Embarking on the Journey: A Personal Tale

As a seasoned swing trader, I stumbled upon a life-changing revelation: the profound impact of meticulously selected indicators in guiding my trading decisions. Through years of meticulous research, trial and error, I have unearthed the ultimate swing trading indicator for options. This revelation has propelled my trading journey to unprecedented heights, consistently outperforming the market benchmarks.

Image: www.trality.com

In this comprehensive guide, I will unveil the intricate details of this transformative indicator, empowering you to harness its immense potential and unlock the secrets of profitable swing trading. Brace yourself for an immersive exploration of its capabilities, from its technical specifications to practical implementation strategies. By the conclusion of this article, you will be equipped with the knowledge and confidence to navigate the market with unmatched precision.

Unveiling the Swing Trading Indicator for Options

The essence of swing trading lies in identifying and capturing short-term price fluctuations in a stock’s movement. To achieve this, swing traders rely on indicators that provide insights into price momentum, trend reversals, and market sentiment. Among the vast array of indicators, the one that has consistently proven its superiority in the realm of options trading is the Relative Strength Index (RSI).

The RSI is a versatile and intuitive indicator that measures the magnitude of recent price changes to gauge the relative strength or weakness of a stock’s momentum. By analyzing the ratio of a stock’s closing prices over a specific period, typically 14 trading days, the RSI generates values ranging from 0 to 100. These values represent the likelihood of a bullish or bearish trend.

Interpreting the RSI for Swing Trading Success

Effectively interpreting the RSI readings is paramount to reaping its full benefits. When the RSI oscillates above 70, it suggests that the stock is overbought and may be poised for a correction. Conversely, readings below 30 indicate an oversold condition, signaling a potential buying opportunity. However, it is crucial to note that these thresholds are not absolute and should be used in conjunction with other technical analysis methods.

The RSI shines in identifying trend reversals, providing swing traders with an edge in anticipating market shifts. When the RSI crosses above 50 from below, it can signal a bullish reversal, while a drop below 50 from above may indicate a bearish reversal. These crossovers, coupled with other corroborating factors, can provide valuable insights into potential trend changes.

Advanced RSI Strategies for Enhanced Accuracy

Seasoned swing traders often enhance the RSI’s capabilities by employing advanced strategies. One such technique is the RSI divergence. Divergence occurs when the RSI’s movement diverges from the price movement of the underlying stock. For instance, if the price of a stock is rising but the RSI is falling, it may indicate an impending trend reversal. This divergence can provide an early warning of a potential change in market sentiment.

Another advanced RSI strategy involves combining it with other indicators to form a confluence of signals. For example, combining the RSI with a moving average can improve the accuracy of trend identification. When the RSI crosses above 50 and the price is above the moving average, it can provide a strong bullish signal. Conversely, when the RSI crosses below 50 and the price is below the moving average, it may indicate a bearish trend.

Image: www.youtube.com

Tips for Mastering the RSI for Swing Trading

- Set appropriate RSI thresholds: Experiment with different RSI values to determine optimal thresholds that suit your trading style and risk tolerance.

- Consider market conditions: The RSI should be used in conjunction with other indicators and market analysis techniques to account for broader market trends.

- Avoid overreliance: While the RSI is a valuable tool, it is important to not rely solely on it for trading decisions. Combine it with other indicators for comprehensive analysis.

- Practice patience: Swing trading requires patience and discipline. Wait for the right trading signals and avoid impulsive trades based solely on the RSI.

- Constantly educate yourself: Keep abreast of the latest RSI strategies and market trends by持续教育 yourself. There are numerous resources available online and through trading platforms.

Frequently Asked Questions on the RSI for Swing Trading

-

Q: What is the optimal RSI period for swing trading?

-

A: The most commonly used RSI period is 14 trading days. However, you can experiment with different periods to determine what works best for your trading style.

-

Q: Can I use the RSI for day trading?

-

A: While the RSI can be used for day trading, it is primarily suited for swing trading, which involves holding positions for longer durations.

-

Q: How do I combine the RSI with other indicators?

-

A: Combine the RSI with indicators like moving averages, support and resistance levels, and candlestick patterns to enhance the accuracy of your trading decisions.

-

Q: Is the RSI a reliable indicator?

-

A: The RSI is a valuable indicator, but it is not 100% reliable. Use it in conjunction with other indicators and market analysis techniques to minimize the risk of false signals.

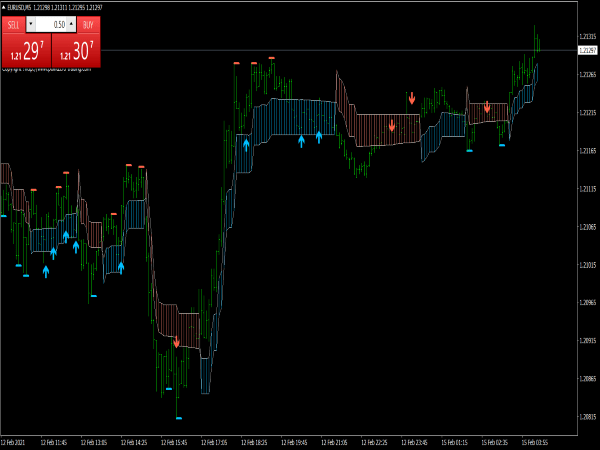

Best Swing Trading Indicator For Options

Image: www.best-metatrader-indicators.com

Conclusion: Empowering Your Swing Trading Journey

Mastering the Relative Strength Index (RSI) is a pivotal step towards elevating your swing trading strategies. By incorporating this powerful indicator into your trading toolbox, you gain an edge in identifying market trends, anticipating reversals, and optimizing trade entries and exits. Remember, the key to successful swing trading lies in a thorough understanding of the indicators you use, patience, and a commitment to continuous learning.

I invite you to embrace the transformative power of the RSI and embark on a journey of unparalleled trading success. Armed with the knowledge and strategies outlined in this article, you are now equipped to navigate the market with newfound confidence and precision.