Introduction

In the ever-fluctuating world of finance, the Cboe Volatility Index (VIX) has emerged as a beacon of market sentiment, providing a measure of the expected volatility in the U.S. stock market over the next 30 days. Traded through options contracts, the VIX offers investors a valuable tool to speculate on market volatility, hedge against risk, and potentially capitalize on market fluctuations.

Image: ryfanumakip.web.fc2.com

This comprehensive guide will delve into the intricacies of OEX options trading, exploring its history, fundamental concepts, strategies, and applications. By harnessing the power of OEX options, traders can navigate the complex terrain of market volatility and potentially reap significant rewards.

Understanding OEX Options

OEX options are a type of option contract based on the VIX. Each OEX option represents a specific price range that the VIX is expected to trade within during a specified expiration month. The buyer of an OEX option has the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) the VIX at a predetermined price, known as the strike price, before the expiration date.

Historical Overview of VIX Options Trading

The origins of VIX options trading can be traced back to the late 1990s, when the Chicago Board Options Exchange (CBOE) introduced the first tradable VIX futures contracts. These futures contracts provided a rudimentary method for investors to bet on future market volatility. However, it was not until 2006 that the CBOE launched OEX options, offering investors even greater flexibility and precision in their VIX trading strategies.

Fundamental Concepts of OEX Options

To grasp the complexities of OEX options trading, it is essential to understand several fundamental concepts:

- Strike Price: The predetermined price at which the holder of an OEX option can buy (call option) or sell (put option) the VIX.

- Expiration Date: The date on which the OEX option expires, after which it becomes worthless.

- Premium: The price paid by the buyer of an OEX option, representing the upfront cost associated with the contract.

- Intrinsic Value: The difference between the current VIX level and the strike price, if the option is in-the-money at the time of purchase.

- Time Value: The portion of the premium that represents the remaining time until the option expires.

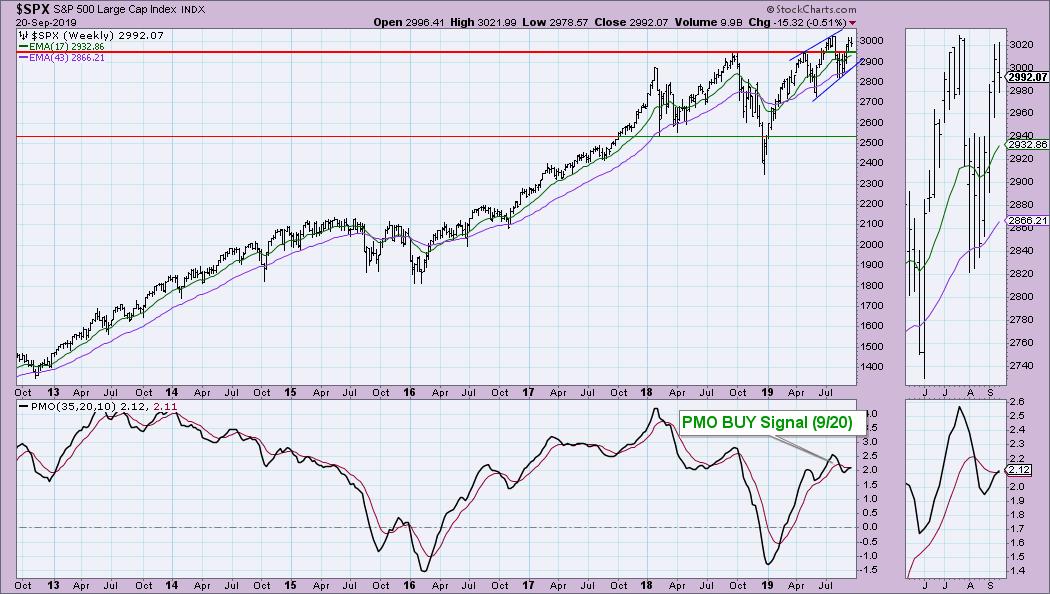

Image: stockcharts.com

Types of OEX Options Strategies

Traders employ a wide range of strategies when trading OEX options, each with its own unique risk and reward profile:

- Bull Spreads: A bullish bet on increasing VIX volatility, involving the purchase of a lower-strike-price call option and the simultaneous sale of a higher-strike-price call option with the same expiration date.

- Bear Spreads: A bearish bet on decreasing VIX volatility, involving the purchase of a lower-strike-price put option and the simultaneous sale of a higher-strike-price put option with the same expiration date.

- Straddles: A neutral strategy that profits from significant VIX fluctuations in either direction, involving the purchase of both a call option and a put option with the same strike price and expiration date.

- Strangles: A more speculative neutral strategy that profits from extreme VIX fluctuations, involving the purchase of both a call option and a put option with different strike prices and the same expiration date.

Applications of OEX Options in Risk Management and Hedging

Beyond speculative trading, OEX options serve as valuable tools for risk management and hedging in investment portfolios:

- VIX Hedging: Investors with exposure to the stock market can use VIX options to hedge against potential volatility spikes that could erode their portfolio value.

- Tail Risk Hedging: By purchasing out-of-the-money put options on the VIX, investors can protect against extreme market downturns, also known as tail risk.

Oex Options Trading

Conclusion

OEX options trading offers a sophisticated and flexible tool for investors to navigate the dynamic world of market volatility. By understanding the fundamental concepts, strategies, and applications of OEX options, traders can tailor their strategies to their specific risk tolerance, investment goals, and market outlook.