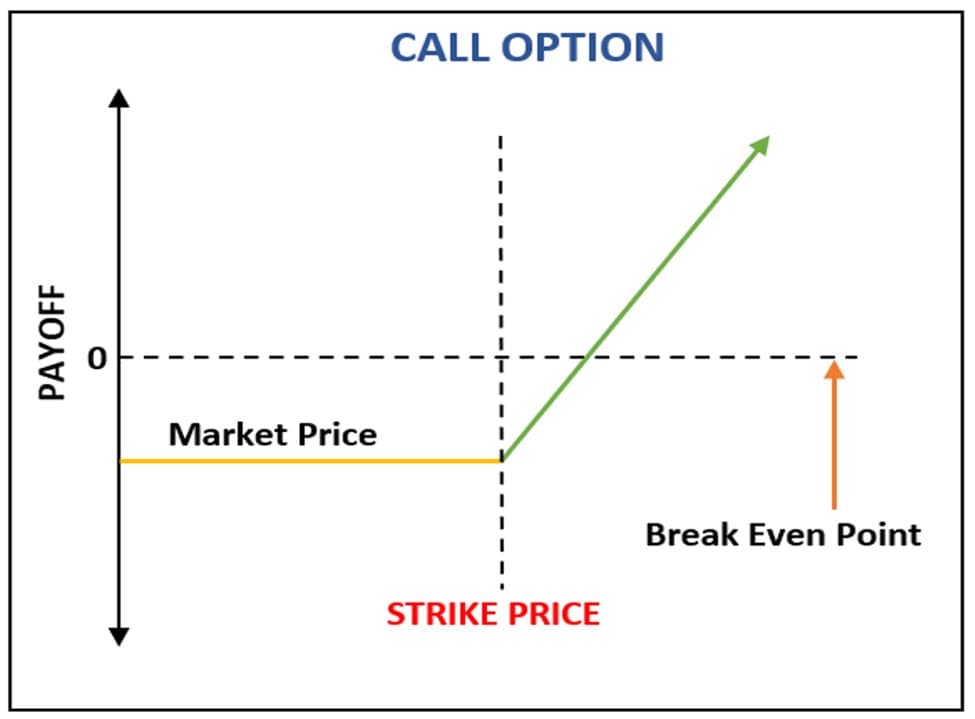

Options trading, an integral part of the financial markets, presents traders with a spectrum of strategies to capitalize on price movements. Among the core concepts in options trading lies the strike price, a pivotal element in determining the potential profitability and risk associated with an options contract.

Image: libertex.com

Defining the Strike Price

A strike price is the predetermined price at which the holder of an option can exercise their right to buy (for a call option) or sell (for a put option) the underlying asset. When an investor buys a call option, they anticipate the asset’s price to rise above the strike price, while purchasing a put option implies their belief in a price decline below the strike. In essence, the strike price serves as the benchmark against which the actual market price is compared to determine the option’s intrinsic value.

Importance of Strike Price Selection

Selecting the appropriate strike price is crucial as it directly influences the options contract’s premium, the price paid to acquire the option. A higher strike price typically results in a lower premium, as the probability of the option expiring worthless (out-of-the-money) increases. Conversely, a lower strike price leads to a higher premium due to the increased likelihood of the option ending in-the-money.

Types of Strike Prices

Options contracts offer various strike prices to cater to diverse trading strategies. Some commonly used strike prices include:

- At-the-Money (ATM): The strike price is equal to the current market price of the underlying asset.

- In-the-Money (ITM): The strike price is below the current market price for call options and above the current market price for put options.

- Out-of-the-Money (OTM): The strike price is above the current market price for call options and below the current market price for put options.

Image: messots.blogspot.com

The Relationship between Strike Price and Profitability

The strike price plays a vital role in determining the profitability of an options contract. If the underlying asset’s price moves in the direction predicted by the trader, they may profit from exercising their right to buy or sell at the predetermined strike price, thus locking in their desired profit or limiting their losses.

Impact of Time Decay on Strike Price

Time decay, the gradual loss of value in an option contract as its expiration date approaches, affects the strike price. As time passes, the value of an option with an ITM strike will erode more slowly compared to an OTM strike option. This is because an ITM option has intrinsic value, which acts as a buffer against time decay.

Strike Price In Trading Options

Image: speedtrader.com

Conclusion

The strike price serves as a fundamental pillar in options trading, influencing the premium, intrinsic value, and ultimately, the profitability of an options contract. Understanding the role and implications of strike prices is essential for traders to make informed decisions and capitalize on the opportunities presented by this dynamic financial instrument. By carefully selecting strike prices and monitoring their impact on the options contract’s value, traders can enhance their trading strategies and navigate the intricacies of options markets effectively.