Introduction:

In the labyrinthine realm of financial markets, where fortunes are made and lost in the blink of an eye, traders seek every edge to maximize their gains. One such strategy that has gained notoriety in recent times is “max pain” options trading. It’s a sophisticated yet highly controversial technique that aims to profit from the collective behavior of market participants. Join us as we delve into the enigmatic world of max pain options trading, its history, mechanics, and the ethical implications it raises.

Image: marketrebellion.com

Defining Max Pain:

Max pain, in the options trading context, refers to a specific strike price that inflicts maximum financial loss on the largest number of options holders. When a stock’s price settles at the max pain strike price at the expiration date, it brings about maximum “pain” or losses to those who have bought (call options) or sold (put options) at prices other than the max pain level. The rationale behind this strategy is that market makers, who are obligated to facilitate trades, often have a vested interest in pushing the underlying stock price towards the max pain strike price.

Historical Roots and Evolution:

The concept of max pain has its roots in the early days of options trading in the 1970s. However, it wasn’t until the advent of electronic trading in the late 1990s that max pain became widely known and utilized by traders. With the proliferation of options exchanges and the emergence of sophisticated trading software, traders could now identify and capitalize on max pain levels in real-time, opening up new avenues for potential profit and manipulation.

Image: thetradinganalyst.com

Max Pain Options Trading

Image: quantifiedtrader.com

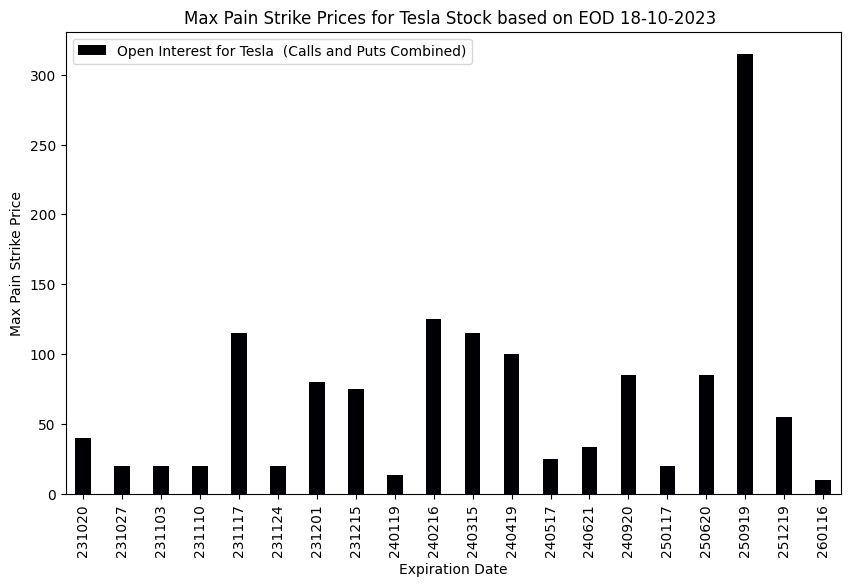

Mechanics of Max Pain:

Max pain is typically calculated based on the open interest (number of outstanding options contracts) at each strike price. The strike price with the highest open interest represents the max pain level, as it indicates where the largest number of options contracts expire worthless. Market makers, seeking to minimize their risk and maximize their profits, will often buy or sell the underlying