, a leading online brokerage, empowers traders with a sophisticated platform to venture into the world of option day trading. This guide will delve into the intricacies of options, their significance, and the essential strategies employed for successful day trading using Webull’s cutting-edge tools.

2. Understanding Options: A Foundation for Day Trading

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts derive their value from the anticipated price fluctuations of the underlying asset, making them ideal for both hedging and speculative trading.

3. Webull: A Platform Geared for Options Day Traders

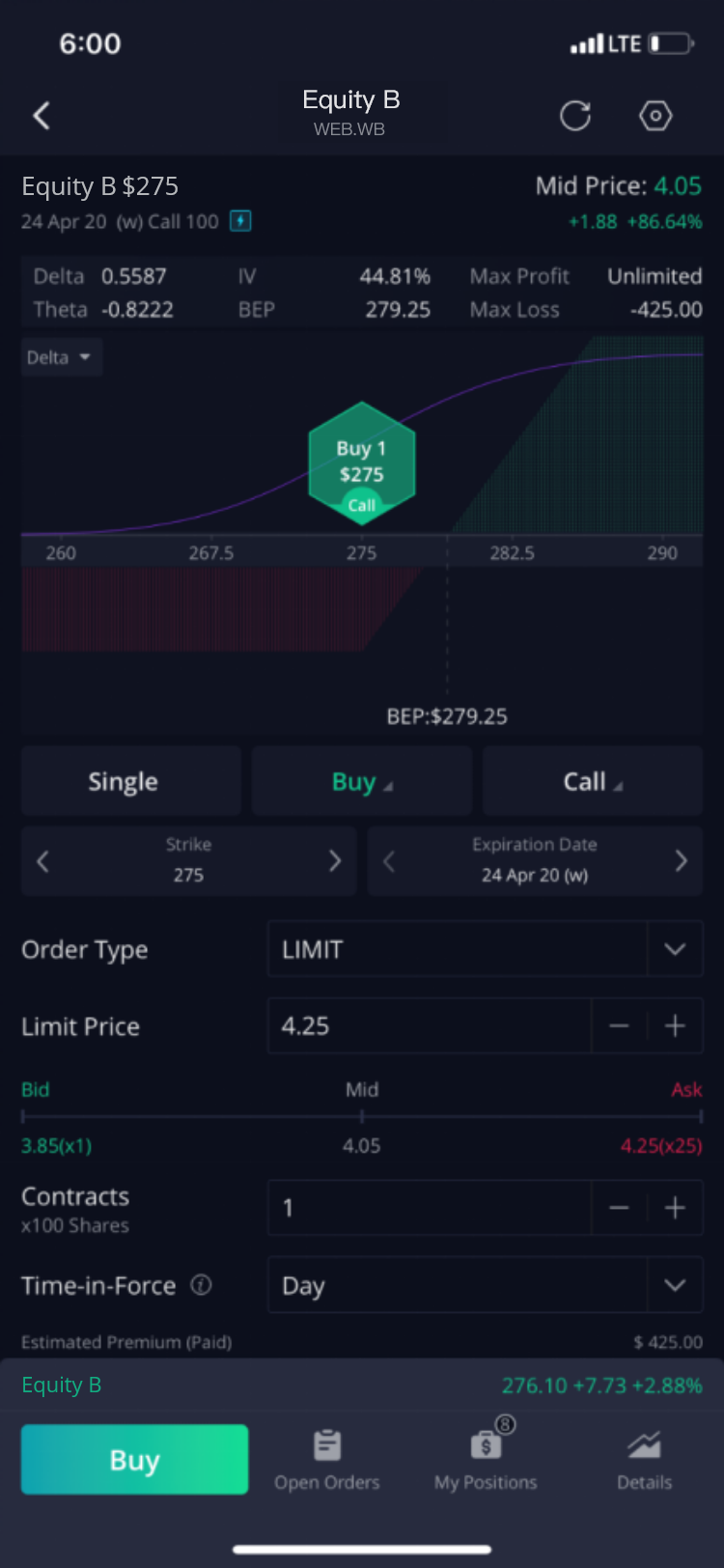

Webull’s user-friendly platform is meticulously designed to cater to the demands of options day traders. Its intuitive interface, coupled with real-time data, sophisticated charting tools, and advanced order types, provides traders with the necessary insights and control to navigate the dynamic options market.

4. Core Strategies for Options Day Trading

4.1 Buying Calls for Potential Upside

When traders anticipate a rise in the underlying asset’s price, they consider buying call options. These options grant them the right to purchase the asset at the strike price, enabling them to capitalize on potential gains.

4.2 Selling Calls for Premium Income

Traders with an outlook for a flat or declining market may opt to sell call options. This strategy allows them to collect a premium from the buyer, while also limiting their potential profit if the price of the underlying asset rises.

4.3 Buying Puts for Downside Protection

Puts are options that give traders the right to sell an underlying asset at the strike price. Traders employ this strategy as a hedge against potential losses or as a speculative bet on price declines.

4.4 Selling Puts for Premium Income

Similar to selling call options, traders can also generate premium income by selling put options. This approach carries the potential for unlimited loss if the underlying asset’s price falls below the strike price.

5. Day Trading Options on Webull: Essential Considerations

5.1 Trade Selection: Choosing the Right Options

Properly analyzing the underlying asset’s price history, volatility, and market sentiment is paramount for selecting suitable options contracts. Traders must consider their risk tolerance and potential profit/loss scenarios before executing any trades.

5.2 Time Decay and Volatility: The Twin Influences

Options have a limited lifespan, and their value erodes over time due to time decay. Additionally, the volatility of the underlying asset significantly impacts option prices. Traders must carefully monitor these factors to optimize their trading strategies.

5.3 Risk Management: A Vital Precaution

Options trading involves substantial risk, and traders must implement robust risk management tactics. Setting stop-loss and take-profit levels, as well as diversifying trades, are essential components of effective risk mitigation.

6. Conclusion

Day trading options on Webull provides traders with an avenue for potential profits, but it also entails the potential for significant losses. By meticulously researching options concepts, utilizing Webull’s advanced trading tools, and adopting sound trading strategies, traders can enhance their chances of success in this dynamic and rewarding market. Remember, knowledge, discipline, and a measured approach are the keys to unlocking the full potential of options day trading.

Image: ifoundwork.com

Day Trading Options Webull