Amidst the tumultuous financial landscape, options trading has emerged as a cryptic realm, shrouded in secrecy and perceived as a forbidden fruit for many investors. Yet, beneath this veil lies a profound opportunity that can unlock the gates to substantial wealth creation. In this comprehensive guide, we embark on an illuminating journey to demystify the enigma of options trading, arming you with the knowledge and confidence to navigate this uncharted territory.

Image: www.youtube.com

What Exactly is Options Trading?

Options, in the financial world, are distinct instruments that grant the buyer (option holder) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (such as a stock, bond, or commodity) at a specific price on or before a certain date. Unlike direct investments in the underlying asset, options trading involves acquiring this right for a fraction of the underlying’s price, known as the option premium. This intricate mechanism empowers investors to leverage market fluctuations to their advantage, both in rising and falling scenarios.

Unveiling the Anatomy of an Option

To comprehend the dynamics of options trading, it’s crucial to dissect its fundamental components:

-

Underlying Asset: The financial instrument to which the option pertains, such as a stock, bond, or commodity.

-

Strike Price: The predetermined price at which the holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

-

Expiration Date: The specified date by which the option can be exercised.

-

Call Option: Grants the holder the right to buy the underlying asset at the strike price.

-

Put Option: Grants the holder the right to sell the underlying asset at the strike price.

Options Trading Strategies: A Versatile Toolkit

Armed with a solid understanding of options terminology, we delve into the practical realm of trading strategies:

-

Covered Call: A strategy where the investor owns the underlying asset and simultaneously sells a call option, generating income from the option premium while potentially profiting from a price increase in the underlying.

-

Protective Put: A strategy where the investor owns the underlying asset and buys a put option, providing downside protection in case of a price decline while surrendering some potential gains.

-

Iron Condor: A neutral strategy that involves selling both a call option and a put option with higher strike prices and simultaneously buying a call option and a put option with lower strike prices, aiming to profit from a limited price range.

-

Bull Put Spread: A strategy where the investor buys a call option at a lower strike price and simultaneously sells a call option at a higher strike price, seeking to profit from rising prices while capping potential gains.

-

Bear Put Spread: A strategy where the investor sells a put option at a higher strike price and simultaneously buys a put option at a lower strike price, profiting from falling prices while limiting potential losses.

Image: pankajchaudhary.in

Master the Art of Risk Management in Options Trading

As with any investment endeavor, options trading carries inherent risks. To mitigate these risks and preserve your hard-earned capital, embracing a prudent risk management approach is paramount:

-

Thoroughly Understand the Risks: Familiarize yourself with the potential risks associated with options trading, including the risk of losing the entire option premium and the potential for significant losses if market conditions move against your position.

-

Set Realistic Expectations: Avoid overestimating your skill level and financial capacity. Start small and gradually increase your trading activity as you gain experience and confidence.

-

Embrace Patience and Discipline: Options trading is not a get-rich-quick scheme. Patience and discipline are essential virtues for thriving in this arena. Avoid impulsive decisions and adhere to your predefined trading plan.

-

Continuous Learning: The financial landscape is constantly evolving, and so should your knowledge. Dedicate yourself to ongoing learning, studying market trends, analyzing trading data, and refining your strategies over time.

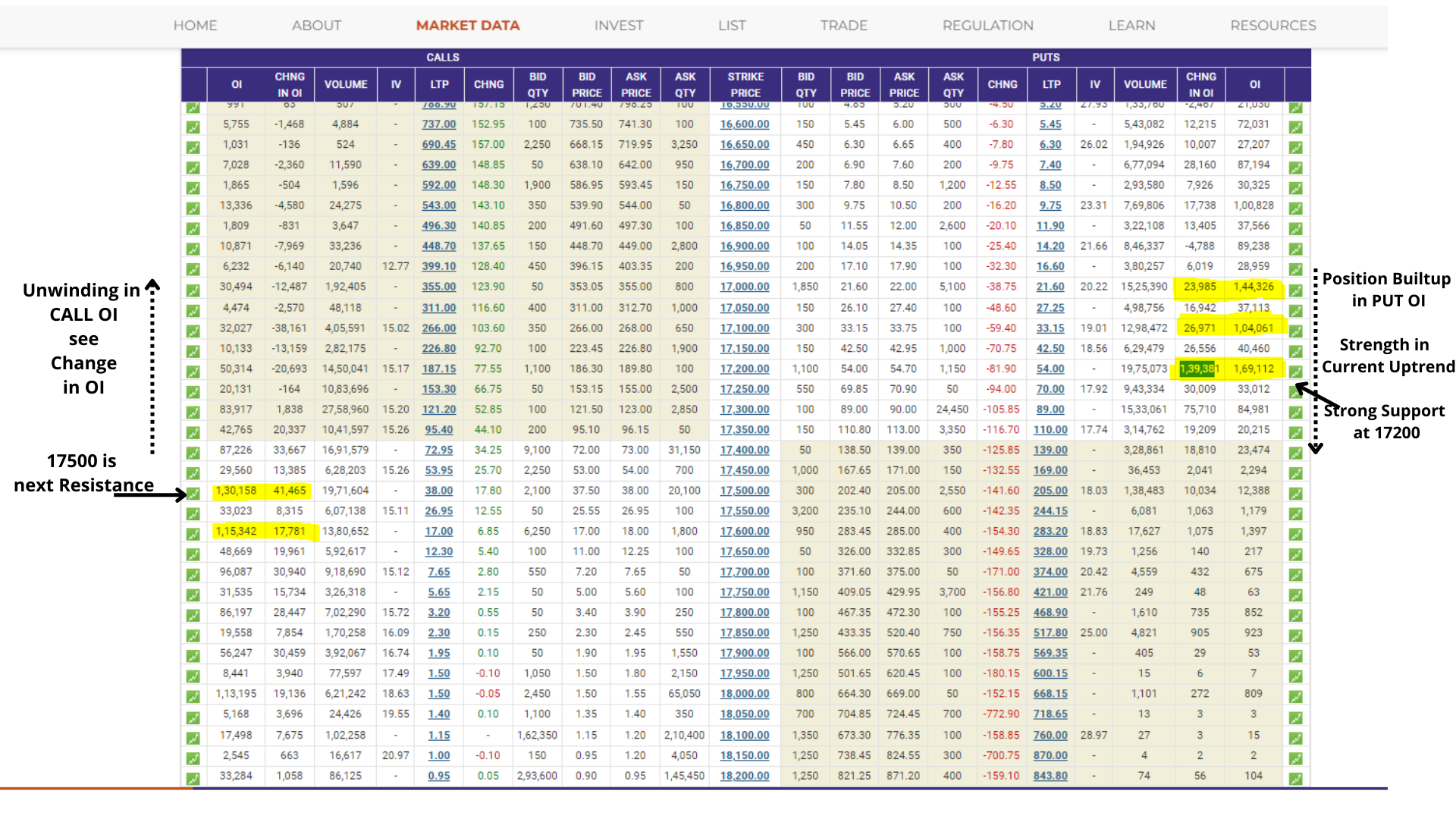

Unwilling To Expose Trading Option

Image: en.rattibha.com

Conclusion: Unveiling Your Inner Trading Potential

In the realm of investing, options trading stands as a powerful tool that can propel your financial journey to new heights. By embracing the knowledge and insights shared within this comprehensive guide, you have taken a bold step towards unlocking the potential that lies within this mysterious and potentially lucrative domain. Remember, the path to financial success requires dedication, patience, and a commitment to continuous learning. We encourage you to explore further resources, consult with experienced traders, and embark on your own trading odyssey with confidence. May the winds of success guide your every move as you navigate the ever-changing currents of the financial markets.