Introduction

The world of finance is constantly evolving, with new opportunities and strategies emerging all the time. One such strategy is options trading, which allows investors to speculate on the future price of an asset without having to own it outright. One of the most popular platforms for options trading is Yahoo Finance, as it provides a user-friendly interface and access to a wide range of assets. In this comprehensive guide, we will explore the basics of Yahoo trading options, from understanding the different types of options to placing your first trade. So, whether you’re a seasoned investor or just starting out, read on to gain valuable insights into the world of options trading on Yahoo Finance.

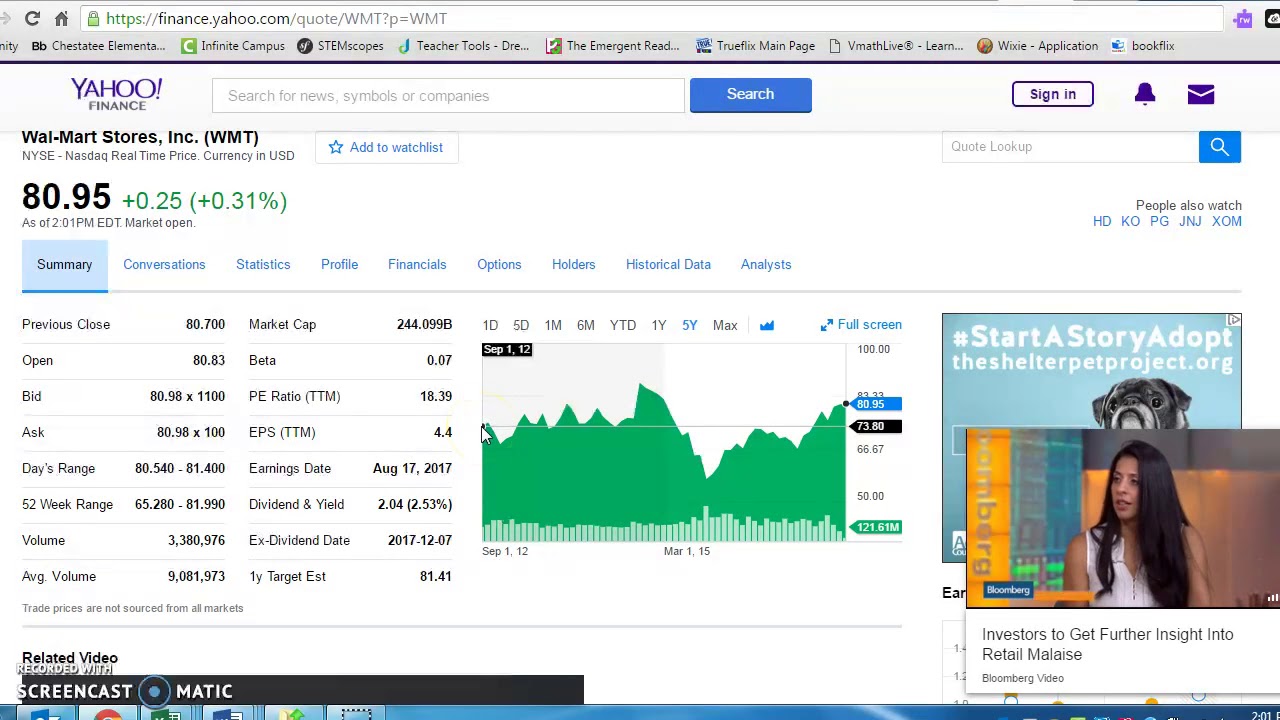

Image: wunesajoc.web.fc2.com

What are Options?

Before diving into trading options on Yahoo Finance, it’s essential to understand the basics of options contracts. Options are financial instruments that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specific price (known as the strike price) on or before a tertentu date (known as the expiration date). The buyer of an option pays a premium to the seller of the option, which represents the cost of acquiring the right to exercise the option contract.

Types of Options

Yahoo Finance offers you a wide range of options, including call options and put options. Call options give the buyer the right to buy the underlying asset at the strike price, while put options confer the right to sell the underlying asset at the strike price. Each type of option has a unique set of strategies and risk-reward profiles, making it crucial to understand the distinctions before trading.

Trading Options on Yahoo Finance

Trading options on Yahoo Finance is a straightforward process. Once you have set up an account, you can search for the underlying asset you want to trade and click on the ‘Options’ tab. From there, you can choose whether to buy or sell an option and select the appropriate strike price and expiration date. Remember to carefully consider your risk tolerance and investment goals before placing any trades.

Image: www.youtube.com

Key Considerations

Options trading carries inherent risks, and it’s crucial to approach it with a comprehensive understanding of the market and the underlying asset. Factors such as the volatility of the underlying asset, time decay, and market sentiment can significantly impact the performance of options contracts. It’s recommended to conduct thorough research and seek professional advice if needed before trading options.

Tips for Beginners

To enhance your options trading experience on Yahoo Finance, consider these practical tips:

- Start with paper trading: Before trading with real money, practice your strategies using the Yahoo Finance paper trading feature. This allows you to gain practical experience without risking capital.

- Focus on high-liquidity options: High-liquidity options offer tighter bid-ask spreads and increased execution efficiency.

- Understand the Greeks: The Greeks are a set of metrics that measure the sensitivity of an option’s price to changes in underlying factors. Understanding these metrics is vital for evaluating the potential risks and rewards.

- Manage your risk: Options trading can involve significant risks. Always clearly define your risk appetite and implement appropriate risk management strategies.

Yahoo Trading Options

Image: simyviqoj.web.fc2.com

Conclusion

Yahoo trading options provide an extensive range of opportunities for savvy investors. By understanding the fundamentals of options, leveraging the user-friendly Yahoo Finance platform, and considering the risks involved, you can navigate this exciting financial instrument with confidence. Enhance your investment strategies and explore the intriguing world of options trading with Yahoo Finance as your dependable companion.