Introduction

The world of finance is constantly evolving, with new strategies and techniques emerging all the time. One of the most popular and versatile investment tools available today is options. Options give investors the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. This flexibility makes options a powerful tool for both hedging and speculative trading. However, the wide range of options strategies available can be overwhelming for new traders. This article provides a comprehensive overview of some of the most popular options strategies, including their risks and rewards.

Image: www.tradethetechnicals.com

Basic Concepts

Before we delve into specific options strategies, it is important to understand a few basic concepts. First, all options contracts have two sides: the buyer and the seller. The buyer of an option pays a premium to the seller in exchange for the right to buy or sell the underlying asset at a specified price. The seller of an option receives the premium and is obligated to fulfill the contract if the buyer exercises their right to buy or sell.

Second, all options contracts have two key dates: the expiration date and the exercise date. The expiration date is the last day on which the buyer can exercise their right to buy or sell the underlying asset. The exercise date is the date on which the buyer actually buys or sells the underlying asset. Options can be either “American-style” or “European-style.” American-style options can be exercised at any time up to and including the expiration date, while European-style options can only be exercised on the expiration date.

Types of Options Strategies

There are dozens of different options strategies available to traders, each with its own unique risks and rewards. Many strategies combine multiple contracts to achieve a specific goal. Some of the most common options strategies include:

- Covered calls: A covered call is a strategy in which an investor sells (or “writes”) a call option against a stock that they own. The call option gives the buyer the right to buy the stock at a specified price on or before a certain date. By selling a covered call, the investor is betting that the stock price will not rise above the strike price of the option. If the stock price does rise above the strike price, the investor is obligated to sell the stock to the buyer of the option at the strike price.

- Protective puts: A protective put is a strategy in which an investor buys a put option against a stock that they own. The put option gives the investor the right to sell the stock at a specified price on or before a certain date. By buying a protective put, the investor is protecting themselves against a decline in the stock price. If the stock price does decline, the investor can exercise their put option and sell the stock at the strike price of the option.

- Bull calls: A bull call is a strategy in which an investor buys a call option on a stock that they believe will rise in price. The investor is betting that the stock price will rise above the strike price of the option on or before the expiration date. If the stock price does rise above the strike price, the investor can exercise their call option and buy the stock at the strike price.

- Bear puts: A bear put is a strategy in which an investor buys a put option on a stock that they believe will decline in price. The investor is betting that the stock price will fall below the strike price of the option on or before the expiration date. If the stock price does decline below the strike price, the investor can exercise their put option and sell the stock at the strike price of the option.

Image: www.studocu.com

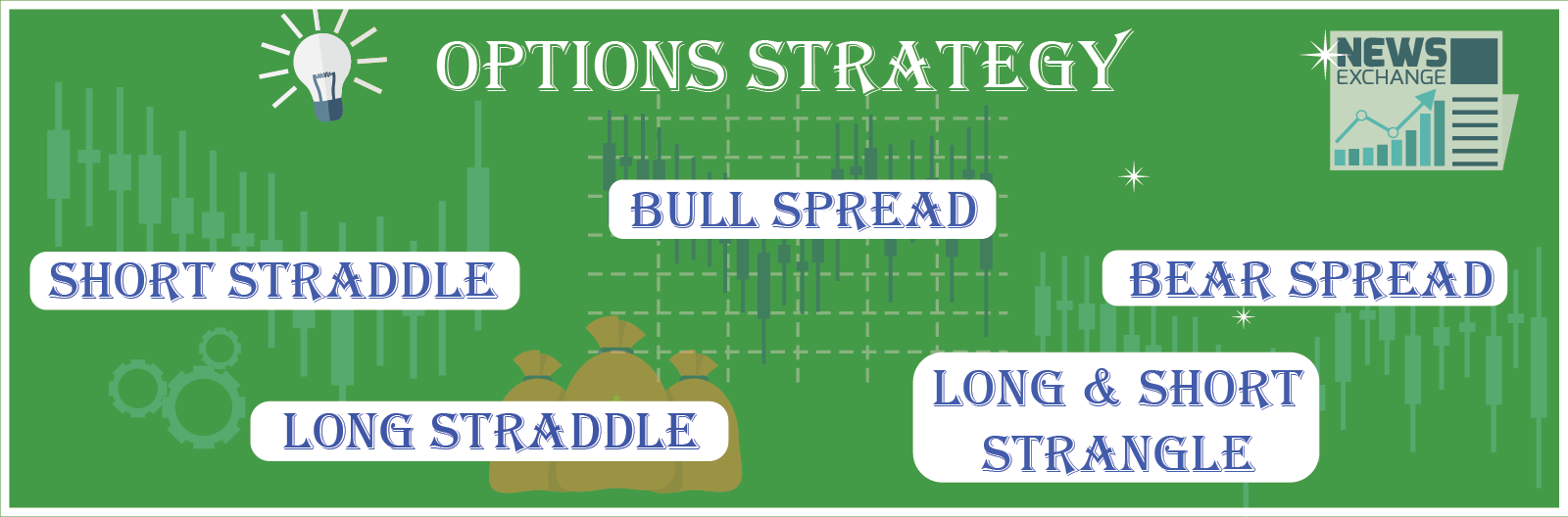

Trading Strategies Involving Options Ppt

Image: gallfishvirh.blogspot.com

Conclusion

Options are a powerful tool for both hedging and speculative trading. However, the wide range of options strategies available can be overwhelming for new traders. By understanding the basics of options and the different strategies available, traders can develop an options trading plan that meets their specific needs and risk tolerance.