Introduction

In the world of finance, timing is everything. When trading foreign currency options, it’s crucial to be aware of the trading cut-off time to ensure your orders are executed before the market closes. This article delves into the concept of trading cut-off time for foreign currency options on Quizlet, explaining its importance and providing essential information for traders.

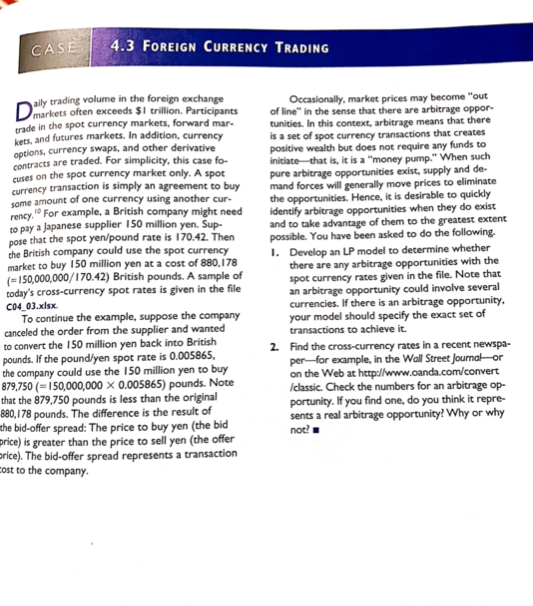

Image: www.chegg.com

What is Trading Cut-Off Time?

Trading cut-off time is the specific time at which trading for a particular financial instrument ceases for the day. After the cut-off time, no further orders can be placed or executed. This deadline ensures the orderly settlement of trades and prevents market manipulation at the end of the trading day.

Cut-Off Time for Foreign Currency Options on Quizlet

The trading cut-off time for foreign currency options on Quizlet varies depending on the underlying currency pair and the specific market where it is traded. Most currency pairs have a trading cut-off time of 4:00 PM Eastern Time (ET) on weekdays, while some less liquid pairs may close earlier.

For example:

- EUR/USD: 4:00 PM ET

- GBP/USD: 4:00 PM ET

- USD/JPY: 4:00 PM ET

Why is it Important?

Understanding the trading cut-off time is essential for several reasons:

- Missed Orders: Placing orders after the cut-off time will result in them not being executed, which could lead to potential losses or missed opportunities.

- Order Cancellation: If an order is placed within a few minutes of the cut-off time, there is a risk that it may be canceled due to insufficient time for execution.

- Market Volatility: The market can become more volatile towards the end of the trading day, especially close to the cut-off time. Understanding the cut-off time allows traders to manage their risk and adjust their trading strategies accordingly.

Image: kosowekavorut.web.fc2.com

How to Find the Cut-Off Time

Traders can find the trading cut-off time for foreign currency options on Quizlet by checking the platform’s trading schedule or contacting their broker. It is recommended to verify the cut-off time beforehand to avoid any surprises or missed opportunities.

Trading Cut Off For Foreign Currency Options Quizlet

Image: titanfx.com

Conclusion

Trading cut-off time is a critical aspect of foreign currency options trading on Quizlet. By understanding the cut-off time for the specific currency pair being traded, traders can ensure that their orders are executed timely, avoid missed trades, and mitigate risks associated with market volatility. Always refer to up-to-date sources for the latest cut-off time information to stay informed and make informed trading decisions.