In the labyrinthine world of financial markets, options serve as sophisticated tools that empower traders to navigate volatility and harness opportunities for profit. Among these options, standard deviation options stand out as a potent weapon in the arsenal of savvy investors. With their ability to capture the elusive ebb and flow of market movements, standard deviation options unlock unparalleled precision and flexibility in option trading.

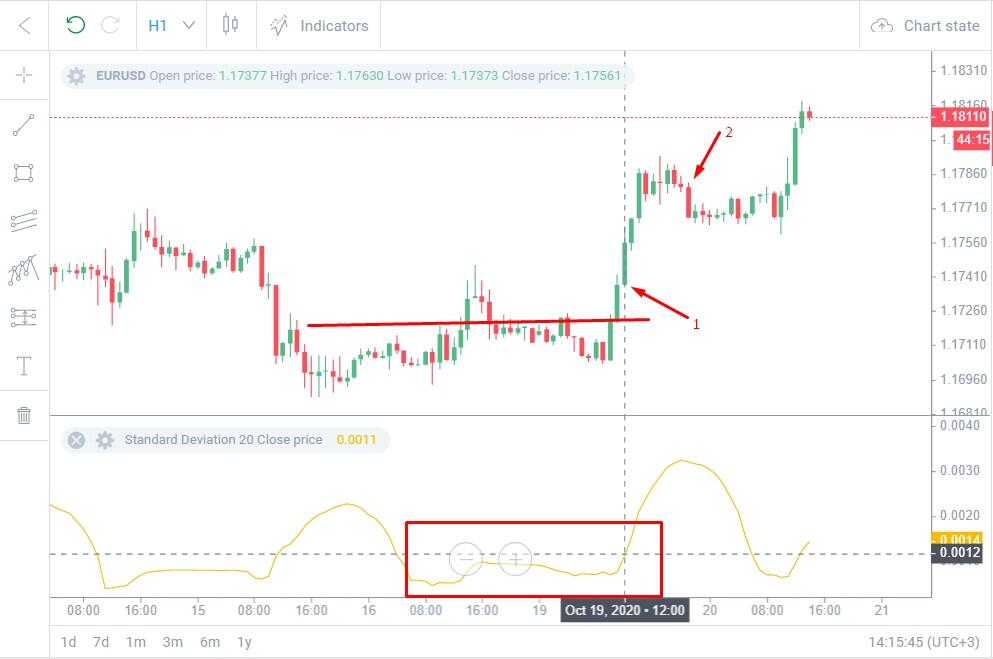

Image: www.litefinance.org

The standard deviation, often denoted by the Greek letter “sigma” (σ), plays a pivotal role in the pricing and evaluation of these options. This statistical measure quantifies the dispersion of returns around the mean, providing insights into the potential volatility of the underlying asset. Armed with this knowledge, traders can craft tailored strategies that respond to market dynamics and maximize profit potential.

Delving into the Mechanics of Standard Deviation Options

Standard deviation options are distinguished by their unique design, which deviates from the structure of traditional options. While traditional options confer the right (but not the obligation) to buy or sell the underlying asset at a predetermined price on a specified date, standard deviation options grant the right to buy or sell a basket of options with varying strike prices and expiration dates.

The basket’s composition is carefully calibrated to track the movements of the underlying asset’s volatility, providing traders with precise exposure to the market’s fluctuations. This innovative approach allows for targeted speculation on volatility itself, opening up a new dimension in options trading that was previously inaccessible.

Unlocking the Power of Volatility Measurement

The allure of standard deviation options lies in their ability to harness volatility, a double-edged sword in the financial markets. Volatility, a measure of the amplitude and frequency of price fluctuations, can both inflate returns and exacerbate losses. By capturing this dynamic, standard deviation options offer traders a powerful tool to mitigate risk and enhance profitability.

Traders can choose to buy standard deviation options when they anticipate an upswing in volatility, anticipating that the increased price swings will increase the value of the option. Conversely, selling standard deviation options provides a hedge against volatility, limiting potential losses in a volatile market environment.

Practical Applications in the Real World

Standard deviation options have proven their versatility in a wide array of real-world applications, catering to diverse investment strategies and risk appetites. For instance, portfolio managers can utilize these options to hedge against systemic risk, minimizing the impact of unanticipated market fluctuations on their investments.

Active traders, on the other hand, employ standard deviation options to capitalize on volatility trends. By accurately predicting the future volatility of an asset, traders can place bullish or bearish bets on volatility using these options. This allows them to profit from both rising and falling markets, expanding their trading horizons.

Image: www.pasitechnologies.com

Standard Deviation Options Trading

Conclusion

Standard deviation options have revolutionized the options trading landscape, empowering traders with unparalleled precision and flexibility to capitalize on market volatility. By granting exposure to the true measure of market movement, these options unlock new avenues for risk management and profit maximization. As the markets continue to evolve, standard deviation options will undoubtedly remain an essential tool in the arsenal of discerning traders, providing them with a competitive edge in the pursuit of financial success.