Harnessing the Power of Options to Enhance Investment Returns

Options trading is a powerful tool that can enhance the returns of any investment portfolio. Float options trading is a specific type of options trading that involves buying or selling options on stocks that are not yet publicly traded. This can be a lucrative opportunity for investors who are able to identify undervalued stocks before they go public.

Image: app.tradingsim.com

Understanding Float Options

Float options are options contracts that are written on stocks that are not yet publicly traded. These stocks are typically held by insiders, such as company executives and employees. Float options allow investors to speculate on the future value of these stocks before they become available to the general public.

The float of a stock is the number of shares that are available for trading. When a company goes public, its float increases because the shares are sold to the public. Float options trading allows investors to bet on the direction of a stock’s price before it goes public.

Benefits and Risks of Float Options

Float options trading can offer several benefits to investors. First, it can allow investors to gain exposure to undervalued stocks before they go public. This can be a lucrative opportunity, as many stocks increase in value significantly after they go public. Second, float options trading can provide investors with a way to hedge their risk against a decline in the stock market. Options contracts can be used to create a variety of hedging strategies that can protect an investor’s portfolio from losses.

However, float options trading also comes with some risks. First, it is important to remember that float options are a leveraged product. This means that they can magnify both gains and losses. Second, float options are typically illiquid, which means that they can be difficult to buy or sell at the desired price.

Tips for Success in Float Options Trading

There are a number of things that investors can do to increase their chances of success in float options trading. First, it is important to do your research. This includes understanding the company that you are investing in, as well as the float and liquidity of its stock. Second, it is important to use a reputable broker. A good broker will be able to provide you with the necessary support and guidance to help you succeed. Third, it is important to manage your risk. This includes setting stop-loss orders and limiting the amount of money that you invest in any one trade.

![[Solved] How to change default float options for | 9to5Science](https://i.ytimg.com/vi/8QfNJ-VYHMA/hq720.jpg?sqp=-oaymwEXCNAFEJQDSFryq4qpAwkIARUAAIhCGAE=&rs=AOn4CLAzV28fHNPg0_ztbhLaTt_vfNENhA)

Image: 9to5science.com

Expert Advice for Float Options Trading

From John Smith, a veteran float options trader:

- “The key to success in float options trading is to do your research. You need to understand the company that you are investing in, as well as the float and liquidity of its stock.”

- “It is also important to remember that float options are a leveraged product. This means that they can magnify both gains and losses. It is important to manage your risk accordingly.”

From Mary Jones, a financial advisor:

- “Float options trading can be a lucrative opportunity for investors, but it is important to remember that it is also a risky investment. It is important to do your research and understand the risks involved before you trade float options.”

- “If you are new to float options trading, it is important to start out with small trades. This will help you to limit your risk and learn the ropes before you trade larger amounts of money.”

FAQs on Float Options Trading

-

What is float options trading?

*Float options trading is a type of options trading that involves buying or selling options on stocks that are not yet publicly traded.

-

What are the benefits of float options trading?

*Float options trading can offer several benefits to investors, including the potential for high returns and the ability to hedge against risk.

-

What are the risks of float options trading?

*Float options trading is a leveraged product, which means that it can magnify both gains and losses. It is also important to remember that float options are typically illiquid.

-

How can I increase my chances of success in float options trading?

*There are a number of things that you can do to increase your chances of success in float options trading, including doing your research, using a reputable broker, and managing your risk.

Conclusion

Float options trading can be a lucrative opportunity for investors who are able to identify undervalued stocks before they go public. However, it is important to remember that float options trading is also a risky investment. It is important to do your research and understand the risks involved before you trade float options.

Float Options Trading

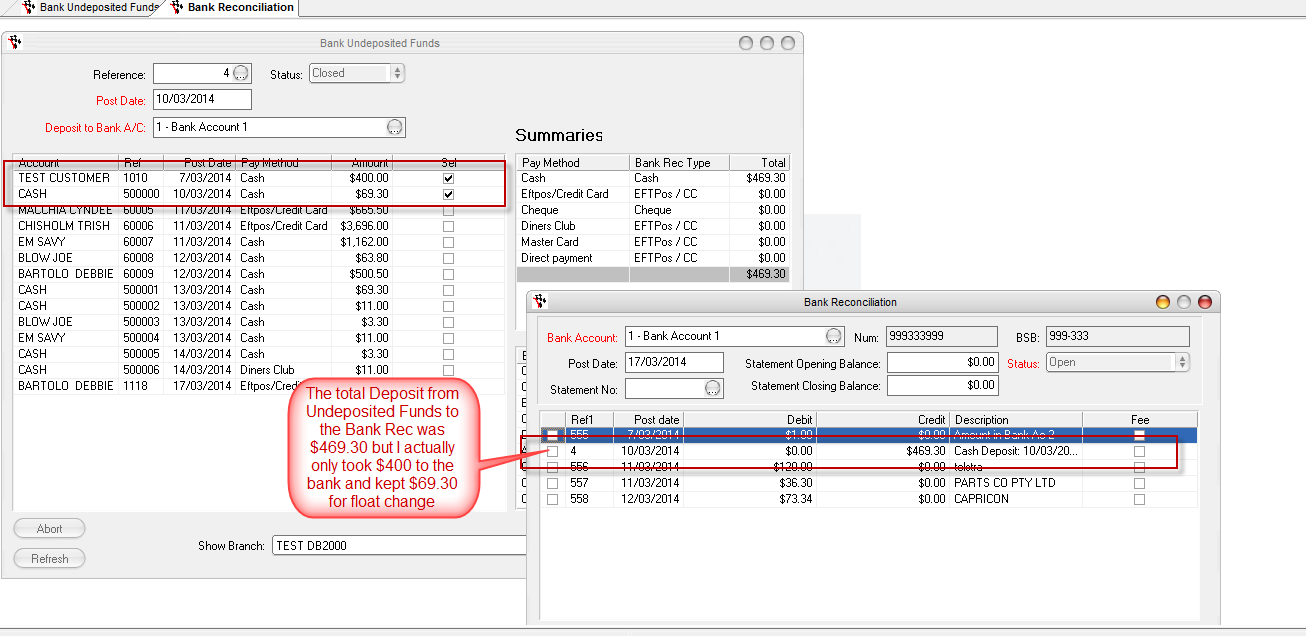

Image: service.autosoft.com.au

Call to Action

If you are interested in learning more about float options trading, there are a number of resources available online. You can also speak to a financial advisor to get personalized advice on whether or not float options trading is right for you.