Introduction

In the captivating realm of finance, options trading has taken center stage as a potent tool for investors seeking both profit and risk management. With the advent of user-friendly platforms like ETRADE, option trading becomes accessible to a broader audience, empowering individuals to leverage this versatile financial instrument. In this comprehensive guide, we delve into the nuances of option trading on ETRADE, providing you with the knowledge and confidence to navigate this dynamic market.

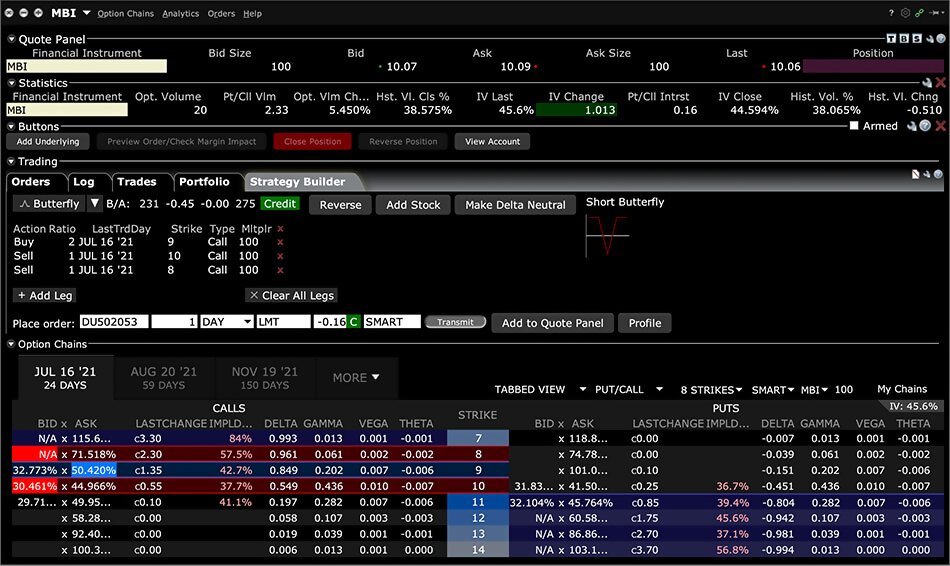

Image: www.interactivebrokers.co.uk

Understanding Option Trading

Options are financial derivatives that confer the right, not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or index, at a specified price (strike price) on or before a certain date (expiration date). These contracts enable investors to speculate on the future direction of the underlying asset, strategize risk mitigation, and potentially enhance their returns.

*Option Trading on ETRADE**

E*TRADE, a renowned online brokerage firm, offers a comprehensive suite of tools and resources tailored to option traders. Their user-friendly platform provides:

-

Real-time Market Data: Stay abreast of market movements with up-to-date quotes, charts, and news.

-

Advanced Options Analysis: Utilize E*TRADE’s proprietary analytics to assess volatility, probabilities, and Greeks, empowering you with informed decision-making.

-

Option Chains: Explore the range of available options contracts for a given underlying asset, including strike prices, expirations, and premiums.

-

Trade Execution: Execute trades seamlessly with E*TRADE’s intuitive trading interface, ensuring efficient order placement and monitoring.

Harness the Power of Options

Options offer a myriad of strategic possibilities for investors:

-

Income Generation: Sell options to collect premiums if you believe the underlying asset will trade within a specific range.

-

Hedging Against Risk: Purchase options to protect your portfolio from adverse price fluctuations in the underlying asset.

-

Leveraged Trading: Amplify your returns by purchasing options with a portion of the underlying asset’s value.

-

Speculation: Take a position on the future direction of the market by buying or selling options based on your predictions.

Image: yolafoq.web.fc2.com

Expert Insights and Actionable Tips

To maximize your success in option trading, heed the insights shared by seasoned experts:

-

Thorough Research: Diligently study the underlying asset, market conditions, and option strategies before making trades.

-

Prudent Risk Management: Define clear entry and exit strategies, set stop-loss orders, and never invest more than you can afford to lose.

-

Capitalize on Implied Volatility: Trade options when implied volatility is elevated to potentially enhance your returns.

Embrace the Future

The future of option trading on E*TRADE promises even greater advancements in technology and analytics. Expect:

-

Algorithmic Trading: Automate your trading strategies using sophisticated algorithms that adapt to evolving market conditions.

-

Personalized Recommendations: Leverage artificial intelligence to receive tailored trade recommendations based on your unique investment objectives.

-

Simplified Execution: Experience frictionless trade execution with mobile and voice-controlled interfaces, streamlining your investing process.

Option Trading Etrade

Image: www.youtube.com

Conclusion

Option trading on E*TRADE empowers you to harness the potential of derivatives while mitigating risk and pursuing growth. By embracing a comprehensive approach, leveraging expert guidance, and staying abreast of technological advancements, you can elevate your investment acumen and achieve your financial aspirations. Take the plunge into option trading today and unlock the boundless opportunities it offers.