Introduction:

Image: speedtrader.com

In the world of finance, options trading can be a labyrinthine maze of complex terms and strategies. Amidst this bewildering landscape, the concept of strike price stands as a pivotal pillar, shaping the destiny of every options contract. Imagine yourself as a skillful swordsman, wielding options contracts as your ethereal blades. The strike price, analogous to a gleaming forged metal, determines the precise point at which your blade strikes, influencing the outcome of every trade. Embark on this enlightening journey as we delve into the intricacies of strike price in options trading, deciphering its multifaceted role and unlocking its transformative power.

Defining Strike Price: The Crucible of Options

At its core, the strike price is a predetermined level that serves as a critical reference point in options trading. It represents the price at which the underlying asset, be it a stock, commodity, or index, can be bought (in the case of call options) or sold (in the case of put options) on the date of expiration. This pivotal price acts as the anchor upon which the intrinsic value of an option contract is forged, much like the foundation of a majestic castle.

Strikes forge a spectrum of possibilities, with each strike price representing a distinct level at which the underlying asset may be transacted. Like a keen-eyed archer, options traders meticulously select strike prices that align with their market outlook and risk appetite, aiming to strike the bullseye of profitability.

Call Options: A Symphony of Bullish Hopes

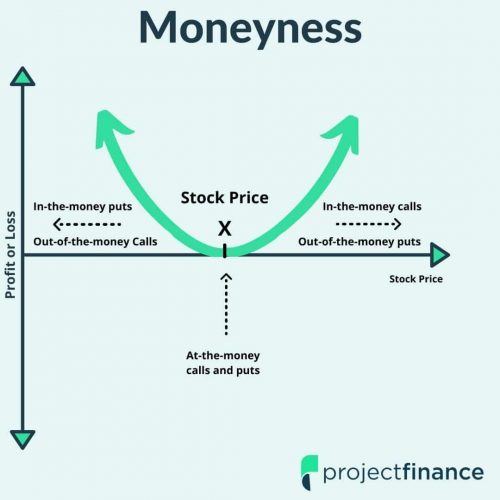

When trading call options, the strike price assumes the mantle of a threshold, a line in the sand that separates hope from despair. If the underlying asset ascends above the strike price by the expiration date, the call option gains intrinsic value, akin to a blossoming flower unfurling its petals under the golden rays of the sun. This inherent worthiness allows the call option holder to exercise their right to buy the underlying asset at the strike price, a triumphant moment comparable to a victorious knight vanquishing his foes.

Put Options: Embracing the Bear’s Embrace

In the realm of put options, the strike price transforms into a bastion of defense against market downturns. When the underlying asset plunges below the strike price, the put option acquires its intrinsic value, much like a resilient fortress withstanding a relentless siege. This intrinsic worthiness empowers the put option holder to exercise their right to sell the underlying asset at the strike price, a strategic retreat that mitigates losses in a bearish market, akin to a wise general salvaging his troops from a losing battle.

Expiration Date: The Day of Reckoning

The expiration date looms large in options trading, marking the moment when the fate of each contract is sealed. On this pivotal day, the strike price becomes the measuring stick against which the performance of the underlying asset is judged. If the underlying asset’s price aligns precisely with the strike price, the option expires worthless, leaving no trace of its existence, akin to a ghost fading into the annals of history.

The Art of Strike Selection: A Delicate Balance

Choosing the right strike price is an art form, a delicate dance between risk and reward that requires a discerning eye and a steady hand. Traders must meticulously consider the market outlook, implied volatility, and their own risk tolerance when selecting strike prices, navigating the treacherous waters of options trading with the precision of a seasoned sea captain.

Conclusion:

The strike price, an indispensable element in options trading, serves as the cornerstone upon which the success or failure of every contract hinges. By comprehending the nature and significance of strike price, options traders can embark on their trading endeavors with greater confidence and discernment, wielding their options contracts like finely honed swords, poised to strike with precision and reap the rewards of the market’s ever-changing tides.

Image: www.projectfinance.com

What Is Strike Price In Options Trading