Introduction

As an options trader, grasping the intricacies of strike price is paramount to maximizing your profitability. Let’s delve into the fundamental concept of strike price, exploring its profound implications in the dynamic world of options trading.

Image: investinganswers.com

Your trading experience will be enriched as we unveil a wealth of information on strike price, including its definition, bearing on option premiums and profitability, and how it interacts with the underlying asset’s price. Empowered with this knowledge, you’ll be better equipped to make informed decisions and navigate the ever-changing derivatives market.

Understanding Strike Price

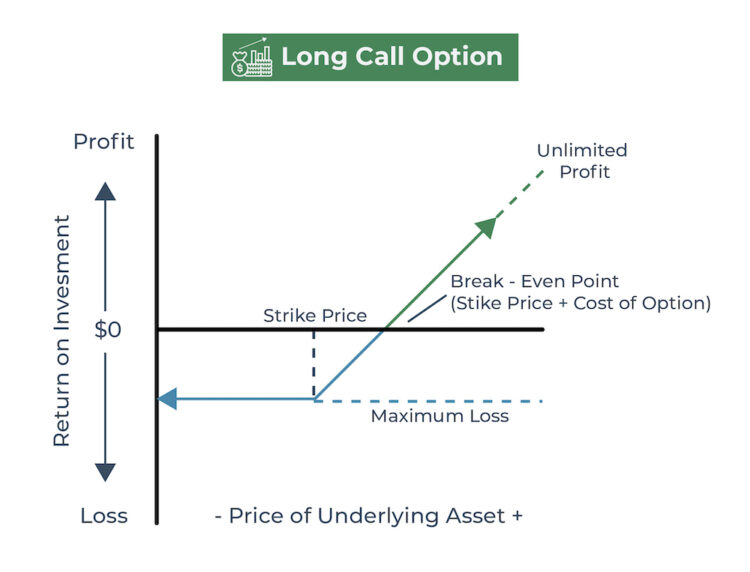

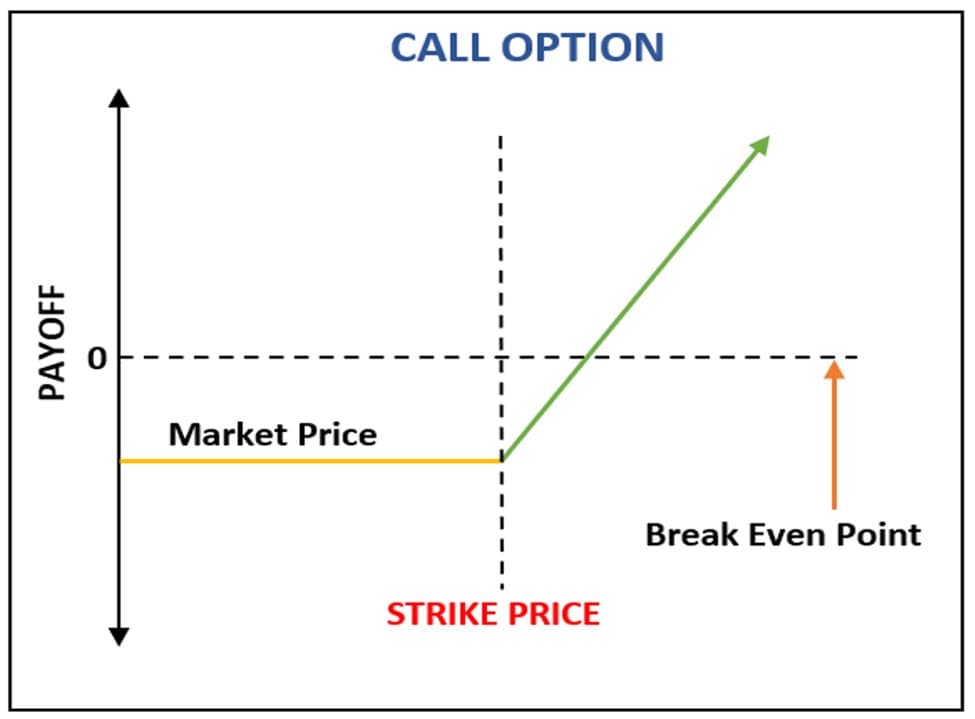

In the realm of options trading, the strike price refers to a predetermined price at which an option contract can be exercised. When purchasing a call option (bullish), the trader anticipates that the underlying asset’s price will rise above the strike price.

Conversely, when purchasing a put option (bearish), the trader expects the underlying asset’s price to fall below the strike price. The strike price serves as a crucial reference point, influencing both the premium paid for the option and the potential profit or loss upon expiration.

Determining Option Premiums

The strike price significantly impacts the option’s premium or price. At-the-money (ATM) options, where the strike price is equal to the underlying asset’s current market price, typically command higher premiums compared to options with strike prices above (out-of-the-money) or below (in-the-money) the market price.

Profitability and Loss Potential

The strike price plays a pivotal role in determining the profitability or loss potential of an options trade. For a call option, if the underlying asset’s price rises above the strike price at expiration, the option holder can exercise the contract and purchase the asset at the strike price, potentially generating a profit.

However, if the underlying asset’s price falls below the strike price, the option expires worthless, resulting in a loss of the premium paid for the contract. Similarly, for a put option, profitability depends on the underlying asset’s price falling below the strike price.

Image: libertex.com

Recent Trends and Developments

The options trading landscape is constantly evolving, with advancements such as the emergence of exchange-traded funds (ETFs) that track option strategies. Social media platforms have also become valuable sources of information and insights for options traders, enabling them to stay abreast of market trends and connect with fellow traders.

Tips for Success in Options Trading

To navigate the complexities of options trading successfully, consider the following tips:

- Thorough Research: Conduct thorough research on the underlying asset, market conditions, and option strategies to make informed decisions.

- Understanding Volatility: Assess the volatility of the underlying asset to gauge the potential risks and rewards of different option strategies.

- Effective Risk Management: Implement robust risk management strategies, such as diversification and position sizing, to mitigate losses.

- Realistic Expectations: Have realistic profit targets and avoid getting caught up in excessive speculation.

- Expert Guidance: Seek guidance from reputable brokers or financial advisors to enhance your understanding of options trading.

Frequently Asked Questions (FAQs)

Q: What happens if the option is not exercised before expiration?

A: If an option is not exercised before the expiration date, it expires worthless, and the premium paid for the contract is lost.

Q: Can options be traded on margin?

A: Yes, options can be traded on margin, but it comes with risks and potential losses.

Q: What is the relationship between strike price and time to expiration?

A: As time to expiration decreases, the premium for out-of-the-money options decays faster than at-the-money options.

What Does Strike Mean In Option Trading

Conclusion

Understanding strike price is integral to successful options trading. By grasping the concepts outlined in this article, you’ll be better equipped to navigate the complexities of options contracts, make informed investment decisions, and uncover the true potential of this financial instrument.

Continue delving into the world of options trading to expand your knowledge and hone your strategies. Stay curious, seek knowledge from credible sources, and engage with fellow traders to gain valuable insights that will guide you toward greater success.