Introduction

In the realm of modern finance, options trading has emerged as a crucial tool for investors seeking to enhance their portfolios and navigate market volatility. Among the diverse array of options trading strategies, the utilization of indexes presents a unique approach to diversify risk and capitalize on market trends. Options trading indexes provide investors with the ability to speculate on the direction of a broad market sector or industry, rather than a single underlying asset, offering potentially lucrative opportunities while also mitigating individual stock risk.

Image: www.marketreview.com

Understanding Index Options

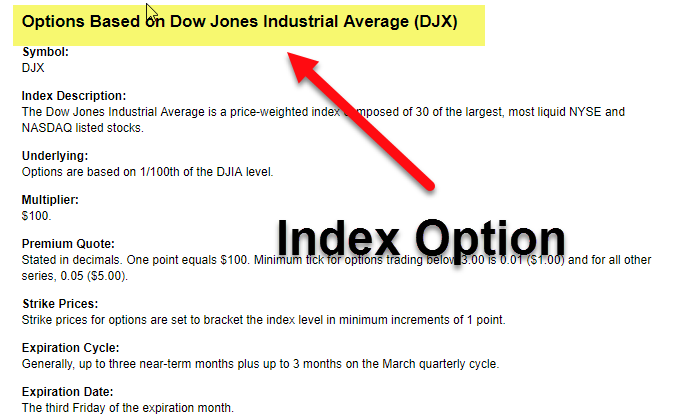

An index option is a contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified quantity of a particular index at a predetermined price (strike price) on or before a designated date (expiration date). The underlying index is a benchmark that tracks the performance of a specific market segment, such as the S&P 500 index for large-cap US stocks. By trading index options, investors can effectively bet on the future direction of the overall market or a particular industry sector.

Benefits of Trading Index Options

The primary advantages of trading index options lie in their ability to enhance portfolio diversification and manage risk. By investing in an index option, investors gain exposure to a broad range of underlying assets, thereby reducing the risk associated with relying on a single stock. This reduces the impact of any specific company’s performance on the overall investment and promotes portfolio stability.

Moreover, index options provide a cost-effective method of gaining exposure to an underlying index. Instead of purchasing individual stocks that constitute the index, investors can trade options that represent the entire index, potentially saving on transaction costs and commissions.

Strategies for Trading Index Options

There are several popular strategies employed in index options trading, each tailored to specific market conditions and investment objectives. Some of the most commonly used approaches include:

-

Bull Call Spread (Long): This strategy is used when the investor expects a bullish market scenario. It involves buying a higher strike call option and simultaneously selling a lower strike call option with the same expiration date. The profit potential is capped, while the risk is defined as the net premium paid.

-

Bear Put Spread (Long): This strategy is employed in anticipation of a bearish market. It entails purchasing a higher strike put option and selling a lower strike put option with the same expiration date. The profit potential is limited, and the risk is the net premium paid.

-

Covered Call (Short): This strategy is implemented when the investor expects a neutral to slightly bullish market scenario. It requires the ownership of the underlying index and involves selling a call option with a strike price higher than the current index level. The profit potential is limited, and the risk is the potential loss on the underlying.

Image: 1investing.in

Risk Management in Index Options Trading

As with any investment strategy, risk management is paramount in index options trading. Investors should carefully consider their financial situation and risk tolerance before engaging in this type of activity. It is essential to set clear profit targets, manage position sizing appropriately, and employ stop-loss orders to limit potential losses.

Options Trading Indexes

Image: truyenhinhcapsongthu.net

Conclusion

Options trading indexes presents a potent strategy for investors seeking portfolio diversification, risk management, and exposure to broader market trends. By understanding the concepts, benefits, and strategies involved, investors can unlock the potential of this financial instrument. It is imperative for investors to conduct thorough research and exercise prudent risk management to maximize the rewards while minimizing the risks associated with index options trading. By embracing this powerful technique, investors can enhance their investment portfolios and navigate the dynamic financial markets with greater confidence and efficiency.