Introduction

In the dynamic and often bewildering realm of option trading, selecting the right strike price can make all the difference between financial triumph and disappointment. A strike price, simply put, is the predetermined price at which the holder of an option contract can exercise their right to buy or sell the underlying asset. Getting it right is like hitting a bullseye, requiring a combination of skill, strategy, and a deep understanding of market dynamics.

Image: www.rockwelltrading.com

Understanding the Basics: Calls vs. Puts

Options fall into two primary categories: calls and puts. Call options grant the buyer the right to buy an asset at the strike price by a specified expiration date. Conversely, put options give the buyer the right to sell an asset at the strike price. Selecting a strike price for call options involves considering the buyer’s belief that the asset will increase in value above the strike price, while for put options, the buyer anticipates a decline below the strike price.

The Art of Striking a Balance: ITM, OTM, and ATM

Strike prices come in three flavors: in-the-money (ITM), out-of-the-money (OTM), and at-the-money (ATM). ITM options have a strike price below (for calls) or above (for puts) the current market price. OTM options have a strike price above (for calls) or below (for puts) the current market price. ATM options have a strike price that matches the current market price. The choice depends on the trader’s risk appetite, time horizon, and market outlook.

Factors to Consider: Market Sentiments and Price Movements

Selecting a strike price requires a thorough analysis of market sentiments, price movements, and volatility. Traders must assess the underlying asset’s historical price action, recent news and events that may impact its value, and broader economic conditions. Volatility plays a crucial role, as higher volatility leads to wider fluctuations in option premiums. A careful evaluation of these factors helps traders narrow down their strike price options.

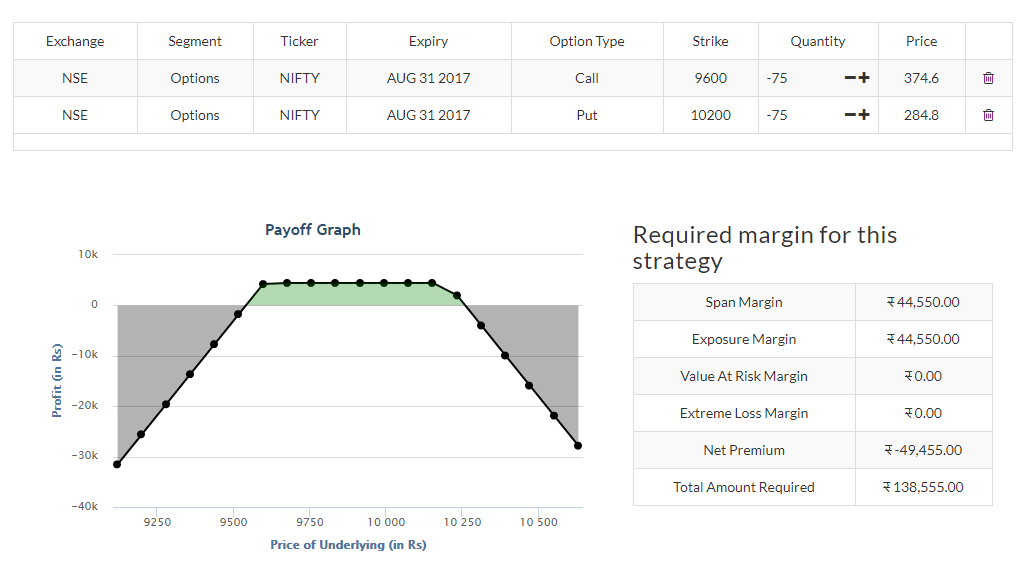

Image: unofficed.com

Traders’ Options: Model Development and Scenario Analysis

Seasoned traders often employ sophisticated models to develop optimal strike price strategies. These models incorporate historical data, market sentiment indicators, and other parameters to predict future asset price movements and option premium behavior. Scenario analysis is another valuable tool, where traders evaluate potential outcomes based on different strike price choices and market conditions.

Technical Analysis Techniques: Support and Resistance Levels

Technical analysts rely on support and resistance levels to guide their strike price selection. Support levels represent areas where prices have historically bounced back from declines, while resistance levels indicate areas where prices have struggled to rise above. Identifying these levels provides insights into potential areas where the asset’s price may reverse direction, helping traders choose strike prices near those points.

Time Factor and Premium Considerations

Time is a critical factor in option trading. Options have a limited lifespan, and their premiums decay over time. Traders must consider the time value of the option when selecting a strike price, as this can significantly impact their potential profit or loss. Premiums for OTM options tend to be lower, but they carry a higher risk of expiring worthless if the underlying asset’s price does not move significantly.

Strike Price Selection In Option Trading

Conclusion

Mastering strike price selection is a cornerstone of successful option trading. By understanding the basics, analyzing market dynamics, considering various factors, and employing analytical techniques, traders can improve their chances of making informed decisions that maximize their returns. Strike price selection is not a one-size-fits-all endeavor, and it requires constant adaptation to market conditions and individual trading strategies. With continued learning and experience, traders can transform this critical aspect of option trading from a potential pitfall to a powerful tool in their financial arsenal.