Prelude: Embracing the Thrill of Uncertainty

In the vast expanse of EVE Online, a unique realm of financial intrigue exists where players can test their mettle with options trading. As a young and ambitious capsuleer, I stumbled upon this enigmatic market and was captivated by its potential for both immense rewards and catastrophic losses. It is in this spirit of shared exploration that I embark on unraveling the intricacies of options trading in EVE Online for my fellow spacefarers.

Image: www.youtube.com

Delving into the Options Market

Options trading in EVE Online is a complex and multifaceted aspect of the game’s economy. It involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell a specified asset at a predetermined price within a defined timeframe. By engaging in this high-stakes game, players can speculate on the future direction of commodity prices or hedge against potential market fluctuations.

Understanding the Mechanics

At the heart of options trading lies the concept of call and put contracts. Call contracts give holders the right to buy a particular asset at a set price, whereas put contracts offer the opposite: the right to sell an asset. The price at which the asset can be bought or sold is referred to as the strike price, and the time period in which the contract can be exercised is known as the expiration date.

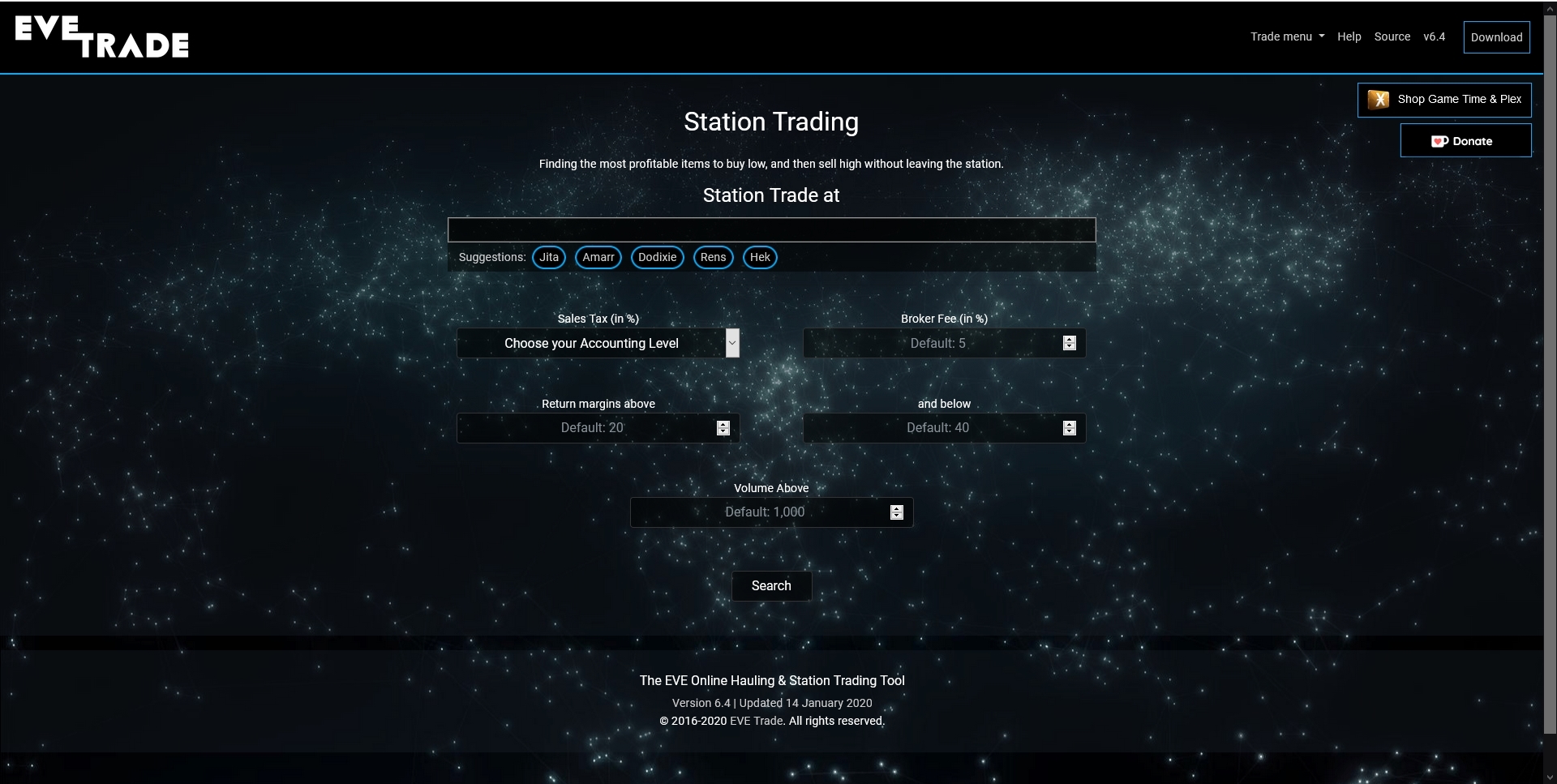

In EVE Online, options trading is primarily conducted through contracts offered by player-run corporations. These contracts are standardized, meaning they adhere to specific terms and conditions, ensuring transparency and fairness in the marketplace. Traders can buy and sell contracts on a secure server known as the Contracts Window, where they can monitor market fluctuations and place their orders.

Harnessing the Power of Market Trends

The value of an option contract is intricately tied to the underlying asset it represents and the prevailing market conditions. If the price of the asset rises above the strike price for call contracts (or falls below for put contracts), the contract becomes more valuable, potentially yielding significant profits for holders. Conversely, if the market moves against the holder’s expectations, the contract may become worthless, leading to losses.

To navigate this volatile landscape, traders need to stay abreast of market trends and fluctuations. This can entail monitoring supply and demand patterns, analyzing economic conditions, and keeping an eye on geopolitical developments that could impact the supply chains of specific commodities.

Image: www.youtube.com

Expert Insights: Navigating the Risks

The high potential rewards of options trading come with inherent risks that novice traders should be aware of. One key risk is the loss of capital due to unfavorable price movements. To mitigate this risk, traders should exercise proper risk management strategies, such as setting clear trading limits and diversifying their portfolio.

Furthermore, traders should carefully consider the expiration date of their contracts. When an option contract expires, it becomes worthless if it is not exercised. Therefore, traders should monitor their contracts closely and make strategic decisions to either exercise them or sell them before they expire.

Frequently Asked Questions

-

Q: What is the minimum capital required to start options trading in EVE Online?

A: The minimum capital requirement varies depending on the specific contract being traded, but generally, it is recommended to have a starting capital of at least 100 million ISK. -

Q: Can I trade options on any asset in EVE Online?

A: Options trading is only available for designated commodities and assets, including Minerals, Ice, and Plex. -

Q: Where can I find more information about options trading in EVE Online?

A: The EVE Online official forums, third-party websites, and in-game player-run organizations can provide additional resources and insights on options trading.

Options Trading In Eveonline

Image: eveworlds.com

Conclusion

Options trading in EVE Online offers intrepid traders the opportunity for immense financial gain but also carries substantial risk. By understanding the mechanics of options contracts, monitoring market trends, embracing expert advice, and managing risks effectively, players can navigate this volatile marketplace and harness its potential for both excitement and profit.

Fellow capsuleers, if you dare to venture into this realm of financial warfare, may fortune favor you. Are you ready to embrace the thrill of uncertainty and seize the boundless possibilities that await you in the options market of EVE Online?