In the dynamic world of swing trading options, the ability to decipher market discrepancies is paramount. One highly effective tool that illuminates these hidden opportunities is divergence, where price action diverges from an underlying indicator. By harnessing the power of divergence, traders can gain a significant advantage by anticipating potential reversals and identifying profitable trade setups.

Image: industrialtrading.co.za

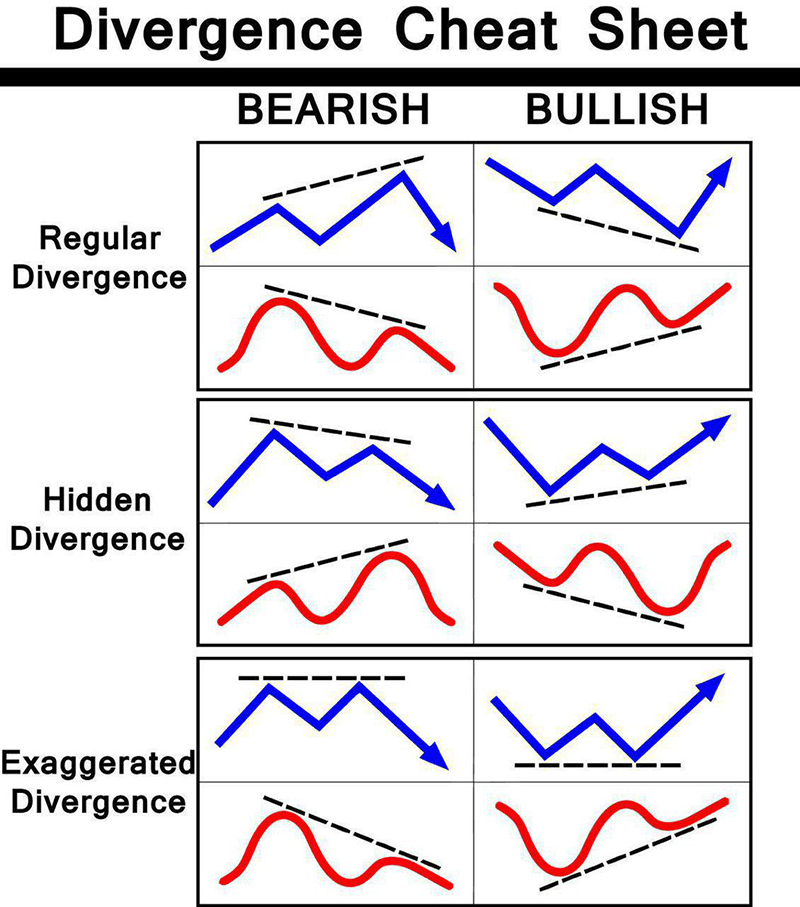

Divergence occurs when the price of an asset deviates from the trajectory of an indicator. This signals a potential shift in market momentum, offering a glimpse into the future direction of prices. Identifying divergence effectively requires a reliable indicator, a beacon in the sea of market data.

MACD: The Pioneer of Divergences

Among the plethora of technical indicators, the Moving Average Convergence Divergence (MACD) stands out as a paragon for detecting divergences. MACD measures the relationship between two exponential moving averages, depicting the difference between them as a histogram. This visualization allows traders to discern both positive and negative divergences, painting a clear picture of bullish or bearish undercurrents.

Types of Divergences

Positive and negative divergences hold distinct implications for traders. A positive divergence, where the MACD histogram forms higher lows while the price creates lower lows, signifies an impending bullish reversal. Conversely, negative divergence, where the MACD histogram produces lower highs while the price charts higher highs, hints at a potential bearish trend reversal.

Unveiling Divergences: A Step-by-Step Guide

- Identify Price Swings: Mark out lower lows for a potential bullish divergence or higher highs for a possible bearish divergence.

- Examine the MACD Histogram: Determine whether the histogram is rising (positive divergence) or falling (negative divergence) in contrast to price action.

- Confirm the Divergence: Wait for a confirmation candle before placing any trades. A bullish confirmation occurs when prices close above a previous swing high, whereas a bearish confirmation appears when prices settle below a previous swing low.

Image: servatafareen.com

Actionable Insights: Riding the Waves of Divergence

Divergences equip traders with invaluable insights that can lead to lucrative trades. When a positive divergence is detected, traders can position themselves for long trades, anticipating a reversal to the upside. On the flip side, recognizing a negative divergence signals an opportune moment for short trades, betting on a potential decline.

However, it is crucial to remember that divergence is not an infallible predictor; false signals may arise. Prudent traders utilize technical analysis in confluence with other factors, such as trend analysis and volume assessments, to enhance trading decisions.

Best Indicator To Spot Divergences When Swing Trading Options

https://youtube.com/watch?v=Bm60v074kxQ

Navigating the Markets with Divergence as Your Compass

Mastering the art of spotting divergences elevates trading strategies to new heights. By decoding the whispers of price action and MACD harmonics, traders can uncover hidden gems in the market and capitalize on opportune trade setups. Divergences act as a guiding star, illuminating the path towards enhanced trading performance and unlocking the full potential of swing trading options.